|

|

The process of reevaluating and upgrading our portfolio and redeploying capital to build shareholder value is a continuous one. It involves responding to the investment climate, carefully evaluating opportunities as they arise and shifting investments in response. “Conditions in 2002 were unusual,” says Karen Dorigan, Chief Investment Officer. ”The investment sales market has been surprisingly strong, despite generally weak underlying fundamentals.“ For CarrAmerica, it was a good year to sell certain assets where we had maximized value for significant profits—and to buy quality properties with higher growth potential.

The $176.1 million in proceeds from the sale of three properties—in Dallas, Austin and Salt Lake City—and a partial interest in a Washington, D.C. building were reinvested in properties in Washington, D.C. and California with strong, long-term growth potential. These sales produced gains of $34.7 million for CarrAmerica.

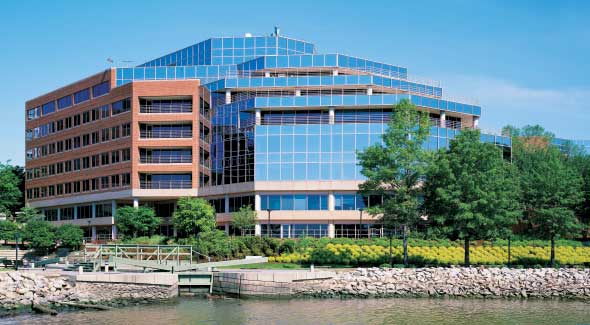

The largest of these acquisitions, Canal Center (shown here), consists of five adjacent buildings totaling approximately 589,000 square feet situated in Alexandria, Virginia, on the banks of the Potomac River, a submarket that CarrAmerica knows well. Acquired for $141.5 million, Canal Center stands to benefit from the overall strength and long-term growth potential of that inside-the-beltway submarket, which includes proximity to downtown Washington, Metrorail access and a healthy and complementary mix of government and private sector tenants.

Three California acquisitions are all in premier locations and are 100% occupied, with strong credit tenants. They include the purchase of Carroll Vista Center, an approximately 108,000-square-foot, three-building biotech complex in San Diego, one of the top biotech markets in the country, as well as 11119 North Torrey Pines Road, an approximately 77,000-square-foot building in the world-class biomedical research submarket of Torrey Pines. In Northern California, the company acquired 3075 Hansen Way in Stanford Research Park, adjacent to Stanford University and home to more than 50 Fortune 500 companies. The two buildings at Hansen Way are under long-term leases to strong credit tenants McKinsey & Company and Merrill Lynch.