Personal Insurance– fulfilling commitments in times of trouble

Suncorp Group's Personal Insurance division is one of Australia's largest and most successful insurers. Our strength lies in our strong portfolio of trusted brands. Collectively, our brands account for 33% of the home and motor insurance markets in Australia. We have more than five million customers, 5,600 employees and manage more than one million claims each year.

Widespread flooding across three States, a cyclone in north Queensland and a series of severe storms across eastern Australia failed to deter Personal Insurance from fulfilling the commitments we made to shareholders last year.

Over the past year, the underlying insurance trading result greatly improved. Gross written premium (GWP) for motor increased by 4.2%, with emerging competitors making little headway in taking market share from our key brands. In the home insurance portfolio, GWP grew by 11.8% which was supported by targeted premium increases for high risks to cover increased reinsurance costs and other weather event expenses.

Simplification

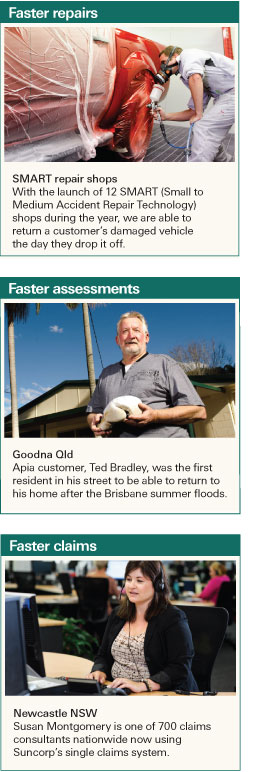

We fulfilled key commitments such as the move to a single pricing engine and the implementation of one claims system, creating a consolidated approach that supports our major insurance brands. This was despite an extraordinary 40,000 home and motor claims arising from the summer of disasters.

In central Queensland, Suncorp completed more than three quarters of claims assessments within three weeks – half the time taken under the old model of operating separate insurance companies.

This was made possible because our strategy differentiates our brands on the outside but leverages our best processes, capabilities and people on the inside to build scale when disaster strikes.

Our decision to replace multiple pricing systems and methodologies with a world-leading single pricing engine has improved margins. We can now charge premiums that reflect the risks associated with individual cars or properties which subsequently reduces our risk and claims costs. The ability to price in such a way also means Suncorp has led the market with innovative products such as automatic flood cover – a position that won widespread customer and community praise and generated profitable new business.

We've previously said that it was crucial to simplify claims processing in order to reduce operational and claims costs. Achieving this required us to create a single claims approach across all of our brands.

The initiatives we've implemented in the past 12 months put us at the forefront of the industry.

We can now return a customer's damaged motor vehicle in half the time taken by traditional smash repairers, with the launch of 12 SMART (Small to Medium Accident Repair Technology) shops. We expect to repair 1,000 cars per week through SMART with lower average repair costs.

We have achieved a great deal in the past year. We have demonstrated that when customers need us most, we have the scale, experience and ability to support them through difficult times.

Next steps

The priorities for the business have not changed. We remain focused on delivering profitable growth, demonstrating cost leadership within all facets of the business and improving our insurance margin.