13. EARNINGS PER SHARE

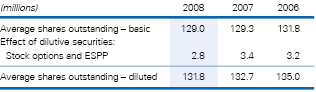

The reconciliation of shares outstanding used in the calculation of basic and diluted earnings per share for the years ended November 30, 2008, 2007 and 2006 follows:

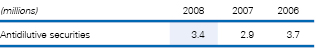

The following table sets forth the stock options and RSUs for the years ended November 30, 2008, 2007 and 2006 which were not considered in our earnings per share calculation since they were antidilutive.

14. CAPITAL STOCKS

Holders of Common Stock have full voting rights except that (1) the voting rights of persons who are deemed to own beneficially 10% or more of the outstanding shares of Common Stock are limited to 10% of the votes entitled to be cast by all holders of shares of Common Stock regardless of how many shares in excess of 10% are held by such person; (2) we have the right to redeem any or all shares of stock owned by such person unless such person acquires more than 90% of the outstanding shares of each class of our common stock; and (3) at such time as such person controls more than 50% of the vote entitled to be cast by the holders of outstanding shares of Common Stock, automatically, on a share-for-share basis, all shares of Common Stock Non-Voting will convert into shares of Common Stock.

Holders of Common Stock Non-Voting will vote as a separate class on all matters on which they are entitled to vote. Holders of Common Stock Non-Voting are entitled to vote on reverse mergers and statutory share exchanges where our capital stock is converted into other securities or property, dissolution of the Company and the sale of substantially all of our assets, as well as forward mergers and consolidation of the Company.

15. COMMITMENTS AND CONTINGENCIES

During the normal course of our business, we are occasionally involved with various claims and litigation. Reserves are established in connection with such matters when a loss

|

|

is probable and the amount of such loss can be reasonably estimated. At November 30, 2008, no material reserves were recorded. No reserves are established for losses which are only reasonably possible. The determination of probability and the estimation of the actual amount of any such loss is inherently unpredictable, and it is therefore possible that the eventual outcome of such claims and litigation could exceed the estimated reserves, if any. However, we believe that the likelihood that any such excess might have a material adverse effect on our financial statements is remote.

16. BUSINESS SEGMENTS AND GEOGRAPHIC AREAS

Business Segments

We operate in two business segments: consumer and industrial. The consumer and industrial segments manufacture, market and distribute spices, herbs, seasonings, specialty foods and flavors throughout the world. The consumer segment sells to retail outlets, including grocery, mass merchandise, warehouse clubs, discount and drug stores under the McCormick brand and a variety of brands around the world, including Lawry’s, Zatarain’s, Simply Asia, Thai Kitchen, Ducros, Schwartz, Vahiné, Silvo, Club House and Billy Bee. The industrial segment sells to other food manufacturers and the food service industry both directly and indirectly through distributors.

In each of our segments, we produce and sell many individual products which are similar in composition and nature. It is impractical to segregate and identify revenue and profits for each of these individual product lines.

We measure segment performance based on operating income excluding restructuring charges from our restructuring programs as this activity is managed separately from the business segment. In 2008 we also measured our segments excluding the non-cash impairment charge to reduce the value of the Silvo brand. Although the segments are managed separately due to their distinct distribution channels and marketing strategies, manufacturing and warehousing are often integrated to maximize cost efficiencies. We do not segregate jointly utilized assets by individual segment for internal reporting, evaluating performance or allocating capital. Asset-related information has been disclosed in the aggregate.

Sales to a customer in our industrial segment accounted for 10% of consolidated sales in 2008 and 2007.

Accounting policies for measuring segment operating income and assets are consistent with those described in note 1, “Summary of Significant Accounting Policies.” Because of manufacturing integration for certain products

|