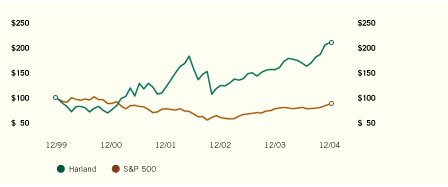

Our mission as a public company is to produce superior returns for our shareholders. We measure our progress in this regard by comparing our performance to that of the S&P 500, and in 2004, we once again outperformed the S&P 500 – the third time in the past four years that we have done so.

Note: The line graph reflects the cumulative, five-year shareholder return on the investment

of $100 (assuming the reinvestment of dividends) on December 31, 1999 in the company’s common

stock compared to such return on the S&P 500 index.

Harland continues to transition from a printing organization to a leading-edge technology company. Producing superior returns for our shareholders facilitates this transition by enabling us to attract capital that we can use for acquisitions, new product development and investments in technology.

Our Pillars and Core Values support our Mission. Together they form the Harland Purpose Statement given at the beginning of this report. By focusing on our four Pillars, and acting in accordance with our Core Values, we will continue to meet our Mission. Using the Harland Purpose Statement as a guide, we achieved a number of significant successes in 2004:

Printed Products began growing on a year-over-year basis in late 2004, and we expect that

growth to continue in 2005. We have won new business and our state-of-the-art production

facilities are hitting record levels of productivity.

We operate in the financial and educational markets, and introduced new products and services for these channels of distribution in 2004, including HarlandImpact(sm), INTERLINQ® E3 and

Achievement Series(sm). Though in the market for only a short time, these new products are being well received and, we believe, are helping us differentiate ourselves from the competition.

Printed Products consolidated five production facilities in 2004. Software and Services, which has made eight acquisitions since 2000, is operating on a more integrated basis. Scantron performed better in 2004, attributable to a reduction in headcount and elimination of expenses in 2003. There is always room for improvement but, as these actions demonstrate, we are committed to operating as efficiently as possible.

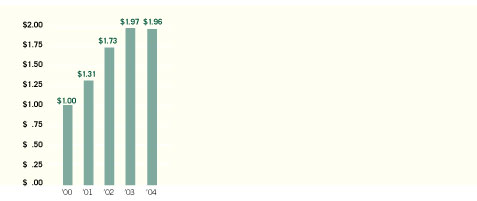

Consolidated sales in 2004 were $798.5 million, a 1.5% increase from 2003 consolidated sales of $786.7 million. Consolidated net income for 2004 was $55.1 million, a decrease of 1.5% from 2003 net income of $56.0 million. Diluted earnings per share for 2004 were $1.96, down from $1.97 in 2003, due to a higher effective tax rate, which more than offset a 1.3% increase in pre-tax income.

Results for 2004 included a pre-tax impairment charge of $7.9 million, equivalent to $0.17 per share. This charge was related to the development of new customer care systems for our Printed Products segment (we determined that upgrading certain existing systems would be more economical than continued development of portions of the new systems) and pre-tax charges of $5.8 million, equivalent to $0.13 per share, related to the reorganization of Printed Products. Results for 2003 included charges of $6.9 million, equivalent to $0.15 per share, related to the reorganization of Printed Products, and pre-tax gains on the sale of certain investments of $3.0 million, equivalent to $0.11 per share.

We have long stated that we are committed to strengthening shareholder value by leveraging our strong cash flow to support internal development, acquisitions, share repurchase, dividends and

improving our balance sheet. Since 1998, we have made 12 acquisitions, which have strengthened our position in a number of key areas, most notably in software for financial institutions. The three acquisitions we made in 2004 are described in the Software and Services segment of this report. Our internal development efforts are also described in their respective sections.

We believe Harland is a good investment and continue to execute on that belief through share repurchase. We repurchased 1.4 million shares in 2004 at an aggregate cost of $45.3 million. Over the past six years we have repurchased 7.8 million shares at an aggregate cost of $178.7 million. Share repurchase will continue to be one of the options we consider to create shareholder value. In 2004, we increased our quarterly dividend 25% to $0.125 per share, the second year in a row that we have done so.

By many measures, 2004 was a good year for Harland and for our shareholders. But, as the saying goes, that was then; this is now.

We will continue to focus on producing superior returns for our shareholders and to measure our

performance against the S&P 500. We believe achieving the following are critical if Harland is

to continue outperforming the index:

- Build on our core areas of expertise: payment transactions, compliance, business intelligence, and testing and assessment. We have strengthened our position in all four areas in recent years.

- Increase organic growth. We have done a good job of growing through acquisition. We must now demonstrate that we can also grown from within.

- Improve operational efficiencies. We have a solid track record in this area. Further improvements

are always possible, and we will pursue them

across the organization.

- Increase internal development. Internal development is improving, and there is more internal development across the organization now than

at any other time in our 82-year history. We

now need to successfully bring new products

and services to market.

You have placed great trust in us by investing in Harland. We don’t take that trust lightly and will continue to focus on rewarding it.

Thank you for your confidence and for sharing our pride in the significant achievements of the past year. We are capable of meeting the new challenges and opportunities we will face in 2005, and I look forward to updating you on our progress next year.

Sincerely,

Timothy C. Tuff

Chairman, President and Chief Executive Office

|