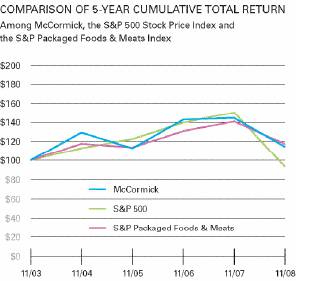

PERFORMANCE GRAPH – SHAREHOLDER RETURN

Set forth below is a line graph comparing the yearly change in McCormick’s cumulative total shareholder return (stock price appreciation plus reinvestment of dividends) on McCormick’s Non-Voting Common Stock with (1) the cumulative total return of the Standard & Poor’s 500 Stock Price Index, assuming reinvestment of dividends, and (2) the cumulative total return of the Standard & Poor’s Packaged Foods & Meats Index, assuming reinvestment of dividends.

The graph assumes that $100 was invested on November 30, 2003 in McCormick Non-voting Common Stock, the Standard & Poor’s 500 Stock Price Index and the Standard & Poor’s Packaged Foods & Meats Index, and that all dividends were reinvested through November 30, 2008.

|

|

MARKET RISK SENSITIVITY

We utilize derivative financial instruments to enhance our ability to manage risk, including foreign exchange and interest rate exposures, which exist as part of our ongoing business operations. We do not enter into contracts for trading purposes, nor are we a party to any leveraged derivative instrument. The use of derivative financial instruments is monitored through regular communication with senior management and the utilization of written guidelines. The information presented below should be read in conjunction with notes 7 and 8 of the financial statements.

Foreign Exchange Risk – We are exposed to fluctuations in foreign currency in the following main areas: cash flows related to raw material purchases; the translation of foreign currency earnings to U.S. dollars; the value of foreign currency investments in subsidiaries and unconsolidated affiliates and cash flows related to repatriation of these investments. Primary exposures include the U.S. dollar versus the Euro, British pound sterling, Canadian dollar, Australian dollar, Mexican peso, Chinese renminbi, Swiss franc and Thai baht. We routinely enter into foreign currency exchange contracts to facilitate managing foreign currency risk.

During 2008, the foreign currency translation component in other comprehensive income was principally related to the impact of exchange rate fluctuations on our net investments in France, the U.K., Canada and Australia. We did not hedge our net investments in subsidiaries and unconsolidated affiliates.

The following table summarizes the foreign currency exchange contracts held at November 30, 2008. All contracts are valued in U.S. dollars using year-end 2008 exchange rates and have been designated as hedges of foreign currency transactional exposures, firm commitments or anticipated transactions, all with a maturity period of less than one year.

|