|

I'm very pleased to present Fairchild Semiconductor International's annual

report for the year 2000. It's been a banner year. Fairchild shipped a

record number of products, producing record sales and profits.

Fairchild Semiconductor's mission is clear and focused:

to be the leading global supplier of high performance building block semiconductors

for multiple end markets. Our products are designed into a wide variety

of electronic systems serving the computing, Internet hardware, telecommunications,

consumer, industrial and automotive markets.  We're

regulating power in cell phones, speeding data transfer on the Internet,

increasing the portability of wireless applications, illuminating displays

in all types of appliances, and helping provide electrical power to just

about every type of electrical product that plugs into a wall outlet.

Our growing list of new products enhances the remarkable capabilities

of today's technologies in almost every electronic market you can think

of. No matter where you go or what you do, Fairchild is there. We're

regulating power in cell phones, speeding data transfer on the Internet,

increasing the portability of wireless applications, illuminating displays

in all types of appliances, and helping provide electrical power to just

about every type of electrical product that plugs into a wall outlet.

Our growing list of new products enhances the remarkable capabilities

of today's technologies in almost every electronic market you can think

of. No matter where you go or what you do, Fairchild is there.

Our broad market presence is a key to the Fairchild strategy.

We focus on applications including power management, power conversion,

data and signal interfacing, and optical electronics because these applications

are found in just about every type of electronic equipment. This focus

provides a quicker, higher return on investment as we develop new products,

new technology, and new manufacturing capacity to expand our sales across

multiple market segments. Because our end markets grow at different rates,

Fairchild can provide steadier overall growth due to our balance of product

lines, key customers, and end market penetration.

Key Accomplishments in 2000

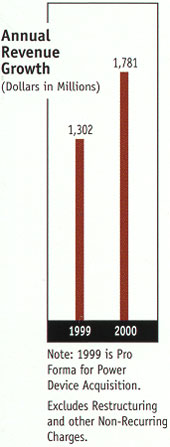

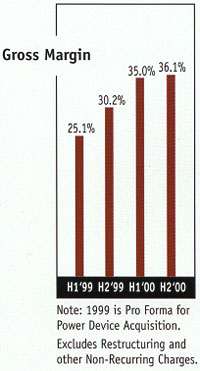

As I wrote you in last year's annual report, Fairchild's

major goal in 2000 was to accelerate our growth through additional R&D,

capital spending, and acquisitions. We accomplished our goal. Fairchild's

overall revenues grew 37% compared to pro forma 1999. Our gross margins

for the year grew eight percentage points. The key to Fairchild's growth

was focusing on developing new products that are used by our customers

in a broad array of applications. In 2000 we spent more than $80 million

in R&D and introduced more than 450 new products. We reinforced our new

product introductions with approximately $300 million in capital spending

to expand our manufacturing capacity, including a new 6-inch wafer fabrication

line in Puchon, Korea. By the end of 2000, new product sales grew to 34%

of trade sales, up from only 5% of sales in 1997. These higher margin

new products are helping penetrate new consumer, communications and portable

electronics markets while strengthening our market share with key customers.

Fairchild is also proud of its accomplishments in the

e-business arena, with the adoption of our Customer First initiative,

reinforcing our strategic initiative of superior customer service. As

part of Customer First, Fairchild launched two major web-based design

tools that allow engineers to design our products into their applications

more quickly. Our WebSIM tool allows designers to optimize their choice

of Power MOSFETs for their specific power supply design. And our Ensigna™

website launched by our Interface and Logic Products group functions as

an online laboratory, providing interactive design support for backplane

and interconnect designs in Internet hardware and wireless communications

systems. We believe we can accelerate our new product sales by using the

Internet to provide more designers with applications help, and we expect

to add more to these capabilities in 2001.

We made key strategic acquisitions during 2000 to strengthen

our product offerings and broaden our market presence. Fairchild acquired

QT Optoelectronics in May, providing  our

initial entry into the six billion dollar optoelectronics market. We acquired

Kota Microcircuits and the power management business of Micro Linear Corporation

in September. These acquisitions bolstered our analog business with high

performance op amps, battery management, power factor control, and bus

terminator products. In December we invested in Silicon Wireless Corporation,

which we expect will provide an entry into the fast growing RF power transistor

market during 2001. With Silicon Wireless we're developing technology

for power amp applications in cellular and wireless local area network

base-stations. Finally, as this report goes to press, we have announced

an agreement to purchase the discrete power business of Intersil Corporation.

Upon completion, this acquisition will make Fairchild the second leading

power MOSFET supplier in the world, will broaden our power discrete line

with IGBTs and rectifiers, and will strengthen our presence in the automotive

and industrial power markets. our

initial entry into the six billion dollar optoelectronics market. We acquired

Kota Microcircuits and the power management business of Micro Linear Corporation

in September. These acquisitions bolstered our analog business with high

performance op amps, battery management, power factor control, and bus

terminator products. In December we invested in Silicon Wireless Corporation,

which we expect will provide an entry into the fast growing RF power transistor

market during 2001. With Silicon Wireless we're developing technology

for power amp applications in cellular and wireless local area network

base-stations. Finally, as this report goes to press, we have announced

an agreement to purchase the discrete power business of Intersil Corporation.

Upon completion, this acquisition will make Fairchild the second leading

power MOSFET supplier in the world, will broaden our power discrete line

with IGBTs and rectifiers, and will strengthen our presence in the automotive

and industrial power markets.

Fairchild also significantly improved its financial

position during the year. We completed a follow-on stock offering that

raised our cash levels and broadened our shareholder base. We eliminated

our bank term debt by opening a revolving credit line which offers more

favorable credit terms. Both of these financial actions strengthened our

balance sheet while providing greater flexibility for funding future growth.

In Summary

Our two-pronged growth strategy of new product development

coupled with strategic acquisitions has positioned Fairchild as a leader

in our target market segments, forecasted to grow to over $60 billion

in the next two to three years. Fairchild plans to capture a large part

of that growth by building our portfolio of power, interface, and optoelectronic

solutions. We expect this to strengthen our leadership in the markets

we serve with a goal of doubling our revenue every three years.

Fairchild has all the necessary ingredients to execute

its growth plan: talented people pursuing a clear strategy, a broad product

portfolio of key high performance products which sell into diverse end

markets, best-in-class manufacturing capabilities and strong customer

relationships with leading global companies-all supported by a solid financial

base. Fairchild is creating an exciting future. I thank you for your interest

in us, and your continued support.

|

|

|

KIRK P. POND

Chairman of the Board, President, CEO |

|