CORPORATE GOVERNANCEThe Board of Directors is committed to being a leader in corporate governance. The Board believes that good governance enhances shareholder value and goes beyond simply complying with legal requirements. It means taking an integrated and collaborative approach that promotes integrity, accountability, transparency, and the highest ethical standards. To that end, the Board has adopted a number of policies and practices to ensure effective governance, including our comprehensive Governance Principles. See “Governance Documents” on page 24 below for information on obtaining copies of the Governance Principles and related materials. BOARD LEADERSHIP STRUCTUREThe Board believes the most effective leadership structure for Raytheon at this time is one with a combined Chairman and CEO, coupled with an independent Lead Director. Having a combined Chairman and CEO promotes a cohesive vision and strategy for Raytheon and enhances our ability to execute effectively. We have found that this structure is particularly advantageous for our international business because many of our foreign government customers value unified leadership and a single ultimate executive decision-maker. The Board created the Lead Director role as an integral part of a leadership structure that promotes strong, independent oversight of Raytheon’s management and affairs. The Lead Director, who must be independent, has the following primary responsibilities:

Working with the Chairman

to develop and approve

Board agendas and

meeting schedules;

Advising the Chairman as to

the quality, quantity and

timeliness of the information

sent to the Board;

Developing agendas

for and chairing

executive sessions of

the Board (in which

the independent

directors

meet without

management);

Attending, to the

extent feasible, the

regularly scheduled

meetings of each

of the standing

committees; and

Communicating

periodically on an

individual basis

with each of the

other independent

directors and acting

as a liaison between

them and the

Chairman and CEO.

Vernon E. Clark has served as the Lead Director since May 2013. The Board annually reviews the role and function of the Lead Director. Our Governance Principles provide that the Lead Director should serve an initial two-year term, and may serve up to three additional one-year terms as determined by the Board. The Board is currently contemplating waiving the term limit provision to reappoint Mr. Clark as Lead Director to serve until May 2019. This reflects Mr. Clark’s special value to Raytheon serving in this capacity and aligns with the Governance and Nominating Committee’s leadership succession planning. BOARD ROLEThe Board is responsible for overseeing the management of the business and affairs of Raytheon. Among the Board’s most significant responsibilities is the oversight of Raytheon’s long-term strategy and management of risk, and the selection of the CEO and planning for the CEO’s succession. THE BOARD’S ROLE IN STRATEGY The Board recognizes the importance of ensuring that our overall business strategy is designed to create long-term value for Raytheon shareholders. As a result, the Board maintains an active oversight role in formulating, planning and implementing Raytheon’s strategy. We have a robust annual strategic planning process during which elements of our business, financial, and investor plans and strategies and near- and long-term initiatives are developed and reviewed. This annual process culminates with a full-day Board session to review Raytheon’s overall strategy with our senior leadership team and other executives. In addition to our business strategy, the Board reviews Raytheon’s five-year financial plan, the first year of which serves as the basis for the Annual Operating Plan for the upcoming year. The Board regularly considers the progress of and challenges to Raytheon’s strategy and related risks throughout the year. At each regularly-scheduled Board meeting, the Chairman and CEO has an executive session with the Board to discuss strategic and other significant business developments since the last meeting. THE BOARD’S ROLE IN RISK MANAGEMENT Our risk management program covers the full range of material risks to Raytheon, including strategic, operational, financial, and compliance and reputational risks. The Board oversees Raytheon’s risk management program and allocates certain oversight responsibilities to its committees. Each committee regularly reports to the Board on risk matters under its purview. The Board periodically reviews our risk management policies, processes and controls (including enterprise risk management, or ERM), and the Audit Committee from time to time separately reviews the Board’s approach to risk oversight. Management carries out the daily processes, controls and practices of our risk management program, many of which are embedded in our operations. In addition, as part of our ERM process, management identifies, assesses, prioritizes and develops mitigation plans for Raytheon’s top risks. The Board and the committees regularly review and discuss significant risks with management, including through annual strategic discussions and regular reviews of annual operating plans, financial performance, merger and acquisition opportunities, market environment updates, international business activities, and presentations on specific risks. BOARD OF DIRECTORS

oversees strategic and significant operational risks, such as operating and financial plan

risks; legal and regulatory compliance risks, including those related to litigation, government

investigations and enforcement actions, disputes, risk exposures and governance issues; and

risks related to prospective mergers and acquisitions.

Audit Committee oversees risks related to financial reporting, internal controls, internal audit, auditor independence, and related areas of law and regulation. Governance and

Nominating

Committee oversees risks related to governance issues. Management

Development and

Compensation

Committee oversees risks related to compensation policies and practices and talent acquisition, retention and development. Public Affairs

Committee oversees various aspects of U.S. and international regulatory compliance, social responsibility, environmental matters, export/import controls and crisis management. Special Activities

Committee oversees cybersecurity risks and risks related to our classified business. THE BOARD’S ROLE IN MANAGEMENT SUCCESSION PLANNING The Board’s Management Development and Compensation Committee (MDCC) and the full Board periodically review succession planning for the Chairman and CEO and other senior leadership positions. These reviews include consideration and assessment of key leadership talent throughout Raytheon, and roles for which it may be necessary to consider external candidates. The Board also reviews Raytheon’s talent strategy for critical positions and has regular opportunities to observe key leaders and high-potential talent through presentations, meetings and other events. The Board’s carefully considered planning is evident in the process by which Thomas Kennedy was ultimately elected as Chairman and CEO. Mr. Kennedy, who has had a 35-year career with Raytheon, previously served in a series of positions of increasing responsibility, including President of Raytheon’s Integrated Defense Systems business and Executive Vice President and Chief Operating Officer. DIRECTOR CANDIDATE CONSIDERATION AND BOARD REFRESHMENTThe Board and its Governance and Nominating Committee seek to have an engaged and independent Board that upholds the strictest ethical standards. Each Raytheon director is expected to:

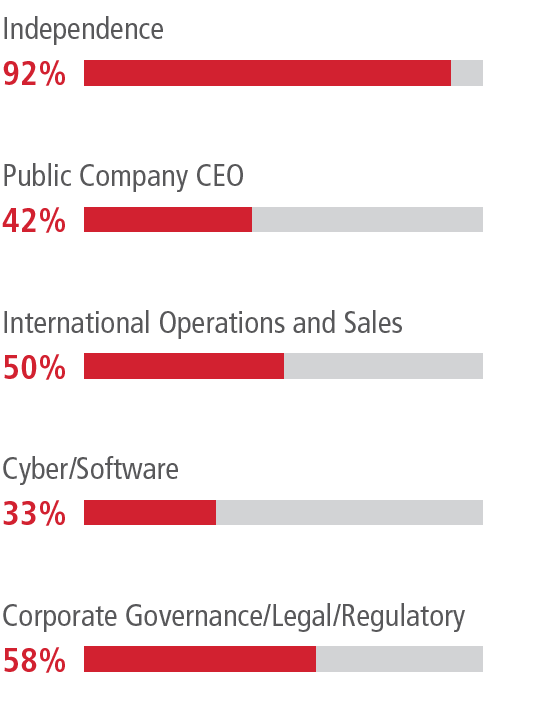

EVALUATING BOARD CAPABILITIES AND DETERMINING NEEDS When evaluating each director nominee and the potential needs and composition of the Board as a whole, the Governance and Nominating Committee looks for individuals with the potential to make significant contributions that will enhance the Board’s ability to continue to serve the long-term interests of Raytheon and its shareholders. To that end, the Governance and Nominating Committee has identified critical experiences, qualifications, attributes and skills, and uses a matrix to ensure each is adequately represented among our directors. The Committee regularly reviews the director skills matrix to confirm that it appropriately reflects the attributes most needed to support Raytheon’s long-term growth strategy. In light of Raytheon’s current emphasis on international growth, emerging customer needs, technological innovation, and cybersecurity, as well as our complex and evolving business and operations generally, including a national security focus and classified and other regulatory requirements, the Governance and Nominating Committee believes the following experiences, qualifications, attributes and skills must be adequately represented on the Board:

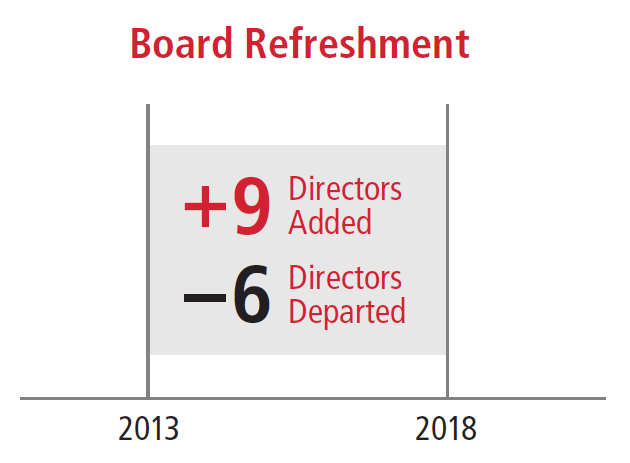

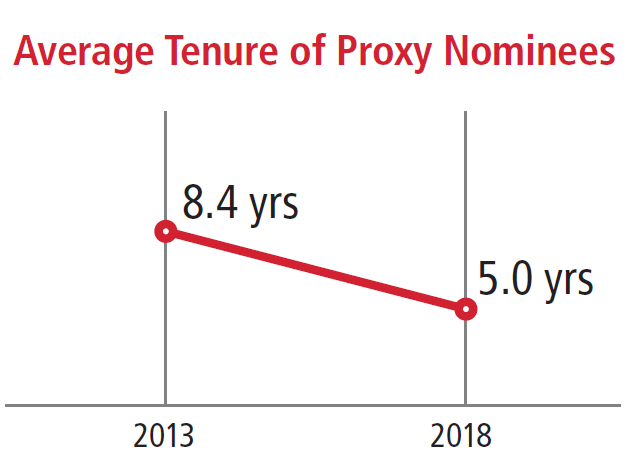

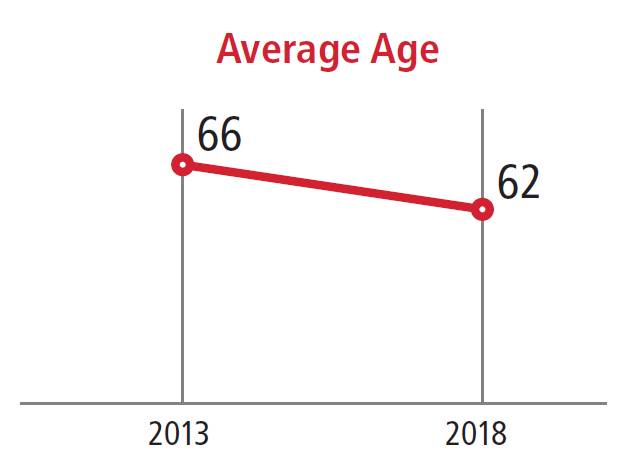

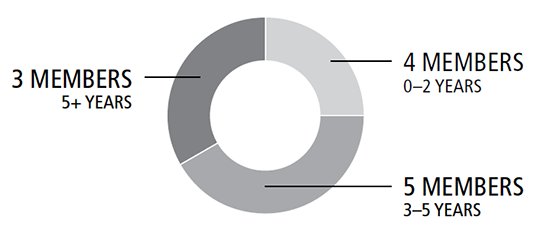

From time to time, the Committee may engage a third party for a fee to assist it in identifying potential director candidates. BOARD REFRESHMENT AND CURRENT COMPOSITION In addition to ensuring the Board reflects an appropriate mix of experiences, qualifications, attributes and skills, the Governance and Nominating Committee focuses on director succession and tenure. Over the last five years, the Board has undergone significant refreshment, resulting in a lower average tenure, younger average age, and broadened diversity of backgrounds. Through this refreshment, a number of directors joined the Board with key experiences and attributes, such as public company CEOs and individuals with experience in international sales and operations, commercial business, information technology, cyber/software and global security. In addition to refreshing the Board’s composition generally, the Board regularly adjusts its committee chair and committee membership assignments. This promotes strong committee leadership and independence as well as director development and succession planning. In the last two years, Tracy A. Atkinson became the Chair of the Audit Committee, Stephen J. Hadley became the Chair of the Governance and Nominating Committee, and Letitia A. Long became the Chair of the Public Affairs Committee. DIRECTOR INDEPENDENCEThe Board has adopted specific director independence criteria, consistent with the New York Stock Exchange (NYSE) listing standards, to assist it in making determinations regarding the independence of its members. These criteria, which are detailed in our Governance Principles, are available as described below under “Governance Documents.” A director is considered independent only if the Board determines the director does not have a material relationship, directly or indirectly, with Raytheon. The Board considers the independence of its members at least annually, in part by reviewing Raytheon’s relationships with organizations with which our directors are affiliated. The Board has determined that no director other than Mr. Kennedy, the Chairman and CEO, has, directly or indirectly, a material relationship with Raytheon, nor does any other director have a direct or indirect material interest in any transaction involving Raytheon. Every director other than Mr. Kennedy satisfies our independence criteria. In connection with its review and determination of director independence, the Board considered certain non-material relationships and transactions involving directors, including:

In all cases, the transactions occurred in the ordinary course of business; none of the directors had any direct or indirect material interest in, or received any special compensation in connection with, the transactions or relationships; and the amounts paid in those transactions were well below thresholds prescribed under the NYSE standards and the Governance Principles. BOARD AND COMMITTEE EVALUATION PROCESSBOARD AND COMMITTEE EVALUATIONS The Governance and Nominating Committee leads an annual performance evaluation of the Board and each Board committee as described below. SEPTEMBER – OCTOBER

Each director completes a Board self-evaluation questionnaire and a separate questionnaire for each committee on which the director serves. The Board-specific questionnaire requests ratings and solicits detailed suggestions for improving Board and committee governance processes and effectiveness. The committee-specific questionnaires are tailored to the respective committees’ roles and responsibilities and any applicable legal or regulatory obligations. OCTOBER – NOVEMBER

Self-evaluation questionnaire results are compiled and summarized by the Office of the Corporate Secretary. The summaries include all specific director comments, without attribution. Each director receives the Board self-evaluation summary and the self-evaluation summary for each committee on which the director serves. The Lead Director and the Chairman receive all of the self-evaluation summaries. NOVEMBER

Committee self-evaluation results are discussed by each committee, and Board self-evaluation results are discussed by the full Board, in each case in executive session. Each committee and the Board identify areas for further consideration and opportunities for improvement, and implement plans to address those matters. JULY

Each committee and the full Board convene in executive session to review progress with respect to any identified areas for further consideration. ONGOING

Directors may

discuss concerns,

including those

related to individual

performance,

separately with

the Lead Director.

The Board views self-evaluation of Board and committee performance as an integral part of its commitment to continuous improvement. This process has prompted a number of changes to the Governance Principles, committee charters, and Board governance practices generally. By way of example, the self-evaluation exercise led the Board to enhance processes related to director candidate identification and recruitment, executive succession planning, and director education. The Governance and Nominating Committee periodically reviews the evaluation process and considers ways to augment it. INDIVIDUAL DIRECTOR SELF-ASSESSMENTS In 2017, the Governance and Nominating Committee introduced annual individual director self-assessments to solicit director input on the following:

Current and potential

future committee

assignments;

Interest in future committee

chair/Lead Director roles

and recommendations on

fellow directors to serve

in those roles;

Self-assessment of current

skills and experience, and

proposed development

goals and plans to enhance

the director’s value to the

Board and committees; and

Possible development

activities and educational

resources needed to

facilitate achievement

of those goals.

Each non-employee director, other than Mr. Work (who was new to the Board at the time), and Ms. Brown (who had not yet joined the Board), was asked to complete an Individual Director Self-Assessment Questionnaire in 2017. The self-assessment questionnaire results facilitate the Governance and Nominating Committee’s efforts relating to director development and Board/committee leadership succession planning. SHAREHOLDER ENGAGEMENTUnder the Board’s supervision, we make a concerted effort to engage with shareholders to ensure we consider their views and address their interests. In addition to meeting with investors to discuss our performance, strategy and operations, we also regularly engage with our shareholders to solicit their views on governance and executive compensation matters. KEY ELEMENTS OF GOVERNANCE AND COMPENSATION OUTREACH We recognize the value of engaging with our shareholders on governance and compensation matters so we can better understand their views and interests and share our perspective on these important subjects. The hallmarks of our shareholder engagement program are described below.

GOVERNANCE INITIATIVES Over the past several years, shareholder input solicited during our outreach efforts has contributed greatly to shaping a number of our governance initiatives. For example, as part of our fall 2015 outreach, we communicated extensively with our shareholders regarding their views on shareholder proxy access, including key terms such as the minimum shareholder ownership percentage, the maximum number of shareholders who could join together to nominate a candidate, and the number of directors that could be nominated. As a result, in 2016, the Board proactively adopted a proxy access by-law amendment. Other key governance initiatives on which we solicited input from our shareholders include:

More recently, in 2017, in response to shareholder input, we introduced a revamped proxy statement that makes key information more accessible and understandable. The proxy combines with our annual report and corporate responsibility report to more clearly illustrate how the Board and executive leadership set a tone at the top that promotes integrity, accountability, transparency and the highest ethical standards. COMPENSATION PROGRAM In regular outreach discussions, we request shareholder input on Raytheon’s executive compensation program, including design elements and metrics, to ensure that the program reflects shareholders’ interests and objectives. We believe the results of Raytheon’s annual say-on-pay vote, which has averaged 95.0% support in the last seven years, confirm the value of this endeavor. GOVERNANCE POLICIES AND PRACTICESMAJORITY VOTING FOR DIRECTORS Our by-laws contain a “majority of votes cast” standard for uncontested elections of directors, meaning that a nominee is elected if the number of votes cast for the nominee exceeds the number of votes cast against the nominee. In contested elections (that is, those in which the number of nominees exceeds the number of directors to be elected), the voting standard is a plurality of votes cast. Our Governance Principles provide that any incumbent director in an uncontested election who fails to receive the requisite majority of votes cast “for” his or her election must tender a resignation to the Governance and Nominating Committee. The Committee will make a recommendation to the Board as to whether to accept or reject that resignation. The Board will act on the resignation and publicly disclose its decision and the rationale behind it within 90 days from the date results are certified. The director whose resignation is under consideration will abstain from participating in both the Governance and Nominating Committee’s recommendation and the Board’s ultimate decision. If a resignation is not accepted by the Board, the director may continue to serve. SERVICE ON OTHER BOARDS Our Governance Principles limit the number of public company boards on which a director may serve to four (including Raytheon), or two in the case of a director who currently serves as an executive officer of a public company (including the board of the company where the director is employed). This latter limitation applies to our CEO. Additionally, we have established a policy requiring all officers and employees to obtain written approval before joining the board of another business entity to ensure that such service is not contrary to Raytheon’s interests. A director who is considering joining the board of another public company must discuss the proposed board service with the Chairman of the Board and the Chair of the Governance and Nominating Committee, and may not accept the position until advised that service on the other board has been approved by the Governance and Nominating Committee. A director also must notify, and obtain preapproval from, the Governance and Nominating Committee before joining the board of a privately-held, for-profit company and before accepting any paid consulting or advisory engagement. In conducting its reviews, the Governance and Nominating Committee considers whether the proposed board or other engagement would conflict with a Raytheon policy or service on the Raytheon board; the time required for Raytheon board and committee attendance, preparation and participation; and other factors it deems appropriate. CODE OF CONDUCT AND CONFLICT OF INTEREST POLICY We have adopted a Code of Conduct and a Conflict of Interest Policy covering a wide range of issues that serve as the foundation of our ethics and compliance program. The Code of Conduct provides guidance on conflicts of interest, insider trading, discrimination and harassment, confidentiality, and compliance with laws and regulations applicable to the conduct of our business. All officers, directors, employees and representatives are required to comply with the Code of Conduct, and are subject to disciplinary action, including termination, for failure to do so. We provide ethics education for directors, officers and employees. Any amendments to the Code of Conduct, or the grant of a waiver from a provision of the Code of Conduct requiring disclosure under applicable Securities and Exchange Commission (SEC) rules, will be disclosed on our website. Under our Conflict of Interest Policy, directors, officers and employees are expected to bring to the attention of the Vice President, General Counsel and Secretary or the Vice President – Ethics and Business Conduct any actual or potential conflict of interest. There are four ways that anyone may report matters of concern to Raytheon’s Ethics Office:

TRANSACTIONS WITH RELATED PERSONS Our Board has adopted a written Related Party Transactions Policy. Related party transactions include all transactions and relationships involving amounts in excess of $120,000 between Raytheon (including subsidiaries) on one side, and any director, executive officer, 5% shareholder, or an immediate family member of any of the foregoing (“interested person”) and certain entities in which an interested person has a significant interest, on the other. Under the policy, the Governance and Nominating Committee reviews the material facts of all related party transactions identified by the Vice President, General Counsel and Secretary and determines whether to approve, disapprove or ratify the transaction or relationship involved. Certain transactions and relationships have been preapproved for purposes of the policy, including (a) executive officer compensation approved by the Board, (b) director compensation, (c) certain relatively small transactions between Raytheon and other companies, and (d) certain charitable contributions made by Raytheon. Mses. Atkinson and Long, and Messrs. Hadley, Oliver, Winnefeld, Work, Kennedy, Wajsgras and Yuse served as members of boards of, or were otherwise affiliated with, charitable or other non-profit organizations to which Raytheon made contributions in 2017 (other than through a trade association membership or our matching gift and charitable awards program). These contributions were consistent with all company policies, and no organization received, in the aggregate, more than $200,000. In a Schedule 13G filing made with the SEC, BlackRock, Inc., including its subsidiaries, reported beneficial ownership of 7.3% of our outstanding common stock as of December 31, 2017. Under a previously established business relationship, BlackRock has provided investment management services for the benefit of the Raytheon Master Benefit Pension Trust. For providing such investment management services, BlackRock received fees of $5.9 million in 2017. The Governance and Nominating Committee has reviewed this relationship and approved it on the basis that BlackRock’s ownership of Raytheon stock plays no role in the business relationship between the two companies and the engagement of BlackRock has been on terms no more favorable to it than terms that would be available to unaffiliated third parties under the same or similar circumstances. POLICY ON SHAREHOLDER RIGHTS PLANS We do not have a shareholder rights plan. The Board will obtain shareholder approval before adopting any shareholder rights plan unless the Board, in the exercise of its fiduciary duties, determines that, under the circumstances then existing, it would be in the best interests of Raytheon and our shareholders to adopt a rights plan without prior shareholder approval. If a rights plan is adopted by the Board without prior shareholder approval, the plan must provide that it will expire within one year of adoption unless ratified by shareholders. RESTATEMENT CLAWBACK POLICY Our Governance Principles contain a Restatement Clawback Policy that gives the Board the right to recover Results-Based Incentive Plan payments, Long-Term Performance Plan awards, and restricted stock awards made on or after January 1, 2009, to any elected officer, to the extent that such payments or awards were inflated due to erroneous financial statements substantially caused by the executive’s knowing or intentionally fraudulent or illegal conduct. The policy is designed to increase the likelihood that Raytheon will be successful if we seek to recover the portion of an executive’s incentive compensation attributable to inflated financial results caused by the executive’s malfeasance. DIRECTOR NOMINATIONS BY SHAREHOLDERSNominations for director may be made by the Board, by a Board committee, or by a shareholder or shareholders entitled to vote who comply with the relevant provisions in Raytheon’s by-laws. SHAREHOLDER NOMINATIONS VIA PROXY ACCESS BY-LAW (SECTION 2.11) The proxy access by-law sets forth conditions under which shareholders may include nominees in Raytheon’s Annual Meeting proxy materials. The proxy access by-law provides that:

SHAREHOLDER NOMINATIONS OTHER THAN VIA PROXY ACCESS BY-LAW (SECTION 2.7) Shareholders also may nominate people for election to the Board at an annual or special meeting of shareholders in accordance with the standard advance notice by-law provisions. For our 2019 Annual Meeting of Shareholders, we must receive this notice between January 31, 2019, and March 2, 2019. We are not obligated to include any such nomination in our proxy materials. Shareholders wishing to propose a director candidate for consideration by the Governance and Nominating Committee may do so by sending the candidate’s name, biographical information, and qualifications to the Committee Chair, in care of the Corporate Secretary, Raytheon Company, 870 Winter Street, Waltham, Massachusetts 02451. The Committee reviews each candidate’s qualifications in relation to the director qualification criteria contained in our Governance Principles and determines whether the candidate should be nominated for election to the Board. DIRECTOR ORIENTATION, DEVELOPMENT AND EDUCATION

Communications are referred to the Lead Director and tracked by the Office of the General Counsel. Here is how anyone who has a concern about our accounting, internal controls over financial reporting, or auditing matters may communicate that concern to the Audit Committee.

Communications will be tracked and investigated in the ordinary course by our Ethics Office, with the assistance of the Office of the General Counsel, unless otherwise instructed by the Audit Committee. POLITICAL CONTRIBUTIONS AND LOBBYING EXPENDITURES DISCLOSURERaytheon has for a number of years voluntarily included disclosure on its website relating to political contributions and lobbying expenditures. In 2016, we significantly expanded this website disclosure to include the following:

This disclosure is available on our website at www.raytheon.com under the heading “Investor Relations/Corporate Governance/Political Contributions and Lobbying Expenditures.” GOVERNANCE DOCUMENTSThe following key governance documents are available on our website at www.raytheon.com under the heading “Investor Relations/Corporate Governance”:

These documents are also available in print to any shareholder who requests them by writing to Raytheon Company, Investor Relations (or Corporate Secretary for the by-laws), 870 Winter Street, Waltham, Massachusetts 02451, or by emailing invest@raytheon.com. | ||||||||||||||||||||||||||||||