Financial Review

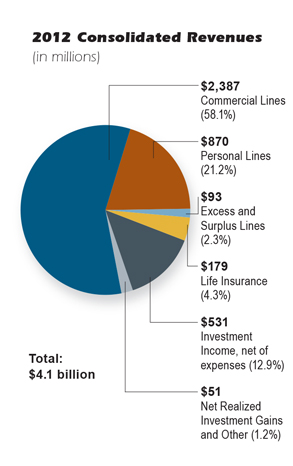

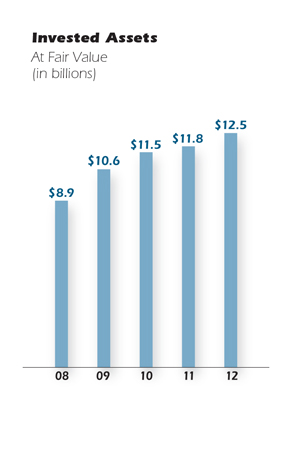

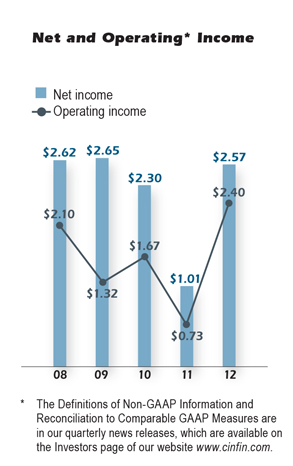

Consolidated revenues rose 8 percent in 2012, compared with 2011, with earned premiums up 10 percent and investment income up 1 percent. Invested assets continued a steady growth pattern, reflecting positive operating cash flows and rising market valuations. Net income increased by over 150 percent in 2012, primarily due to improvement in the contribution of property casualty underwriting, with lower losses from natural catastrophe events contributing 27 percent of the improvement.

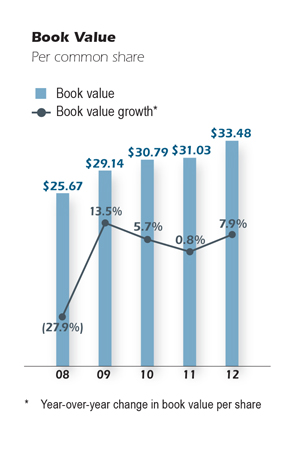

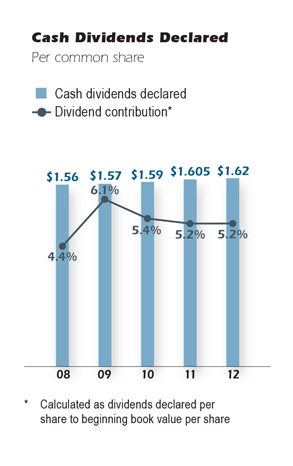

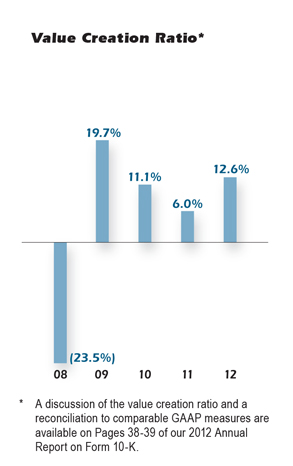

Book value per share continued to move higher, and 2012 marked the 52nd consecutive year of an increase to our shareholder dividend. The components of our value creation ratio are change in book value plus the contribution of our shareholder dividend, both measured as a percentage of book value at the beginning of the year. During 2009 through 2012 our annual value creation ratio averaged 12.4 percent. The 2012 ratio improved by 6.6 percentage points over 2011, including 5.3 points from better operating results and 1.5 points from investment portfolio gains, offset by 0.2 points from other items.