The December 1997, $4.3 billion merger of Equity Office with Boston-based Beacon Properties Corporation was the largest-ever office REIT transaction. Profitably managing the combination was paramount. The December 1997, $4.3 billion merger of Equity Office with Boston-based Beacon Properties Corporation was the largest-ever office REIT transaction. Profitably managing the combination was paramount.

The two companies had developed quite differently. While Equity Office was nationally focused from the start, Beacon started in Boston and added regions later. So systems, operating practices, lines of authority and employee expectations were markedly different.

Other companies facing the same challenging cultural integration have failed. But a seasoned management team with strong support systems in place made the transition relatively quick and effective for Equity Office.

Key customers immediately received personal visits, and a high level of communication quickly immersed new employees in the Equity Office culture. Within six months, more than 20 different training seminars and a buddy system pairing Equity Office and Beacon employees eased the transition. Reinforcement of the Equity Office culture has been continuous.

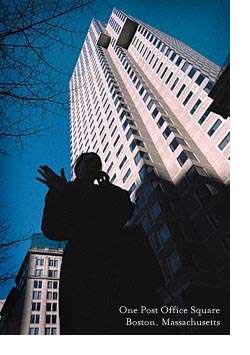

"The wonderful thing was seeing myself grow as a manager," says Chuck Fuller, general manager of two former Beacon buildings in Boston. "Under Equity Office, I have more autonomy. People now feel like they're part of the Equity Office team, with rewards and opportunities. And most important, all of this has been good for our customers."

It has also been good for Equity Office. Revenues and net operating income exceeded anticipated budgets for 1998. Savings from overhead reductions exceeded $21 million. And 90% of Beacon field employees stayed with the team.

|