Performance Comparison

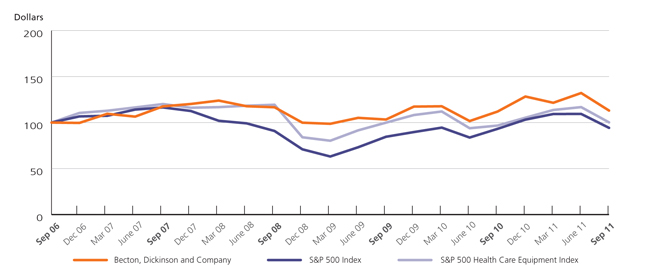

The graph below presents a comparison of cumulative total return to shareholders for the five-year period ended September 30, 2011 for BD, the S&P 500 Index and the S&P 500 Health Care Equipment Index.

Cumulative total return to shareholders is measured by dividing total dividends (assuming dividend reinvestment) plus per share price change for the period by the share price at the beginning of the measurement period. BD’s cumulative shareholder return is based on an investment of $100 on September 30, 2006 and is compared to the cumulative total return of the S&P 500 Index and the S&P 500 Health Care Equipment Index over the same period with a like amount invested.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN AMONG BECTON, DICKINSON AND COMPANY,

THE S&P 500 INDEX, AND THE S&P 500 HEALTH CARE EQUIPMENT INDEX*

*Source: Standard & Poor's