To Our Shareholders

Consolidated Operating Results

TDS increased revenues and improved profitability in 2011, as our primary business units—U.S. Cellular and TDS Telecom—made solid progress on their strategies, enhancing customer experiences and improving operational efficiency.

- U.S. Cellular achieved growth in average revenue per customer by increasing smartphone penetration, data use, and adoption of higher-revenue data plans, and through growth in inbound roaming revenues. U.S. Cellular also effectively managed device subsidies, even as the number of smartphones sold increased significantly.

- U.S. Cellular improved profitability through revenue growth and effective cost management, though costs remained stable due in part to fewer customer additions.

- TDS Telecom increased data revenues and penetration of broadband services among its residential customers.

- TDS Telecom grew its managedIP customer base and expanded its hosted and managed services portfolio through acquisitions and organic growth.

- TDS simplified its capital structure and improved its financial flexibility through a Share Consolidation.

- TDS increased its dividend for the 37th consecutive year, and recently announced its 38th increase.

BUILDING VALUE FOR SHAREHOLDERS

TDS is committed to growing shareholder value over the long term, and to maintaining an open dialogue with its investors.

In 2011, to simplify our capital structure and reduce the trading discount on the TDS Special Common Shares, relative to the TDS Common Shares, TDS proposed a Share Consolidation amendment to its Restated Certificate of Incorporation to reclassify each Special Common Share as a Common Share on a one-for-one basis. The amendment also proposed to reclassify each Common Share as 1.087 Common Shares, and each Series A Common Share as 1.087 Series A Common Shares. Additionally, the proposal included a Vote Amendment to fix the percentage voting power in certain matters, and amendments to eliminate obsolete and inoperative provisions of the Restated Certificate of Incorporation.

Shareholders approved the amendments on January 13, 2012, and the Share Consolidation became effective on January 24, 2012. On behalf of TDS and the board of directors, we thank our investors for their support. We continue to look for and evaluate operational and strategic opportunities to strengthen and build the company and create shareholder value, and we welcome suggestions from our investors.

In the first quarter of 2011, TDS repurchased 407,000 Special Common Shares for $11.6 million, and U.S. Cellular repurchased 357,000 Common Shares for approximately $17.4 million. Due to the Share Consolidation, TDS and U.S. Cellular ceased repurchasing shares for the remainder of 2011.

STRENGTHENING OUR FINANCIAL FOUNDATION

TDS continued to strengthen its balance sheet and increase its financial flexibility in 2011. To further reduce future interest expense and extend maturity dates, TDS issued $300 million of 7 percent senior notes and used the proceeds to redeem $282.5 million of 7.6 percent Series A notes. U.S. Cellular issued $342 million of 6.95 percent senior notes and used the proceeds to redeem $330 million of 7.5 percent senior notes. TDS will consider issuing additional debt if favorable interest rates continue in the long-term bond market, and there is a compelling business use for such funds.

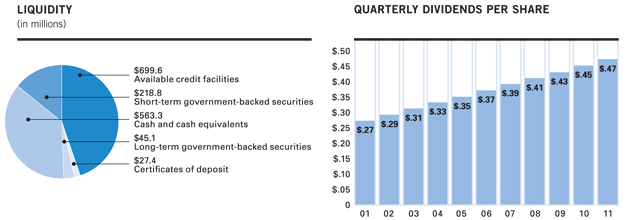

We ended 2011 with a strong balance sheet and ample liquidity, giving us the flexibility to support our businesses by investing in infrastructure improvement and growth opportunities. TDS also increased efficiency by identifying opportunities to share services and resources across the enterprise. We believe that U.S. Cellular and TDS Telecom have effective strategies that will enable them to build toward their respective return on capital targets over the long term.

ADVOCATING FOR OUR BUSINESSES

For wireless and wireline carriers, 2011 was very active on the regulatory front, as the Federal Communications Commission (FCC) revised the rules for universal service funding and intercarrier compensation and proposed further rules to advance reform. The new rules issued by the FCC in November offer both benefits and challenges for our companies, and many areas are still under review and discussion, such as the availability of support for the new Mobility Fund, and issues related to rate-of-return wireline companies, such as TDS Telecom.

We continue to advocate on the issues that impact our ability to compete and to serve our customers effectively, including spectrum availability, special access costs, device exclusivity and interoperability, and data roaming.