PRODUCTION

In 2010, net production averaged 418,000 barrels of oil equivalent per day, up 2.5 percent from 408,000 barrels of oil equivalent per day in 2009. This increase resulted from production growth in the North Dakota Bakken shale oil play, Russia and the Llano Field in the deepwater Gulf of Mexico.

In the Bakken, we continued to build on our strong position. We increased our land holdings and drilled 44 wells. Additionally, Hess completed two key Bakken acquisitions. The acquisition of American Oil & Gas for common stock increased Hess' strategic position by approximately 85,000 net acres. The $1.08 billion purchase of TRZ Energy added approximately 167,000 net acres near Hess' existing holdings. Excluding the two acquisitions, Hess' Bakken production exited the year at its targeted rate of 20,000 barrels of oil equivalent per day.

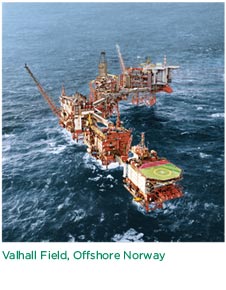

In Russia, continued development drilling in conjunction with strong reservoir performance raised net production to 44,000 barrels of oil equivalent per day at year end. The drilling program in the Llano Field (Hess 50%) raised net production to approximately 16,000 barrels of oil equivalent per day at year end. In September, the company completed a strategic asset trade in which Hess assumed Shell's 28 percent interest in the Valhall Field and 25 percent interest in the satellite Hod Field offshore Norway. In return, Shell assumed Hess' 9 percent interest in the Clair Field in the United Kingdom and all of Hess' interests in Gabon. Also in September, Hess completed the acquisition of Total's 8 percent interest in Valhall and 12.5 percent interest in Hod. These transactions brought Hess' interest in Valhall and Hod up to 64 percent and 62.5 percent, respectively.

DEVELOPMENTS

In support of the growing Bakken shale oil development in the Williston Basin in North Dakota, the company sanctioned the expansion of the Tioga Gas Plant, the addition of three compressor stations and a rail loading terminal.

At the Hess operated Pony Field (Hess 100%) in the deepwater Gulf of Mexico, we signed a letter of intent with the Knotty Head partners to jointly develop the Pony and Knotty Heads Fields. Also at Pony, we spud an additional appraisal well on Green Canyon Block 469 to test the eastern extent of the structure; drilling has been suspended since the second quarter. A plan for reentry in the second half of 2011 has been developed subject to receipt of necessary permits from the U.S. Bureau of Ocean Energy Management, Regulation and Enforcement.

Another key development in the Gulf of Mexico was our agreement to double our interest in the Tubular Bells Field by acquiring an additional 20 percent from BP, bringing our interest to 40 percent and assuming operatorship. Transition of the project from BP to Hess is complete and we signed a letter of award for a third party owned production facility.

In the Norwegian North Sea, the Valhall redevelopment project achieved major milestones with the installation of the main deck and personnel accommodations. In the Danish North Sea, the company sanctioned the South Arne Phase 3 development. Production startup is planned for 2013.

In Indonesia, the company continued development of the Ujung Pangkah Field (Hess 75%) with installation of a second wellhead platform. Drilling operations from the new platform commenced in September. The main central processing platform and the accommodation and utility platform will be installed during 2011. In addition, the Natuna wellhead platform was installed and development drilling commenced in the Gajah Baru Field (Hess 23%). In Malaysia, we continued to progress the development of the Belud (Hess 40%) and PM301 (Hess 50%) assets.

EXPLORATION

We continue to strengthen our portfolio with unconventional resources becoming an increasing proportion of our mix and commanding a significant portion of our investment program. In 2010, we expanded into new unconventional hydrocarbon areas by acquiring acreage in the Eagle Ford play in South Texas and the Paris Basin in France.

At year end, Hess had acquired approximately 90,000 net acres in the Eagle Ford. Exploration drilling commenced in the fourth quarter and additional exploration and appraisal activities are planned throughout 2011.

In France, Hess formed a partnership with Toreador Resources to explore the unconventional oil potential of the Paris Basin. Drilling is expected to commence in 2011.

In Australia, we completed the 16th and final commitment well on our WA-390-P Block (Hess 100%) resulting in 13 natural gas discoveries. An appraisal program that includes additional drilling and flow testing wells commenced in the fourth quarter and will continue into 2011.

Following resolution of a boundary dispute between Brunei and Malaysia, plans are now proceeding to commence exploration drilling on Block CA-1 (Hess 13.5%), offshore Brunei, in the second half of 2011.

In Peru, drilling operations on Block 64 (Hess 50%) concluded appraising a prior well and a successful well test. Planning is underway to determine the best way to develop the discovered resources.

The successful exploitation program on our Samara- Nafta licenses (Hess 85%) in Russia continued and included the drilling of a significant discovery at the Moretskoye prospect. This discovery was tied into the existing field infrastructure and brought into production.

In December we spud a well on our Cherry prospect on North Red Sea Block 1, in which Hess has an 80 percent working interest. A second well is planned on the block following completion of drilling at Cherry.

In 2010, net production averaged 418,000 barrels of oil equivalent per day, up 2.5 percent from 408,000 barrels of oil equivalent per day in 2009. This increase resulted from production growth in the North Dakota Bakken shale oil play, Russia and the Llano Field in the deepwater Gulf of Mexico.

In the Bakken, we continued to build on our strong position. We increased our land holdings and drilled 44 wells. Additionally, Hess completed two key Bakken acquisitions. The acquisition of American Oil & Gas for common stock increased Hess' strategic position by approximately 85,000 net acres. The $1.08 billion purchase of TRZ Energy added approximately 167,000 net acres near Hess' existing holdings. Excluding the two acquisitions, Hess' Bakken production exited the year at its targeted rate of 20,000 barrels of oil equivalent per day.

In Russia, continued development drilling in conjunction with strong reservoir performance raised net production to 44,000 barrels of oil equivalent per day at year end. The drilling program in the Llano Field (Hess 50%) raised net production to approximately 16,000 barrels of oil equivalent per day at year end. In September, the company completed a strategic asset trade in which Hess assumed Shell's 28 percent interest in the Valhall Field and 25 percent interest in the satellite Hod Field offshore Norway. In return, Shell assumed Hess' 9 percent interest in the Clair Field in the United Kingdom and all of Hess' interests in Gabon. Also in September, Hess completed the acquisition of Total's 8 percent interest in Valhall and 12.5 percent interest in Hod. These transactions brought Hess' interest in Valhall and Hod up to 64 percent and 62.5 percent, respectively.

DEVELOPMENTS

In support of the growing Bakken shale oil development in the Williston Basin in North Dakota, the company sanctioned the expansion of the Tioga Gas Plant, the addition of three compressor stations and a rail loading terminal.

At the Hess operated Pony Field (Hess 100%) in the deepwater Gulf of Mexico, we signed a letter of intent with the Knotty Head partners to jointly develop the Pony and Knotty Heads Fields. Also at Pony, we spud an additional appraisal well on Green Canyon Block 469 to test the eastern extent of the structure; drilling has been suspended since the second quarter. A plan for reentry in the second half of 2011 has been developed subject to receipt of necessary permits from the U.S. Bureau of Ocean Energy Management, Regulation and Enforcement.

Another key development in the Gulf of Mexico was our agreement to double our interest in the Tubular Bells Field by acquiring an additional 20 percent from BP, bringing our interest to 40 percent and assuming operatorship. Transition of the project from BP to Hess is complete and we signed a letter of award for a third party owned production facility.

In the Norwegian North Sea, the Valhall redevelopment project achieved major milestones with the installation of the main deck and personnel accommodations. In the Danish North Sea, the company sanctioned the South Arne Phase 3 development. Production startup is planned for 2013.

In Indonesia, the company continued development of the Ujung Pangkah Field (Hess 75%) with installation of a second wellhead platform. Drilling operations from the new platform commenced in September. The main central processing platform and the accommodation and utility platform will be installed during 2011. In addition, the Natuna wellhead platform was installed and development drilling commenced in the Gajah Baru Field (Hess 23%). In Malaysia, we continued to progress the development of the Belud (Hess 40%) and PM301 (Hess 50%) assets.

EXPLORATION

We continue to strengthen our portfolio with unconventional resources becoming an increasing proportion of our mix and commanding a significant portion of our investment program. In 2010, we expanded into new unconventional hydrocarbon areas by acquiring acreage in the Eagle Ford play in South Texas and the Paris Basin in France.

At year end, Hess had acquired approximately 90,000 net acres in the Eagle Ford. Exploration drilling commenced in the fourth quarter and additional exploration and appraisal activities are planned throughout 2011.

In France, Hess formed a partnership with Toreador Resources to explore the unconventional oil potential of the Paris Basin. Drilling is expected to commence in 2011.

In Australia, we completed the 16th and final commitment well on our WA-390-P Block (Hess 100%) resulting in 13 natural gas discoveries. An appraisal program that includes additional drilling and flow testing wells commenced in the fourth quarter and will continue into 2011.

Following resolution of a boundary dispute between Brunei and Malaysia, plans are now proceeding to commence exploration drilling on Block CA-1 (Hess 13.5%), offshore Brunei, in the second half of 2011.

In Peru, drilling operations on Block 64 (Hess 50%) concluded appraising a prior well and a successful well test. Planning is underway to determine the best way to develop the discovered resources.

The successful exploitation program on our Samara- Nafta licenses (Hess 85%) in Russia continued and included the drilling of a significant discovery at the Moretskoye prospect. This discovery was tied into the existing field infrastructure and brought into production.

In December we spud a well on our Cherry prospect on North Red Sea Block 1, in which Hess has an 80 percent working interest. A second well is planned on the block following completion of drilling at Cherry.