Differentiating U.S. Bancorp

In 2010, U.S. Bancorp continued to differentiate itself from its peer banks through its industry leading financial performance, prudent risk profile, balance sheet and business line growth, and ongoing investments in the company’s franchise and future. Thanks to our low-risk operating model, strong balance sheet and diversified businesses, U.S. Bancorp has been profitable every single quarter during the past three years spanning this recession. In fact, we have further differentiated ourselves by being the only bank in our peer group to have generated a profit every quarter for the past 20 years. U.S. Bancorp, again, ended the year as one of the strongest — if not the strongest — banks in the industry.

We have made good strategic use of our historic strength as a conservatively managed, efficient, solid performer to also successfully evolve and transform our company into a growth-oriented organization.

Throughout this difficult economic cycle, we have remained focused on what’s fundamental — and what’s right for our shareholders, our customers, our employees and our communities. We are building on our strengths and building for the future.

Growth and investment

Over the past two years, we’ve expanded our banking franchise through FDIC-assisted bank acquisitions and other branch purchases in California, Arizona, Nevada, Chicago and, most recently, New Mexico, which represented our expansion into the 25th contiguous state in our retail footprint. These are all attractive markets and each acquisition reflected our strategy of accretive, market fill-in and expansion to add density and relevant market share to our franchise. Other business expansion efforts are highlighted in the following pages, including our growth in corporate banking, high-grade bond sales, corporate trust, and payments portfolios, among others. In fact, since 2007, we have acquired five corporate trust operations and numerous payments businesses and portfolios. Our capital generation capabilities and fundamental strength have allowed us to take advantage of these attractive acquisition opportunities, as competitors were distracted by internal issues or choosing to divest.

As the country emerges from the worst of the downturn and begins to recover, you will see the results from our recent strategic investments accelerate. We will continue to pursue strategic acquisition opportunities that meet or exceed our stringent financial criteria. This is an organization focused on sustainable, repeatable and consistent organic growth and any acquisition will simply represent an “opportunity not missed.”

Financial performance

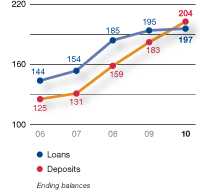

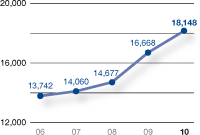

Net income for the year rose 50 percent to $3.3 billion, or $1.73 per diluted share, from $2.2 billion the year before. Our performance was driven by record revenue and declining credit costs, and once again, we were an industry leader in return on assets, return on common equity and efficiency, all the while continuing to improve our top-of-class customer service. At year end, credit-loss provisions declined for the fifth consecutive quarter, and loans had risen to a record $197 billion. These results reflected the benefits of our diversified business model, recent investments, deeper customer relationships and overall financial strength.

Continued challenges

Despite these positive results, U.S. Bancorp and the industry still face challenges in loan demand which, though showing some welcome signs of recovery, remains muted. Credit-worthy businesses are applying for credit lines, but many are not actively utilizing them. Commercial utilization levels are at historic lows, and only a continuing and robust recovery will allow that to change.

Capital and liquidity positions

We continued to generate significant capital in 2010, ending the year with a Tier 1 common equity ratio of 7.8 percent and a Tier 1 capital ratio of 10.5 percent, both measures significantly higher than the regulatory levels required to be considered “well-capitalized.” Our ability to generate capital each and every quarter, and the significant growth we have experienced in deposits over the past few years have provided us with the capacity to fund and grow our balance sheet. Further, the strength of our capital and liquidity has been recognized by the rating agencies, as our debt ratings continue to place us among the highest-rated banks in the country.

Our role in the recovery

The financial services industry is no longer in a crisis situation; many banks are doing well, and the economy is slowly recovering. As one of America’s strongest banks, we are proud to be an industry leader, providing guidance on public messaging and communicating on behalf of our industry with regulators and legislators.

It is now time for America’s banking industry to be heard. A healthy and vibrant banking industry is essential to drive the economy forward and help our country recover from this recession. When the intensity of the economic downturn became clear several years ago, and as some financial companies’ role in the downturn became known, the entire industry lost a great deal of respect and its reputation suffered. This proved to be harmful to all banks, customers, shareholders and communities. It is now clear that strong banks, including U.S. Bancorp, are critically important to the recovery and must have a voice in the direction of industry regulation. U.S. Bancorp will continue to work with the administration, legislators, the regulators — and our peer banks — to make it clear to all that the banking industry holds the key to accelerating the economic recovery. Importantly, however, we must continue to highlight the consequences of excessive regulation that could be injurious, rather than supportive, of a full recovery.

Financial reform and USB

That being said, U.S. Bancorp is well-positioned to manage the uncertainty of industry regulatory reform and its impact on the economic recovery. While our earnings have, and will be, negatively affected by many of these actions — our strength and stability will be emboldened. We began this recession in a relative “position of strength” and we are positioned to emerge in the recovery even stronger.

Although we are defined as a large financial services company, we are still, essentially, an uncomplicated, (even “old-fashioned”) bank. Our lower-risk business model and focus on consumer and commercial banking, credit cards, quality home mortgages and fee businesses differentiate us from institutions whose investment banking, brokerage, insurance and other businesses are more volatile and exposed to economic forces more than U.S. Bancorp.

Regardless of the regulatory outcomes, our operating model and growth strategies are proven and sound. We are headed in exactly the right direction even if regulatory, legislative and economic headwinds cause us to take a little longer to get there.

U.S. Bancorp Managing Committee (left to right)

- Richard C. Hartnack, Vice Chairman, Consumer and Small Business Banking

- Jeffry H. von Gillern, Vice Chairman, Technology and Operations Services

- Pamela A. Joseph, Vice Chairman, Payment Services

- Richard J. Hidy, Executive Vice President and Chief Risk Officer

- Richard B. Payne, Vice Chairman, Wholesale Banking

- Howell (Mac) McCullough, III, Executive Vice President, Chief Strategy Officer

- Richard K. Davis, Chairman, President and Chief Executive Officer

- Joseph C. Hoesley, Vice Chairman, Commercial Real Estate

- P.W. (Bill) Parker, Executive Vice President and Chief Credit Officer

- Terrance R. Dolan, Vice Chairman, Wealth Management and Securities Services

- Jennie P. Carlson, Executive Vice President, Human Resources

- Andrew Cecere, Vice Chairman and Chief Financial Officer

- Lee R. Mitau, Executive Vice President and General Counsel

Investing in our employees

Perhaps the most important investment we’ve made in the past couple of years has been our investment in our employees and our efforts to increase an already-high level of employee engagement. Some may consider such an investment secondary to technology or geography; however, we believe that employees are THE key to our success. Our strategy is to create the most engaged employee partners, who will inspire and deliver an industry-leading customer experience, optimizing our earnings potential — which, in turn, will favorably impact the communities we serve. It all begins with great employees!

Rewarding our shareholders

While the 19.8 percent increase in our share price in 2010 was a very positive reflection of our performance, raising the dividend remains a top priority for me, our management team and board of directors. Our strong capital position and ability to generate capital each quarter through solid operating earnings, even under the most severe economic conditions, gives us confidence in our ability to increase our dividend in 2011. In January, we submitted information to the regulators for their assessment of our capital position, a precursor to obtaining permission to raise our dividend. We believe our shareholders deserve to be rewarded for the investment they have made in this company and for the loyalty, confidence and patience they have shown over the past several years.

As we begin the new year, U.S. Bank is “Positioned to Win” and eager to continue our support to the country’s economic recovery. We are proud to be bankers and respectful of the key role we play in helping to make dreams come true.

Sincerely,

Richard K. Davis

Chairman, President and Chief Executive Officer

February 28, 2011

Chairman, President and

Chief Executive Officer

Loans and deposits

(Dollars in Billions)

Revenue

(Dollars in Billions)

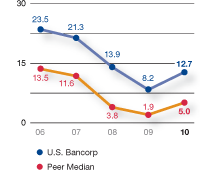

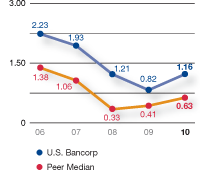

Return on average assets

(In Percents)

Return on common equity

(In Percents)