Interest Rates

We finance a portion of our operations with both fixed and variable rate debt instruments, primarily commercial paper, notes and bank loans. We utilize interest rate swap agreements to minimize worldwide financing costs and to achieve a desired mix of variable and fixed rate debt.

We entered into three separate forward treasury lock agreements totaling $100 million in July and August of 2008. These forward treasury lock agreements were executed to manage the interest rate risk associated with the forecasted issuance of $250 million of fixed rate mediumterm notes issued in September 2008. We cash settled these treasury lock agreements, which were designated as cash flow hedges, for a loss of $1.5 million simultaneous with the issuance of the notes and effectively fixed the interest rate on the $250 million notes at a weighted average fixed rate of 5.54%. The loss on these agreements was deferred in other comprehensive income and is being amortized over the five-year life of the medium-term notes as a component of interest expense. Hedge ineffectiveness of these agreements was not material.

In August 2007, we entered into $150 million of forward treasury lock agreements to manage the interest rate risk associated with the forecasted issuance of $250 million of fixed rate medium-term notes issued in December 2007. We cash settled these treasury lock agreements for a loss of $10.5 million simultaneous with the issuance of the medium-term notes and effectively fixed the interest rate on the $250 million notes at a weighted average fixed rate of 6.25%. We had designated these forward treasury lock agreements as cash flow hedges. The loss on these agreements was deferred in other comprehensive income and is being amortized over the 10-year life of the medium-term notes as a component of interest expense. Hedge ineffectiveness of these agreements was not material.

In March 2006, we entered into interest rate swap contracts for a total notional amount of $100 million to receive interest at 5.20% and pay a variable rate of interest based on three-month LIBOR minus .05%. We designated these swaps, which expire in December 2015, as fair value hedges of the changes in fair value of $100 million of the $200 million 5.20% medium-term notes due 2015 that we issued in December 2005. Any unrealized gain or loss on these swaps will be offset by a corresponding increase or decrease in value of the hedged debt. No hedge ineffectiveness is recognized as the interest rate swaps qualify for “shortcut” treatment as defined under U.S. GAAP.

|

|

In 2004, we entered into an interest rate swap contract with a total notional amount of $50 million to receive interest at 3.36% and pay a variable rate of interest based on six-month LIBOR minus 0.21%. We designated this swap, which expires on April 15, 2009, as a fair value hedge of the changes in fair value of the $50 million of medium-term notes maturing on April 15, 2009. No hedge ineffectiveness is recognized as the interest rate swap qualifies for “shortcut” treatment as defined under U.S. GAAP.

Fair Value of Financial Instruments

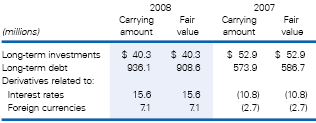

The carrying amount and fair value of financial instruments at November 30, 2008 and 2007 were as follows:

Because of their short-term nature, the amounts reported in the balance sheet for cash and cash equivalents, receivables, short-term borrowings and trade accounts payable approximate fair value.

Investments in affiliates are not readily marketable, and it is not practicable to estimate their fair value. Long-term investments are comprised of fixed income and equity securities held on behalf of employees in certain employee benefit plans and are stated at fair value on the balance sheet. The cost of these investments was $51.7 million and $46.9 million at November 30, 2008 and 2007, respectively.

Concentrations of Credit Risk

We are potentially exposed to concentrations of credit risk with trade accounts receivable, prepaid allowances and financial instruments. Because we have a large and diverse customer base with no single customer accounting for a significant percentage of trade accounts receivable and prepaid allowances, there was no material concentration of credit risk in these accounts at November 30, 2008. Current credit markets are highly volatile and some of our customers and counterparties are highly leveraged. We continue to closely monitor the credit worthiness of our customers and counterparties. We feel that the allowance for doubtful accounts properly recognized trade receivables at realizable

|