McCORMICK & COMPANY

2008 ANNUAL REPORT

McCORMICK & COMPANY 2008 ANNUAL REPORT |

| Sales in the Americas rose 1.9% with favorable foreign

exchange rates adding 0.5%. In this region, customer

and product rationalization reduced sales approximately

2%. The remaining increase was primarily due to price

increases. During 2007 new products and other volume

gains with sales to food manufacturers were offset by

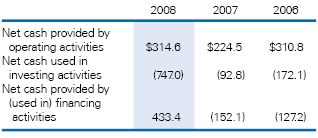

weakness in the restaurant industry. In EMEA, sales increased 20.1%, which included a favorable foreign exchange rate impact of 9.2%. In this region, customer and product rationalization reduced sales approximately 2%. The remaining increase of approximately 13% was mostly volume-related due to increases in snack seasonings and products sold to quick service restaurants. In the Asia/Pacific region, sales increased 25.8% with 8.0% from foreign exchange rates. Rapid expansion of industrial business, especially in China with quick service restaurant customers, contributed to sales in this region. Operating income excluding restructuring activities decreased in both dollar terms and in terms of margin. Higher material costs during the year more than offset the benefit of our 7.3% sales increase and the cost savings from our restructuring activities. At the end of 2007 and into early 2008, we took further pricing actions in response to higher costs. LIQUIDITY AND FINANCIAL CONDITION  We generate strong cash flow from operations which enables us to fund operating projects and investments that are designed to meet our growth objectives, make share repurchases when appropriate, increase our dividend and fund capital projects and restructuring costs. In the cash flow statement, the changes in operating assets and liabilities are presented excluding the effects |

of changes in foreign currency exchange rates, as

these do not reflect actual cash flows. Accordingly, the

amounts in the cash flow statement do not agree with

changes in the operating assets and liabilities that are

presented in the balance sheet. Operating Cash Flow — When 2008 is compared to 2007, most of the increase in operating cash flow is due to a higher level of collections on receivables and a higher level of cash generated from improved net income. Also, we did not make any contribution to our major U.S. pension plan in 2008 as the plan was overfunded as of November 30, 2007 (in 2007 we made a $22 million pension contribution). When 2007 is compared to 2006, most of the decrease in operating cash flow was due to $30 million in increased payments made in 2007 for incentive compensation based upon 2006 operating results and $41 million in higher income tax payments made in 2007 when compared to 2006. Also impacting 2007 cash flow is a higher level of receivables in 2007 than in 2006 due to higher sales and the timing of sales within the year. Investing Cash Flow — The changes in cash used in investing activities from 2006 to 2008 is primarily due to fluctuations in cash used for acquisition of businesses. Cash outflow for the acquisitions of businesses was primarily for the purchases of the Lawry's and Billy Bee Honey Products businesses in 2008, Thai Kitchen in Europe in 2007, and the Simply Asia Foods in 2006 (see note 2 of the financial statements). Also, included in 2008 were $14.0 million in net proceeds from the sale of our Season-All business and $18.1 million in proceeds from the disposal of various assets as a part of our restructuring plan. In 2006 we had $9.2 million in net proceeds from the redemption of a joint venture (see note 3 of the financial statements). Capital expenditures were $85.8 million in 2008, $78.5 million in 2007 and $84.8 million in 2006. We expect 2009 capital expenditures to be slightly in excess of depreciation and amortization. |