value. We consider nonperformance credit risk for other financial instruments to be insignificant.

9. FAIR VALUE MEASUREMENTS

In the first quarter of 2008, we adopted SFAS No. 157, “Fair Value Measurements” for financial assets and liabilities. This standard defines fair value, provides guidance for measuring fair value and requires certain disclosures. This standard does not require any new fair value measurements, but rather applies to all other accounting pronouncements that require or permit fair value measurements. This standard does not apply measurements related to share-based payments, nor does it apply to measurements related to inventory.

SFAS No. 157 discusses valuation techniques, such as the market approach (comparable market prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace the service capacity of an asset or replacement cost). The statement utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The following is a brief description of those three levels:

■ Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities.

■ Level 2: Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active.

■ Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions.

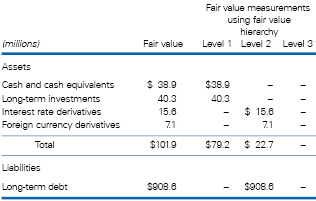

Our population of financial assets and liabilities subject to fair value measurements at November 30, 2008 are as follows:

|

|

The fair values of long-term investments are based on quoted market prices from various stock and bond exchanges. The long-term debt fair values are based on quotes for like instruments with similar credit ratings and terms. The fair values for interest rate and foreign currency derivatives are based on quotations from various banks for similar instruments using models with market based inputs.

10. EMPLOYEE BENEFIT AND RETIREMENT PLANS

We sponsor defined benefit pension plans in the U.S. and certain foreign locations. In addition, we sponsor 401(k) retirement plans in the U.S. and contribute to governmentsponsored retirement plans in locations outside the U.S. We also currently provide postretirement medical and life insurance benefits to certain U.S. employees.

Effective November 30, 2007, we adopted the recognition and disclosure provisions of SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans.” SFAS No. 158 required us to record the funded status of our pension and other postretirement plans on our balance sheet, with a corresponding adjustment to accumulated other comprehensive income, net of tax. The funded status of defined benefit pension plans is measured under the statement as the difference between the fair value of plan assets and the projected benefit obligation. The funded status of other postretirement benefit plans is measured as the difference between the fair value of plan assets and the accumulated postretirement benefit obligation.

Included in accumulated other comprehensive income at November 30, 2008 is $86.7 million ($55.8 million net of tax) related to net unrecognized actuarial losses and unrecognized prior service credit that have not yet been

|