Good partnerships in real estate rest on a foundation of trust and financial strength, attributes that Equity Office has in abundance. That's one important reason why Jon Runstad and his partners at Wright Runstad & Company, one of the country's most respected office building developers, chose Equity Office as their partner in December 1997. Good partnerships in real estate rest on a foundation of trust and financial strength, attributes that Equity Office has in abundance. That's one important reason why Jon Runstad and his partners at Wright Runstad & Company, one of the country's most respected office building developers, chose Equity Office as their partner in December 1997.

"They're good, savvy real estate people," says Runstad of the company that purchased 10 Wright Runstad & Company properties for $610 million and an equity interest in Wright Runstad itself in December 1997. "They understand underlying real estate values and opportunities. They have a high appreciation for quality, and a high emphasis on service to tenants. It was a very nice fit."

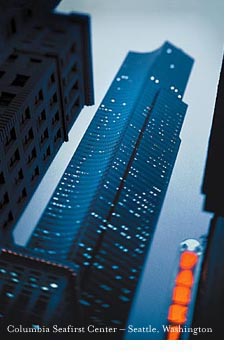

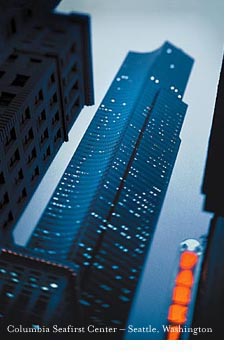

Another key factor was a strategic development relationship formed by the two companies. Since the initial transaction, Equity Office has invested in three additional Wright Runstad Seattle-area developments — World Trade Center East, Sunset North and Three Bellevue Center. Once completed, these projects will bring the company's total Seattle-area portfolio to 6.0 million square feet in 16 buildings, including the most prominent building in the city, Columbia Seafirst Center.

"We now have Wright Runstad, the premier developer in the area, finding the right opportunities at the right time and presenting them to us," says Bill Cutler, Equity Office's vice president of developments. "It's a wonderful situation."

|