|

April 9, 2001

To Our Shareholders:

By nearly every measure, 2000 will be remembered

as a watershed year for AutoNation.

On a pro forma basis, full-year earnings per share

jumped 27% to 84 cents on income from continuing operations of $303

million, versus 66 cents per share on income from continuing operations

of $289 million in 1999. But the story behind the numbers is

equally compelling.

During the year, we completed the closure of the

former used vehicle megastores, spun off the automotive rental group,

sold most of our non-retail assets and reduced expenses by $100 million.

In brief, we transformed AutoNation from a collection of unrelated

business divisions into a company with a clear focus: to be America's

largest and most-valued pure-play automotive retailer.

By focusing the company in 2000, we have set the

stage to perform well in a challenging new vehicle market in 2001.

And we believe we have positioned ourselves to achieve our annual

earnings-per-share growth target of 10 to 12% each year thereafter.

To achieve these results, AutoNation will execute

a strategic plan that extends its leadership in new vehicles and leverages

its scale to generate margin growth in such key areas as used vehicles,

parts and service, finance and insurance, and collision repair. We

outline this strategy later in this report. But first, let's review

our 2000 financial performance.

2000: A Watershed Year

Revenue in 2000 increased 7% to $20.6 billion,

excluding the impact of the former used vehicle megastores. The growth

in revenue came despite the slowdown in auto sales that hit most retailers

late in 2000, while the significant improvement in earnings per share

reflected the improved efficiency of our operations. The fact that

AutoNation delivered record net income for the fourth quarter of 2000

suggests that the company is positioned to perform well - even in

a challenging retail environment.

(left

to right)

Mike Jackson, Chief Executive Officer

H. Wayne Huizenga, Chairman

Michael E. Maroone, President & Chief Operating

Officer |

|

On average,

AutoNation sells

2,300 vehicles each day. |

|

On average, AutoNation services

25,000 vehicles each day.

|

Also during 2000, AutoNation cemented its position as

the leading online automotive retailer by generating more than $1.5

billion of vehicle sales via the Internet.

The year was filled with other signposts of success.

During 2000, AutoNation:

- Grew earnings before interest, tax, depreciation and amortization

(EBITDA) 25% to $892 million, giving us tremendous financial flexibility

- Improved fourth quarter same-store operating margins by 70

basis points to an industry-leading 5% versus 4.3% at the same

time last year

- Cut corporate overhead 34% versus 1999 and 44% versus the run

rate in fourth quarter 1999

- Sold more than one million cars and light trucks, including

fleet sales, for the second consecutive year

During the year, AutoNation used its cash flow

to upgrade and acquire dealerships, retire more than $300 million

of long-term debt and to repurchase $189 million worth of our shares,

or 7% of our shares outstanding.

The fact that AutoNation generated this financial

performance while simultaneously re-focusing its energy on becoming

a pure-play automotive retailer is a tribute to the talent and

energy of our 31,000 employees.

Building on Success in 2001

How do we build on this success? First, we

leverage our sustainable competitive advantages. Then, we enhance

this performance with a solid growth plan.

What are those advantages? The first would

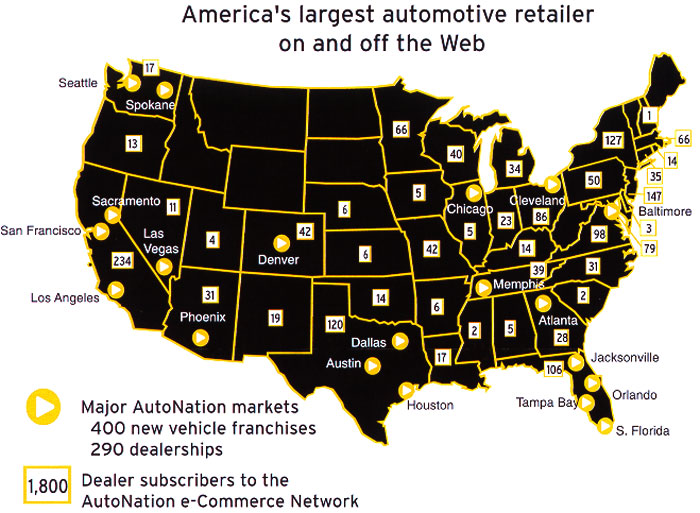

undoubtedly be our scale. AutoNation is the largest competitor

in one of the largest retail categories in America: the nearly

$1 trillion market that comprises the sale, financing, servicing

and repair of new and used vehicles. On average, we retail about

2,300 cars every day, and we service another 25,000 vehicles as

well. On a revenue basis, AutoNation is more than three times

larger than its nearest competitor and, in fact, is larger than

all of the other publicly traded auto retailers combined. Measured

against other public companies of all types, at #63 on the 2000

Fortune 500, AutoNation is one of the largest companies in America.

That size gives AutoNation a sustainable competitive advantage

in such key areas as cost of capital and volume purchasing on

products and services like insurance, advertising and auto parts.

Another advantage is the critical mass that we

have achieved in many of the fastest growing markets in America. This

includes great markets like Las Vegas, Phoenix, Dallas, Houston, Orlando,

Tampa, Denver, Atlanta, Los Angeles and South Florida, among others.

Our goal is to ensure that if you live or work in one of these markets,

you cannot make an intelligent choice about buying or servicing your

vehicle without considering one of our dealerships. Scale and critical

mass go hand-in-hand. For example, our large size in specific markets

has enabled AutoNation to negotiate advertising rate reductions of

as much as 40%.

A third advantage is the fact that AutoNation has

established framework agreements with all of the major automotive

manufacturers. These agreements set the tone for long-term, mutually-rewarding

relationships with our primary suppliers and provide a clear growth

path.

The fourth competitive advantage is our strong

balance sheet. With a non-vehicle debt-to-equity ratio of about 22%,

AutoNation has the flexibility to take advantage of important growth

opportunities as they arise.

And finally, AutoNation enjoys a leadership position

in automotive e-Commerce, using the Web to sell more vehicles than

any other automotive retailer. Our alliances with America Online and

Microsoft's MSN Carpoint web site leverage our leadership position

and our proprietary e-Commerce infrastructure by providing a continuous

stream of high-quality sales leads for our company-owned dealerships

and for dealers who subscribe to the AutoNation e-Commerce Network.

With this record of financial achievement in 2000,

and with these sustainable competitive advantages as the foundation

for AutoNation's continued progress, we invite you to read the balance

of this report to learn more about how AutoNation will grow in the

years ahead.

As always, we thank you for your continued support.

| |

|

|

|

|

|

H. Wayne Huizenga

Chairman of the Board |

Mike Jackson

Chief Executive Officer |

Michael E. Maroone

President, Chief Operating Officer |

|

|

|