We file income tax returns in the U.S. federal jurisdiction and various state and non-U.S. jurisdictions. The open years subject to tax audits varies depending on the tax jurisdictions. In major jurisdictions, with few exceptions, we are no longer subject to income tax audits by taxing authorities for years before 2003. In 2007, the Internal Revenue Service commenced an examination of our U.S. income tax return for the tax year 2005. Based on negotiations, settlement is expected in the first quarter of 2009.

Various state and non-US income tax returns are also under examination by taxing authorities.

It is possible that the amount of the liability for unrecognized tax benefits will change during the next 12 months as a result of audit settlements, statute expirations, and additions for positions taken, if any, arising in fiscal year 2009. We do not anticipate any significant impact to the unrecognized tax benefit balance.

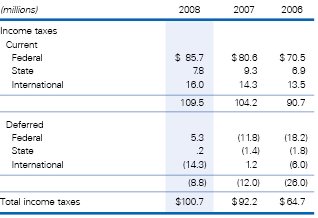

The provision for income taxes consists of the following:

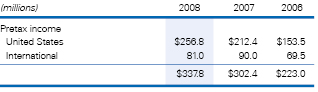

The components of income from consolidated operations before income taxes follow:

|

|

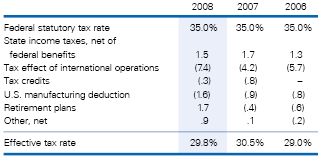

A reconciliation of the U.S. federal statutory rate with the effective tax rate follows:

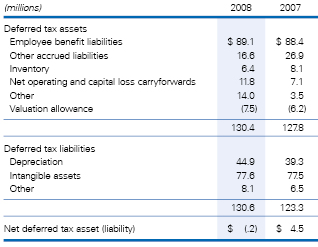

Deferred tax assets and liabilities are comprised of the following:

At November 30, 2008, our non-U.S. subsidiaries have tax loss carryforwards of $49.3 million. Of these carryforwards, $17.6 million expire through 2015, $12.2 million through 2022 and $19.5 million may be carried forward indefinitely. The current statutory rates in these countries range from 8.5 to 34%.

At November 30, 2008, our non-U.S. subsidiaries have capital loss carryforwards of $11.4 million. Of these carryforwards, $2.0 million expire in 2009 and $9.4 million may be carried forward indefinitely. The current statutory rates in these countries range from 15 to 28%.

A valuation allowance has been provided to record deferred tax assets at their net realizable value. The $1.3 million net increase in the valuation allowance was mainly due to an additional valuation allowance related to losses generated in 2008 which may not be realized in future periods.

U.S. income taxes are not provided for unremitted earnings of non-U.S. subsidiaries and affiliates where our intention is to reinvest these earnings permanently. Unremitted earnings of such entities were $513.9 million at November 30, 2008.

|