|

Wholesale Banking:

New one-stop treasury management product enhances efficiency

KEY BUSINESS UNITS:

Middle Market Commercial BankingCommercial Real Estate

National Corporate Banking

Correspondent Banking

Dealer Commercial Services

Community Banking

Equipment Leasing

Foreign Exchange

Government Banking

International Banking

Specialized Industries

Specialty Lending

Treasury Management

OUR BUSINESS CUSTOMERS TOLD US WHAT'S MOST IMPORTANT TO THEM when it comes to treasury management — the highest levels of convenience, flexibility, control and speed. We listened and responded, investing significant resources and technology into an exciting new product called

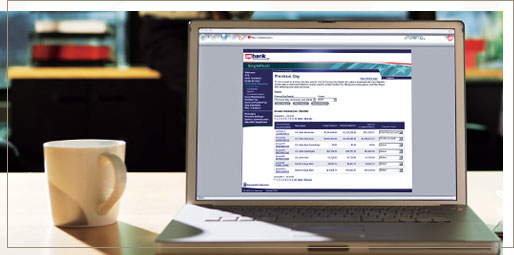

Combining powerful monitoring, payment, image access and administrative features, SinglePoint is a complete suite of treasury management services delivered through one integrated website.

With SinglePoint, treasury management customers can conveniently monitor account activity — from broad trends to single transactions — for better insight into cash flow. Enhanced access to check images enables tighter control over finances and improves fraud prevention, while extensive audit reporting tracks user access to help keep data and accounts secure. Plus, by providing a central hub for all electronic payment activities, SinglePoint increases money transfer efficiency. We're helping our customers get to the point of all their treasury management needs — with

Large corporations, middle market businesses,

financial institutions, private sector customers

and government entities drive growth in

our economy, and we proudly serve as

their financial partner. We're continually

improving our lending, depository, treasury

management and other financial offerings

to exceed our wholesale banking customers'

service expectations.

Left: We worked closely with treasurers, cash managers, controllers and other users through interviews and test-runs to identify the features and functionality most important to them, and then incorporated that feedback into the SinglePoint design.