If the decade ending 2010 were a football game, it would be a story of two distinct halves. The first characterized by several years of the industry regaining profitability through rate increases, leading to significant industrywide growth in written premium. Progressive posted growth rates more often than not in the strong double digits zone for this half. As well documented frequency declines emerged and industry rate levels proved to be more than adequate, a six-year period of industry profitability followed. Best efforts interpreting history would suggest that two consecutive profitable years was the previous high water mark. Growth in written premium inevitably slowed, producing a slightly lagged, but matching, period of industrywide written premium declines. Progressive frustratingly posted low single digit growth numbers above and below zero for the same period. While gas prices, driving behavior, Internet adoption, media spending, and the economic crisis at a minimum would be required to fully chronicle the decade, there is little doubt the classic nature of the insurance cycle, with unique wavelength and amplitude to extend the analogy, has played a significant role. The closing years of the decade appear to be the approximate time frame during which industrywide profitability will once again be moderated and sustained industry premium declines will turn positive.

With that as a back drop, it is helpful to review Progressive’s evolution as a company during the same period and, more importantly, our positioning for whatever emerges over the next decade.

Underwriting Results

Our commitment to a profitability target of a 96 combined ratio served well during the decade and at no time did we fail to meet or exceed our targets — a result we view with some pride. The period has seen an emergence of our Direct business as an industry leader and a significant contributor to our growth and profitability, joining our important and now growing Agency operations. With that emergence has come greater recognition for the margin contribution effects in any given calendar year from the timing dynamics unique to Direct distribution, prompting me last year at this time to write, “However, under certain high growth new business scenarios, we would be happy to see the reported monthly and calendar-year combined ratios go above 96 for our Direct business, as long as our new and renewal business consistently meets predefined targets that ensure a lifetime result at or below 96,” and, by implication, without compromise to the attainment of an aggregate companywide 96 in any calendar year. In fact, we were happy to experience high growth scenarios in our Direct business in 2010, notably in the first two quarters, driven by strong double digit new application growth. On three occasions during the year, our monthly combined ratio for the Direct business exceeded 96 but, as designed, our new and renewal cohorts met the necessary targets to ensure both lifetime profitability and aggregate calendar-year performance goals. The Direct business finished the year with a 94.6 calendar combined ratio, about two points higher on an accident-year basis — a strong performance given significant new business.

The momentum building in the second half of 2009 in our Agency auto production carried into 2010 and we saw attractive growth in new applications and policies in force for the entire year. Similar to Direct, demand was stronger on a year-over-year basis earlier in the year, but Agency, more so than Direct, maintained a reasonably consistent pattern throughout the year. Our policies in force for Agency had fallen from our all-time highs and, while not happy for that experience, we are now back to levels closely approximating our best, with reason to believe in continued momentum and new highs in 2011.

We ended the year with both channels and all Personal Lines products meeting targets both on the GAAP presentation of numbers and our more preferred accident year presentation. We started the year with significant problems in several large states and personal injury protection (PIP) coverage was one common denominator. Efforts throughout the year to manage these states, involving actions and rate level changes to position us for future profitable growth, were generally effective, with profitability first among priorities. We now have reason to be more optimistic for the growth outlook in these states for 2011.

In Personal Lines, 4 out of 51 regulatory jurisdictions in which we operate failed to make a profit. One, a recent market entry that in retrospect was mispriced and the recovery while slow is very much on track; one in which extreme and unusual weather is an identifiable condition; one where our management of the PIP coverage is still a work in progress; and a fourth just missed. Several others, while profitable, did not meet their planned targets. I offer this perspective to reinforce the point that we manage the business at the local level with talented product managers focused on the issues and conditions of their state, a view which is not always visible from the aggregate reporting offered in our financial presentations.

Our Commercial Auto business, largely distributed by our agents, had about as good of a year as we could expect. Our year-over-year reduction in active policies was a very small negative by year-end, down somewhat more on a multi-year basis, reflecting general economic and employment conditions. Profitability was strong at an 87.5 combined ratio and meaningful signs of growth were emerging during the year. We will need large and important states to reflect greater growth going forward to regain lost ground in this segment. Similar to our work in all products, our Commercial Auto group has been actively redesigning its product offering to reflect our best knowledge and experience and has done a great deal of work, in a period of less robust growth, to position for the future.

A Destination Company

One way I have described Progressive today is having evolved from a “Transaction” company to a “Destination” company. As a transaction company, we were and remain very focused on the essential transactions of insurance — presenting rates to our agents with the best possible technology; settling claims in a fast, fair, and efficient manner; providing 24/7 service on all manner of issues; changing rates to reflect current market conditions quickly; and the many other critical functions of our business.

What has evolved now is the distinct overlay of a customer-care culture, making our actions even more consistent with a company our customers can expect to be their long-term auto insurance destination. While few service companies would have differing objectives, we feel very good about our intensity and progress. Industry surveys would support our feelings, but most importantly customer policy life expectancy continues to lengthen and our 2010 actions, including our improved loyalty programs and commitment to rate stability at renewal, continued our push, with both channels increasing policy life expectancies during the year to all-time highs. Our effective use of Net Promoter® Scores as an internal barometer of our progress leaves open considerable room for improvement and will remain a top priority.

Increased rigor around customer segments in recent years highlighted the need to provide our customers with other products they need over time and may have had to leave Progressive to acquire. Offering a homeowners product underwritten by others, but packaged with our auto product, has met a consumer need and resulted in very attractive retention characteristics. We ended the year closing in on a million customers with multiple products purchased from Progressive, with a significant and growing percentage of those bundling homeowners’ or renters’ with their auto coverage.

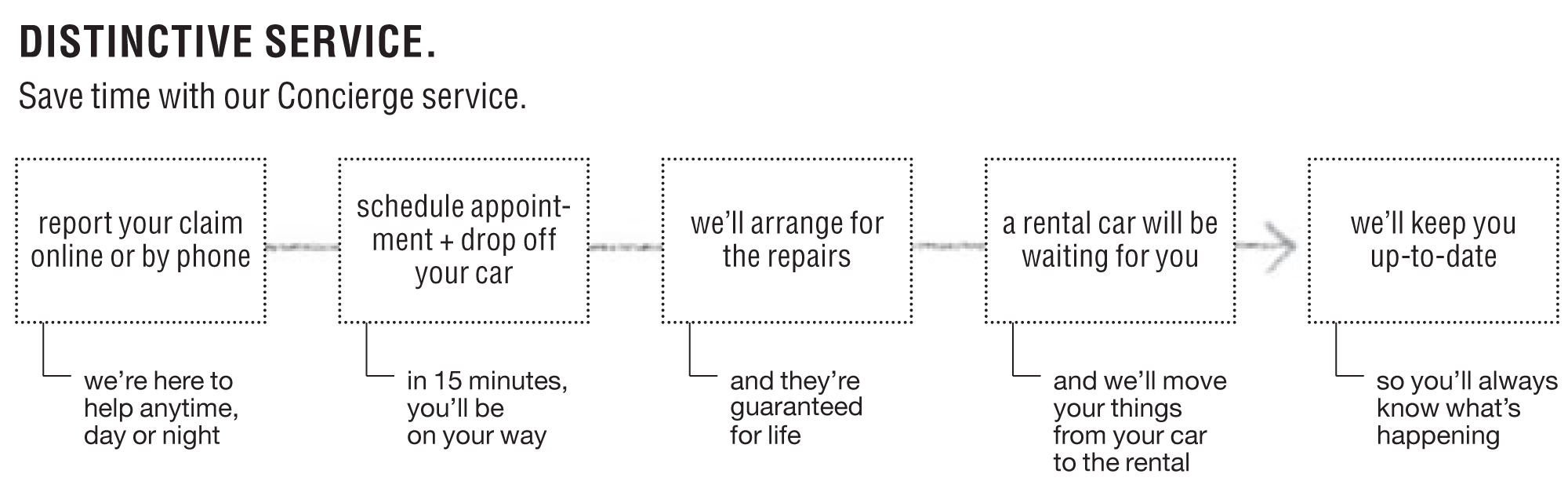

Creating the environment where customers want to stay involves some bolder strategic moves, such as offering homeowners and concierge claims service, but more so a relentless focus on the thousands of details in product design, customer service, claims delivery, and every other aspect of our business. Progressive today is a different company and, in the broadest of terms, the asset value of the company, represented by numbers of customers and future months and years of life expectancy, is a different product by far than at the start of the decade.

Brand Strategy

Our success and ability to communicate our brand has built consistently during the decade and 2010 was perhaps one of our best years. With the same caveat regarding survey results as in my opening, we are encouraged that consumer awareness of our brand continues to grow and the substance of their awareness is consistent with our intentions.

In addition to greater recognition of the company that changes how insurance is done, we are perceived as a company that “Has unique and distinctive features” and “Makes the entire auto insurance process easier.” These are more than acceptable consumer characterizations. Our now quite recognizable employee spokesperson “Flo” continued to be the central figure in our advertising for 2010, and while no one taste satisfies all, “Flo’s” appeal is very real. With nearly 2.5 million Facebook fans, she has no comparables in the insurance industry and one needs to look to the Boston Celtics or The Daily Show for a closer match.

The insurance advertising space was very active in 2010, as we expect it will be going forward, and making our brand truly distinctive requires continuous product innovation and compelling messaging. Last year I covered in greater detail the effectiveness of “Flo” not just in creating demand, but as the model of brand ambassadorship she exhibits and the stylized, but accurate, portrayal of our more than 24,000 employees. Expect to see much more of “Flo” in 2011.

Complementing the point of view expressed through “Flo” and the superstore will be the point of view of a satisfied customer as an advocate or promoter. This character feels licensed to comment on other people’s shopping experiences based on his knowledge and experience with Progressive. The character, we call the “Messenger,” will help tell the Progressive story from a different point of view while incorporating meaningful points of branding with our established campaign. Developed and tested in late 2010, we have high hopes this identifiable character will provide added weight to our “Flo” of customers (I know).

The rate of change in the diversity of media available to all of us as consumers has been, and will continue to be, game changing in creative development and media placement disciplines. While our skills and talents have been building to match the environment and importance, we did not yet have the leadership in this area that would ensure performance standards comparable to our other essential disciplines. I’m happy to report that I think this has changed with Jeff Charney accepting my invitation to join Progressive as our Chief Marketing Officer late in 2010.

Product Development

Product development is at the core of Progressive, whether continuously refining our product at the macro level or for state-specific adaptation. 2010 saw the culmination of multi-year efforts to take the best features of our product designs independently derived for the Agency and Direct channels and integrate them into one design with maximum flexibility to serve both channels. Consistency of product, not necessarily price, regardless of whether presented by an agent or directly by Progressive, is a meaningful advantage along with the attendant reduction in maintenance costs and talent dilution associated with multiple systems.

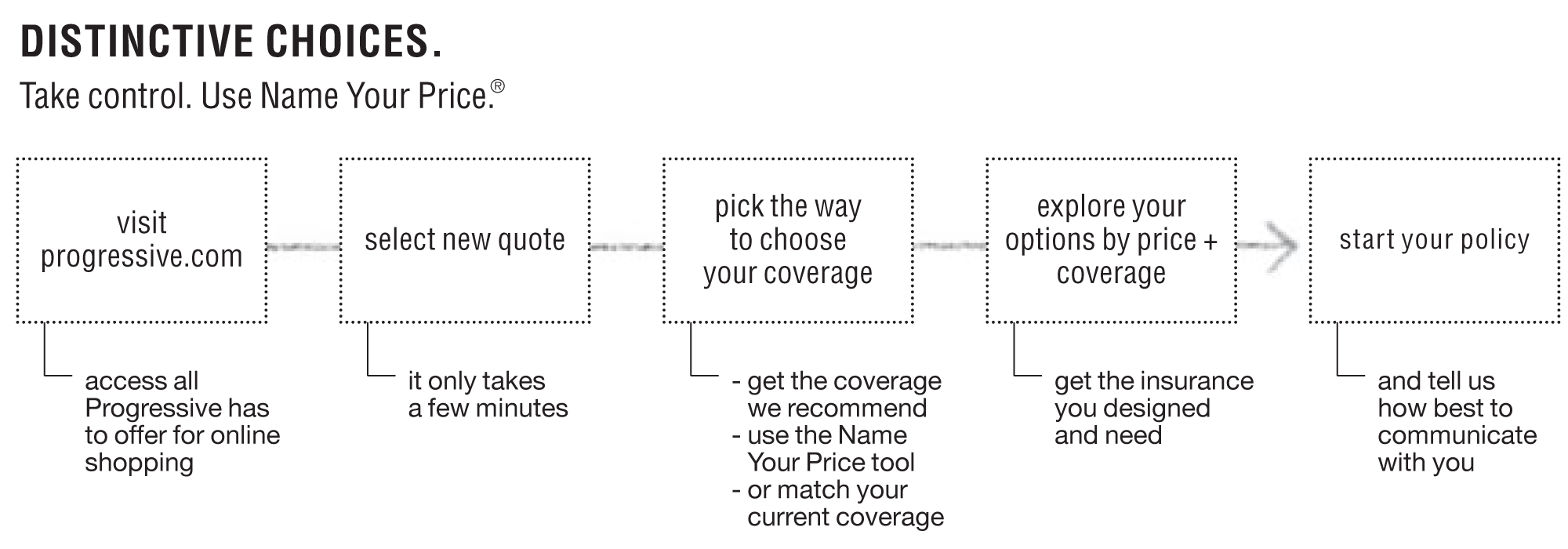

More dramatic product features and packaging, like Name Your Price® (NYP), provides consumers wishing to shop online a very real opportunity to leverage technology and explore the options available to them. Agents have always helped customers reach smart decisions on price and coverage. We believe NYP contributed very nicely to our growth in 2010, but equally as important is consumer realization and appreciation that Progressive is a company willing to challenge and change how things are done.

These types of product presentations are only possible with great consumer facing technology. Progressive has been recognized as the industry leading Web site and received 16 out of 17 Keynote awards. However, consumer facing technology now is a much expanded category with smart phones and tablets providing form factors we intend to exploit to extend our product presentation and drive profitable growth. As NYP leveraged technology in one way, the potential for devices that are on your person, often with a camera and location software, is a whole new and really exciting dimension for all aspects of our business. Expect more next year.

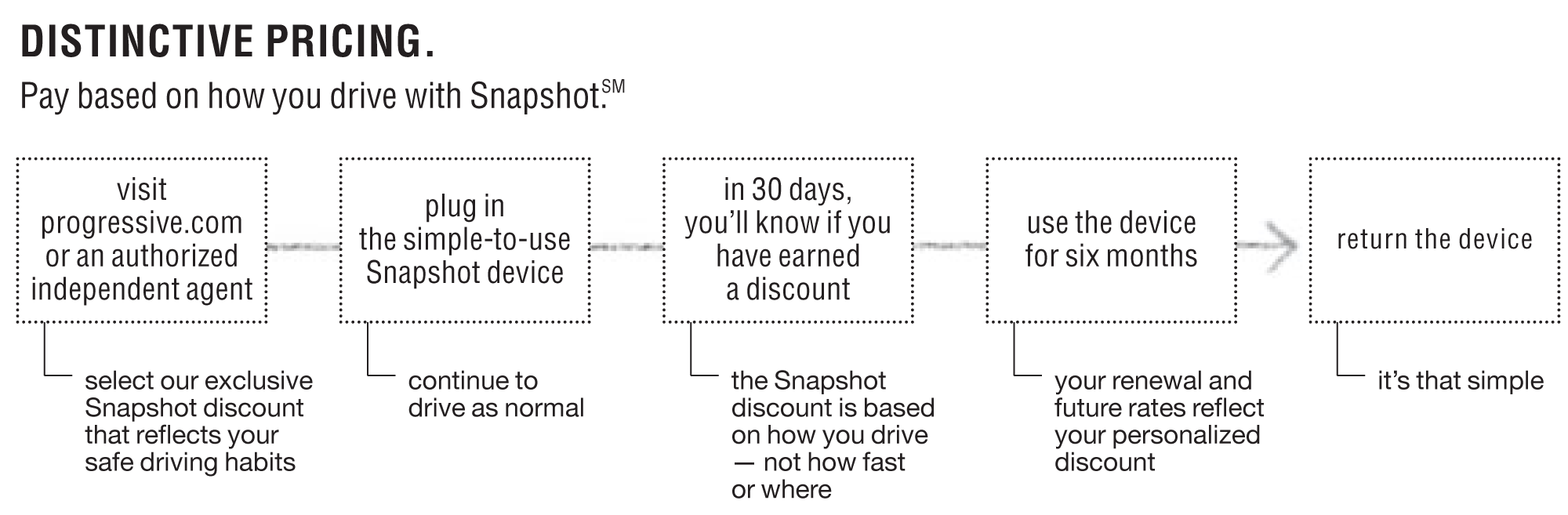

Ironically, usage-based insurance, a concept correctly associated with Progressive, has been around for most of the last decade, but the technology to track in-vehicle data and the insurance product development were for the most part experimental. The later years of the decade saw rapid improvement in the technology and the cumulative knowledge we had acquired was leading to a better product and increasingly improved commercialization of the idea. 2010, however, was a breakthrough year. We dramatically repackaged the concept, making the consumer experience easier, incorporated usage as a product feature within our mainstream product offering, simplified the marketing message, and reduced the costs, all, we believe, while maintaining the rating effectiveness we know and understand. Early rollout and transitions from prior versions suggest that we are very much on-track with the redesign objectives. Our repackaged product known as SnapshotSM, reflecting the “snapshot” of driving behavior we seek in the monitoring period, is available through participating agents and for online consumers. It’s hard not to be excited by the potential for this concept and our redesign. Our 2011 plans call for increasing the number of states in which we offer the product, further improving the customer experience, and active marketing.

Operational Skills

Marketing, product design, and distribution, perhaps for some are the more visible elements of Progressive, but our success is directly dependent on our operational skills and the talented individuals who execute, lead, and design the processes we follow. It is here the customer care culture really has been operationalized. Claims resolution, our call centers operations, and our technology operations all had very good years in 2010.

Claims resolution continues to produce quality results and operating costs that in no small way reflect in our aggregate performance. Our numerous call center operations continue to seek ways to increase their focus on customer retention and agent satisfaction through superior, yet efficient, service. This commitment is now leading us to begin using technology that will help provide insightful diagnostics of a phone call, not just statistics, including consumer interaction styles and points of consumer stress during the call and by so doing provide for greater feedback on the emotional adaption required of us to provide the best possible future service. And while there are moments we can’t live with it, we know we can’t live without it. Technology makes all that has been featured in this letter possible and getting it right and getting it fast and getting it cost effective is a never-ending challenge.

Continuously innovating and changing things that work because there is a better way is difficult and demanding and requires a special mindset and motivation. Relentlessly improving our products and services, providing reasons for customers to stay and others to join is never ending. That is what we do. The decade has seen a lot of changes and 2010 was as big a year as any. I like the changes and the options we’ve created. I like the greater breadth of customers that we have been able to attract as a destination insurer. I like the customer culture that our leaders have created.

Investments and Capital

Investment and capital management, happily, had a year further removed from the hot seat imposed by prior years. The challenge became the return of underleveraged capital and effective asset management in a low interest rate world. We positioned our portfolio near the low end of our duration guidelines, with preference for credit and reinvestment risk over interest rate risk. Implicit in this positioning was an asymmetric view on the future directions of interest rates — more likely up than down from such low levels. While we cannot be sure of the timing on this positioning, we are sure that we will continue to invest in a manner that recognizes that our ability to underwrite all the insurance available to us is the “protected asset.”

Signs late in the year suggest this positioning had merit. We were comfortable with the composition of our portfolio during 2010, but, as with everything we do, there is always room for review and improvement. Our decision to increase our corporate bond, asset-backed, and commercial mortgage-backed portfolios helped us earn a strong return. Portfolio results contributed $765.7 million to comprehensive income in 2010. Municipal budget woes, and by extension municipal bonds, became front page news during the second half of 2010. We began selling some of our municipal bond exposure during 2009 and continued into the first quarter 2010 when valuations were high. Later in the year, when valuations were lower and, to us, at more attractive levels, we increased our holdings. We continue to diligently manage our credit exposure to all of our investments, including municipal bond positions. Adding to our common equity position during the year produced good results and, with hindsight, could have been larger. We finished the year with 24% of our invested assets in what we call Group I, which includes common stocks.

Our capital position was very strong throughout the year and by mid-year we were actively considering a range of actions, consistent with our long-standing philosophy of returning underleveraged capital to shareholders when appropriate to do so, in addition to the 13.3 million shares we repurchased during the year. Our first notable capital action, which took place last summer, was the retirement of $223 million of our outstanding hybrid debt issue, which we were able to do paying 95 cents on the dollar. Prior to that transaction, we were required to gain consent from the holders of our 2032 senior debt issue to terminate a replacement capital covenant. We were successful in our solicitation to eliminate that requirement. This combined transaction was a very effective use of underleveraged capital and creates a significant increase in the freedom we will have in future years regarding the remaining hybrid debt. Our debt-to-total capital ratio closed the year at 24.5%, well below our 30% guideline, preserving significant debt capacity should we need or choose to use it.

We spend significant time and effort modeling our capital requirements and sizing what we call layers of capital to satisfy regulatory requirements and the contingencies for all manner of risks we can envision in our business. Based on this modeling, we formulate our minimum capital requirement and, by definition, a sizing of any underleveraged capital. Based on this work, and after considering all options, the Board of Directors approved a $1 extraordinary dividend, which was paid in December.

While the timing was similar, our declaration of an annual variable dividend is quite distinct from the extraordinary dividend. Our performance as a company is reflected in our Gainshare score, a measure of some complexity that reduces to a score between 0 and 2. Our final score for 2010 was 1.50, a welcome rebound from prior years and I believe a very fair reflection of the year. Companywide performance compensation has the Gainshare score as a base as does our shareholder variable dividend. The 1.50 score, after-tax underwriting income of $704.3 million, and the 25% target factor established by the Board, combined for a variable dividend of $0.3987 per share paid in February 2011 for 2010 performance.

We remain very confident that the variable dividend is an appropriate part of our capital management arsenal, and now have several years that have tested its formulation. With minor changes to reflect a constraint that comprehensive income exceed underwriting income and an increase last year in the percentage of underwriting income, the design has achieved exactly what we had hoped. For 2011, the Board of Directors has changed the target factor, which is the percentage of underwriting income available to be distributed by the formula, to 331⁄3%. It is more likely than not that this target factor will remain at this level for some time.

Our People and Culture

Addressing groups within Progressive, I often simplify our business to two critical components to make a point — “We don’t have many characteristics of other businesses — the tangible product features of consumer electronics, the intellectual property of the pharmaceutical business, the production lines of the manufacturing segment,…” we have “People” and “Reputation.” Much of this letter and report, as is appropriate and the custom, focuses on this year’s economic and tactical accomplishments along with an accounting-based presentation. It doesn’t fit well in that format, but it is simply not a complete report without due recognition to all the people who make it possible and upon whom our reputation rests. Our people and our culture are what make us special.

My close each year thus is appropriately the most constant part of this letter for it is the most public forum I have to thank the people of Progressive, our agents and brokers, customers and shareholders for their support.

To all the people who make Progressive, “Progressive” — Thank you.

Glenn M. Renwick

President and Chief Executive Officer