McCORMICK & COMPANY

2008 ANNUAL REPORT

McCORMICK & COMPANY 2008 ANNUAL REPORT |

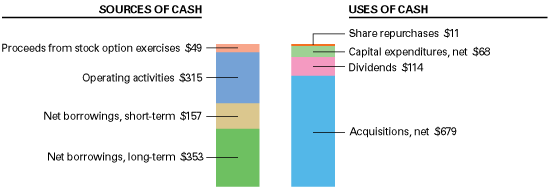

| Financing Cash Flow — We increased our total

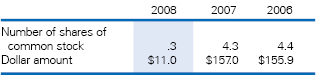

borrowings by $509.1 million in 2008 compared to $65.5 million in 2007 and $77.2 million in 2006. In 2008, these borrowings, along with internally generated cash flow, were used to fund $693.3 million for the purchases of the Lawry's and Billy Bee Honey Products businesses. In September 2008, we issued $250 million of 5.25% notes due 2013, with net cash proceeds received of $248.0 million. The net proceeds from this offering were used to pay down commercial paper which was issued for the purchase of the Lawry's business. In December 2007, we issued $250 million of 5.75% medium-term notes which are due in 2017. The net proceeds of $248.3 million were used to repay $150 million of debt maturing in 2008 with the remainder used to repay short-term debt. In 2006, we issued $100 million of 5.80% senior notes due 2011. Also, in 2006, we issued $200 million of 5.20% senior notes due 2015. The net proceeds from the $200 million offering were used to pay down $195 million of long-term debt which matured in 2006. The following table outlines the activity in our share repurchase programs:  |

The amount of share repurchases in 2008 was less

than prior years due to the funding required for the

Lawry's and Billy Bee acquisitions. As of November 30,

2008, $39 million remained under the $400 million share

repurchase program approved by the Board of Directors

in June 2005. The Common Stock issued in 2008, 2007

and 2006 relates to our stock compensation plans.

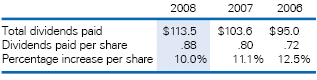

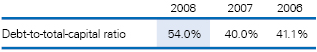

Our dividend history over the last three years is as follows:  In November 2008, the Board of Directors approved a 9.1% increase in the quarterly dividend from $0.22 to $0.24 per share. During the last five years, dividends per share have risen at a compound annual rate of 11.4%.  The increase in our debt-to-total-capital ratio in 2008 (total capital includes debt and shareholders' equity) was the result of a significant increase in our total debt, coupled with a decrease in shareholders' equity. Our total debt |

2008 CASH UTILIZATION (in millions of dollars)  Cash for acquisitions is net of the proceeds from the sale of Season-All. Cash for capital expenditures is net of proceeds from the sale of property, plant and equipment. |