McCORMICK & COMPANY

2008 ANNUAL REPORT

McCORMICK & COMPANY 2008 ANNUAL REPORT |

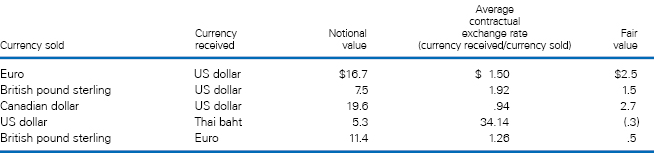

FOREIGN CURRENCY EXCHANGE CONTRACTS AT NOVEMBER 30, 2008 |

We have a number of smaller contracts with an aggregate notional value of $4.4 million to purchase or sell various other currencies, such as the Australian dollar and the Swiss franc as of November 30, 2008. The aggregate fair value of these contracts was $0.2 million at November 30, 2008. At November 30, 2007, we had foreign currency exchange contracts for the Euro, British pound sterling, Canadian dollar, Australian dollar and Singapore dollar with a notional value of $63.1 million, all of which matured in 2008. The aggregate fair value of these contracts was $(2.7) million at November 30, 2007. Contracts with durations which are less than 5 days and used for short-term cash flow funding are not included in the notes or table above. |

Interest Rate Risk – Our policy is to manage interest rate risk by entering into both fixed and variable rate debt arrangements. We also use interest rate swaps to minimize worldwide financing costs and to achieve a desired mix of fixed and variable rate debt. The table that follows provides principal cash flows and related interest rates, excluding the effect of interest rate swaps and |

the amortization of any discounts or fees, by fiscal year of maturity at November 30, 2008 and 2007. For foreign currency-denominated debt, the information is presented in U.S. dollar equivalents. Variable interest rates are based on the weighted-average rates of the portfolio at the end of the year presented. |

||

|