|

In fiscal year 2000, The Cooper Companies continued to generate strong

increases in revenue, earnings and cash flow. Since 1995, the first full

year under the current management, Cooper's revenue has grown at a compounded

annual rate of 29 percent, its operating income at 46 percent, its pro

forma earnings per share from continuing operations at 45 percent and

its cash flow per share at 38 percent.

During this period, both of our medical device business units have prospered.

CooperVision (CVI), our contact lens business, has grown its revenue at

a compounded annual rate of 29 percent and today is one of the world's

leading and fastest growing manufacturers of contact lenses.

CooperSurgical (CSI), our women's healthcare business, has achieved significant

scale, with revenue growing at a compounded annual rate of 29 percent

and now approaching $50 million annually, as we continue to consolidate

a fragmented market. During this period, CSI has become a major manufacturer

and marketer of medical device products for the gynecology segment of

the women's healthcare market in the United States and, we believe, the

largest supplier of gynecology devices for the physician's office.

Other measures of financial performance are equally strong. Over the past

five years:

• Cash flow (pretax income from continuing operations plus depreciation

and amortization) per share has grown from $.69 to $3.51.

• Debt has declined to 20 percent of total capitalization.

• One hundred shares of Cooper stock that cost $588 on October 31, 1995

increased in value by over 500 percent to $3,575 by the end of fiscal

2000. During this period the Company's market capitalization grew from

$68 million to $517 million.

We are proud of this record of consistent growth that Cooper's employees

have delivered and thank them for their continued commitment to our goals.

As we look ahead, we see positive market dynamics driven by favorable

demographics for both businesses and continued efficiency and innovation

in serving them.

The soft

contact lens market around the world remains attractive, growing

at about six percent to an estimated $3 billion in 2000. In the United

States and in other industrialized countries, a new group of teenagers

is entering the market. As contact lens wear begins in the pre- and early

teen years, these new wearers are now beginning to generate a revenue

annuity. The soft

contact lens market around the world remains attractive, growing

at about six percent to an estimated $3 billion in 2000. In the United

States and in other industrialized countries, a new group of teenagers

is entering the market. As contact lens wear begins in the pre- and early

teen years, these new wearers are now beginning to generate a revenue

annuity.

In Japan, the world's second largest contact lens market, practitioners

are rapidly shifting to disposable and planned replacement soft contact

lenses from hard gas permeable lenses.

In addition to these positive macro market trends, many lens manufacturers

are now launching new specialty, value-added products that are upgrading

the value of the market. In many countries outside the United States,

contact lens fitters are finding that toric lenses both benefit patient

vision and enhance practice income, and the market is expanding. Toric

lenses, the fastest growing segment of the worldwide contact lens market,

are CooperVision's leading products.

In addition to these positive macro market trends, many lens manufacturers

are now launching new specialty, value-added products that are upgrading

the value of the market. In many countries outside the United States,

contact lens fitters are finding that toric lenses both benefit patient

vision and enhance practice income, and the market is expanding. Toric

lenses, the fastest growing segment of the worldwide contact lens market,

are CooperVision's leading products.

New aspheric lens designs that provide a crisper quality of vision and

improved acuity in low light conditions also have been well accepted.

CVI's Frequency Aspheric lens has become the worldwide leader in

this value added category. CVI also married its aspheric technology to

a new line of cosmetic lenses, Frequency Colors, and entered this

second fastest growing segment of the worldwide specialty lens market

during 2000.

Favorable demographic trends also drive our women's healthcare business.

Women of the "baby-boomer" generation are reaching the age when gynecology

procedures are performed most frequently, and CooperSurgical has, through

both acquisition and internal development, built an extensive product

line to support them. You'll read more about this below in a special section,

CooperSurgical: Consolidating Women's Healthcare for Profitable Growth,

that details the women's healthcare market and CooperSurgical's strategy.

We feel strongly that CooperSurgical is an important member of the Cooper

family, and this section describes why.

YEAR

IN REVIEW

The Cooper Companies reported sales of $197.3 million for the fiscal year,

a 19 percent increase over 1999. CVI's revenue grew to $151.8 million,

up 12 percent, while CSI's grew to $45.5 million, a 55 percent increase

that reflects primarily the acquisition of two lines of women's healthcare

products earlier in the fiscal year. Diluted earnings per share from continuing

operations grew 32 percent to $2.03. Cash flow per share reached $3.51,

up from $2.82 the previous year.

COOPERVISION COOPERVISION

In the United States, the largest contact lens market in the world, CVI's

revenue grew 18 percent to $97.8 million, improving its market share by

about one share point.

Outside the United States, CVI's core revenue grew 18 percent at constant

currency rates as new product launches, particularly in Canada and in

Europe, brought fresh vigor to our operations abroad. With the recent

acquisition of distributors in Sweden and Spain, we now have CVI infrastructures

in five countries outside the United States.

In Japan, through its marketing partner Rohto Pharmaceuticals, Inc., a

leader in the Japanese consumer eye care market, CVI has so far introduced

only conventional lenses – those worn for about a year before replacement

– and revenue is limited. We expect Rohto to introduce CVI's line of frequently

replaced lenses to Japanese practitioners in 2002 following regulatory

approval.

Rohto is the fourth-largest company in Japan's drug, cosmetic and healthcare

products industry with 2000 revenue of about $515 million and about 640

employees. It is the leading "over-the-counter" eye drop manufacturer

in Japan and ranks second or third in sales of contact lens solutions.

Rohto will use its significant distribution presence to market CVI's contact

lenses.

Rohto received Japanese regulatory approval in 1999 to sell CVI's conventional

spherical and toric lenses and has introduced these lenses under the Rohto

i.Q brand in Japan.

Toric lenses to correct astigmatism continue to be CVI's strongest product

line. The torics lens market, about $330 million worldwide, continues

to grow faster than any other segment of the contact lens market. In the

United States, where about three-quarters of these products are sold,

we estimate that the toric market grew 7 percent, compared with a flat

market for spherical lenses, which correct only near- and farsightedness. Toric lenses to correct astigmatism continue to be CVI's strongest product

line. The torics lens market, about $330 million worldwide, continues

to grow faster than any other segment of the contact lens market. In the

United States, where about three-quarters of these products are sold,

we estimate that the toric market grew 7 percent, compared with a flat

market for spherical lenses, which correct only near- and farsightedness.

Sales of CVI's toric products in the United States grew 19 percent in

fiscal 2000, six times faster than the total U.S. contact lens market,

and its share of the total toric lens market in the United States reached

31 percent, up more than two share points. CVI's disposable planned replacement

toric revenue, led by Frequency Toric and the new CV Encore

Toric, grew 32 percent. CVI now holds about 34 percent of this market.

CVI's gross margin improved from 66 percent of revenue to 69 percent

year to year due to a favorable product mix shift to higher margin products

and to continuing manufacturing efficiencies. As our sales to Rohto in

Japan become significant, we expect our gross margin to decline but operating

margins to remain at historic levels while we generate incremental operating

income from our Japanese sales. Under our agreement, Rohto will incur

the costs to market the lenses in Japan, and our prices to them will reflect

this arrangement. These lower prices will reduce our gross margins, but

without local marketing costs, our operating margins will remain intact.

CVI launched three important new specialty lens products during 2000.

In the first quarter, we launched Frequency Aspheric in the United

States following its overseas introduction in 1999. The optical properties

of this lens improve visual acuity in low light conditions and correct

low amounts of astigmatism where toric lenses are not indicated. This

offers practitioners the opportunity to improve patient vision while adding

incremental income to their practices with a value added, highly featured

product.

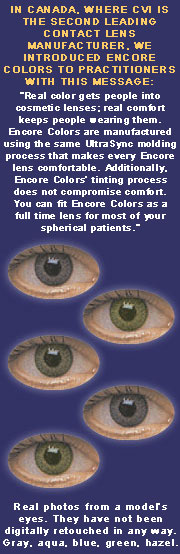

In May,

CVI introduced Frequency Colors in Europe and in September,

launched Encore Colors in Canada. In the first quarter of 2001,

CVI will start marketing Frequency Colors in the United States.

The cosmetic lens market – opaque and color enhancing lenses that change

the appearance of the eye's natural color – is the second largest specialty

lens market segment behind toric lenses. Worldwide revenue is about $250

million, growing at about 8 percent annually. The Frequency Colors

line of five opaque colored lenses is well differentiated from its competition

in three important ways: In May,

CVI introduced Frequency Colors in Europe and in September,

launched Encore Colors in Canada. In the first quarter of 2001,

CVI will start marketing Frequency Colors in the United States.

The cosmetic lens market – opaque and color enhancing lenses that change

the appearance of the eye's natural color – is the second largest specialty

lens market segment behind toric lenses. Worldwide revenue is about $250

million, growing at about 8 percent annually. The Frequency Colors

line of five opaque colored lenses is well differentiated from its competition

in three important ways:

First, patients rated Frequency Colors equal or better in appearance

than the top-selling brand of disposable color contacts. The technology

used to color the lenses randomly places dashes of color throughout the

lens in varying tones and intensity to give the appearance of a natural

iris.

Second, Frequency Colors has demonstrated superior comfort in clinical trials

compared to the leading competitive products.

Third, it incorporates

the benefits of the aspheric design of Frequency Aspheric.

Importantly, CVI's line of colored lenses are interchangeable with the leading brands of disposable spherical lenses,

so practitioners will not have to refit current wearers who want to use colored lenses occasionally.

During 2000, CVI also introduced a cast molded toric lens, CV Encore

Toric, to compete in the two-week segment of the disposable toric

market in the United States. Because of the efficient UltraSync

manufacturing technology, this lens can be priced competitively.

CVI also introduced the Cooper Prosthetic Lens this year. Prosthetic

lenses are similar to opaque lenses, but are denser in color to mask corneal

scarring and other conditions that cause the eye to appear unattractive.

CVI's bifocal lens remains in clinical trials with a marketing decision

expected during 2001. Results must be superior to competitive lens performance

after six months of wear or we will not introduce this product. CVI's bifocal lens remains in clinical trials with a marketing decision

expected during 2001. Results must be superior to competitive lens performance

after six months of wear or we will not introduce this product.

CVI expanded its presence on the World Wide Web during 2000 with a new

marketing initiative that informs consumers about its advanced technology

lenses and refers them to local contact lens practitioners who have registered

on the CVI site. A second feature allows practitioners to ship lenses

directly to their patients or order lenses directly for their own inventory.

The Website is www.coopervision.com.

COOPERSURGICAL

Two acquisitions helped drive CSI's 2000 revenue to $45.5 million, up

55 percent. In December 1999, CSI purchased a group of women's healthcare

products from BEI Medical Systems Company, Inc., including a well-known

uterine manipulator and other products for the gynecological surgery market.

In January 2000, CSI purchased Leisegang Medical, Inc, a leading global

designer and manufacturer of precision instruments for women's healthcare

including colposcopes, instruments to perform loop electrosurgical excision

procedures, hand-held gynecology instruments, disposable specula and cryosurgical

systems. Many of the products are disposable, including the Sani-Spec

line of plastic specula, its largest product group. CSI believes it is

now the world's leading manufacturer and marketer of colposcopy products

– instruments used to examine the cervix.

In another transaction announced in October 2000, CSI purchased MedaSonics,

Inc., which markets a line of compact, hand-held Doppler ultrasound systems

used in obstetrics and gynecology, cardiology and other medical specialties.

Fetal Dopplers detect fetal life and viability from as early as nine weeks

gestation and assess the rate and rhythm of the fetal heartbeat. Vascular

Dopplers locate and determine the status of blood vessels and measure

systolic blood pressure in infants, and patients with trauma or obesity.

During surgery, dopplers detect venous air embolism, evaluates direct

vessel and transcutaneous blood flow and measures systolic blood pressure.

In November, CSI announced an exclusive distribution agreement with Norland

Medical Systems, Inc. to distribute a line of bone measurement systems

used to evaluate osteoporosis, a condition that affects 22 million American

women, many of whom could benefit from early diagnosis through pharmaceutical

intervention.

These transactions continue CSI's market consolidation strategy, and

CSI now believes that it is the largest manufacturer and marketer of

products for the physician's office segment of the gynecology market.

CSI's target is to reach $100 million in revenue by 2003 or 2004.

During fiscal 2000, CSI's operating income grew 45 percent. In fiscal

2001, we expect its operating margin to approach 20 percent as we complete

the integration of the recent acquisitions.

During fiscal 2000, CSI's operating income grew 45 percent. In fiscal

2001, we expect its operating margin to approach 20 percent as we complete

the integration of the recent acquisitions.

In January 2000, the FemExam pH and Amines TestCard System

– a rapid, economical point of care diagnostic test used to help determine

if a vaginal infection is bacterial or fungal – received reimbursement

codes and guidelines from the American Medical Association and the United

States Health Care Financing Administration.

Since then, it has shown strong growth, averaging 30 percent sequential

quarterly revenue growth in the past three quarters. The Cerveillance

Digital Colposcope line of advanced imaging and information processing

technologies used to examine and monitor cervical tissue generates about

$2.5 million in annual revenue.

NEXT YEAR'S

GOALS

We see the momentum of the past five years continuing in 2001. We expect

earnings per share from continuing operations in the range of $2.36 to

$2.42 with revenue increasing between 16 percent and 21 percent. Both

of our businesses will continue to benefit from favorable demographics.

At CooperVision, recently introduced contact lens products and geographic

expansion will drive incremental revenue, and we look forward to beginning,

late in the year, to compete aggressively in Japan, the world's second

largest market. At CooperSurgical, we will continue to pursue our strategy

to consolidate the gynecology segment of the women's healthcare market.

Thank you for your continued support.

Allan E. Rubenstein, M.D.

Chairman of the Board

A. Thomas Bender

President and Chief Executive Officer

January 24, 2001

|