|

Kirk Pond, Chairman,

President and Chief

Executive Officer,

discusses Fairchild's

future with

Joe Martin, Executive Vice

President and Chief

Financial Officer.

|

|

Question: Kirk, you have led Fairchild with a strategy

to win in the multi-market segment for about four years now. How is it

going?

Kirk: Our

strategy is a winner. We focus on providing high performance products

to multiple end markets. 2000 was a watershed year for Fairchild. All

of our hard work since 1997-building our work force with top notch employees,

developing new products, making key acquisitions, investing in our manufacturing

facilities-positioned us for great success in 2000. We had phenomenal

growth across all of our product segments. We not only grew, but we outgrew

many of our market segments and competitors.

Question: Joe, what do you see as your major accomplishments?

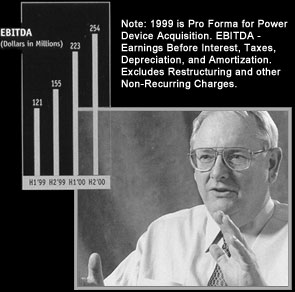

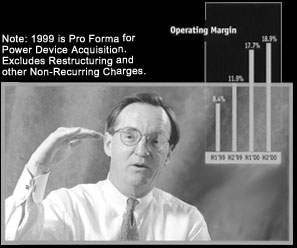

Joe: I think

one key point is how well our business model has worked. When we set up

Fairchild, we knew we had to grow new product sales, keep our factories

fully utilized, invest strongly in R&D, control SG&A spending, and incrementally

spend capital where we get immediate sales leverage. By doing those things

well, we believed we could operate this business with operating margins

in the 15-20 percent range, while growing sales at or above the rate of

the industry. In 2000 we did all of those things, and our results speak

for themselves.

Question: Kirk, tell

us more about Fairchild's new product focus.

Kirk: New products

are my favorite topic. From day one we have focused internally on maximizing

our R&D and capital to develop new products in our key target areas. Our

strategy is to choose applications, such as power management, power conversion,

and data and signal interface that are necessary across many different

end markets and offer high growth potential. For example, managing the

power in a cellular phone is really not very different from managing power

in a notebook computer or digital camera...at least in the way that our

products contribute to the solution. We then work closely with the leading

customers who design these applications, find out what they want and try

to develop it before our competitors do. We introduced more than 450 new

products this year, focusing on power MOSFETs, power analog, interface,

and advanced logic. Our new product sales accounted for 34% of sales at

the end of 2000, up from 5% in 1997. New products tend to have higher

sales growth and higher gross margins. New products also cement tighter

relationships with key customers, providing Fairchild future opportunities

to develop next generation products ahead of our competitors.

Question: Joe, what

about the other side of Fairchild's growth strategy, making strategic

acquisitions?

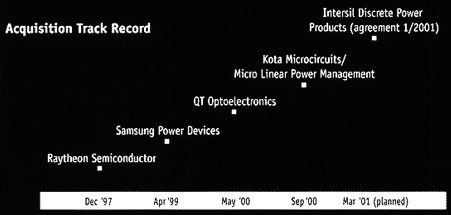

Joe: We've

put together a great track record of key acquisitions over the past few

years. Fairchild focuses on acquisitions that will broaden and complement

our product lines, allow us to enter new markets, strengthen our regional

market share and are financially sound. This year we acquired QT Optoelectronics,

giving us entry into the last major target market segment in which we

were not a player. The optoelectronics market topped $6 billion in 2000,

and we now have the ability to serve over half of that market with our

lines of optocouplers, lamps, displays, and infrared products. We also

strengthened our analog product portfolio by acquiring Kota Microcircuits,

a supplier of high performance op amps, and by acquiring the power management

business of Micro Linear. And, in January 2001, we announced our agreement

to acquire the discrete power business of Intersil. This really strengthens

our power MOSFET and IGBT lines, and increases our penetration into industrial

and automotive power applications. We expect that these acquisitions combined

with our internal development will increase our total power product sales

to more than one billion dollars in 2001.

Question:

Kirk and Joe, what do you see as the major priorities for the next couple

of years? Question:

Kirk and Joe, what do you see as the major priorities for the next couple

of years?

Kirk: On

the acquisition front, our major goals are to continue building our power

businesses, and to continue our global expansion, particularly looking

at Japan and Europe-two regions with tremendous growth potential for Fairchild's

products. We're a leading power semiconductor supplier now, and when we

complete the acquisition of the Intersil discrete power business, we will

rank as one of the top two worldwide power MOSFET suppliers, and among

the top five suppliers in the seven billion dollar power discrete market.

Our $400 million analog business enhances our power position, and also

makes us one of the leading standard linear suppliers in the world. We

believe our current overall portfolio addresses a market that was worth

roughly $40 billion in 2000. That means we have about 4-5% market share.

We believe the total multi-market segment, including discretes,

optoelectronics, standard linear, logic, and interface, will grow to over

$60 billion within the next two to three years. Our goal is to be the

leader of that segment, and become dominant with at least a 10% share.

We have a clear and focused strategy, with a proven track record and considerable

future growth potential. We have talented employees who understand our

mission and how to quickly and effectively execute on our goals.

Joe: Kirk hit the nail on the head.

We plan to continue to build the business and heat the competition, just

as we've executed for the past four years. And, we need to continue to

tell investors our story. Considering our mix of power, analog, and interface

sales, we believe our stock should be valued at least on par with our

peers. Fairchild has an exciting future. We're aiming at a $60 billion

market that's servicing a one trillion dollar electronics industry. If

you combine our new product development with the potential acquisitions

we are looking at, you can't help but be really excited.

Kirk: We're the leaders in our market now. Our market is growing and we plan to extend

our leadership. The future looks very bright. Our power, interface, and

optoelectronic products are critical to just about every kind of electronic

system you can think of. We've had a phenomenally successful first four

years, and we plan to continue our success.

|