|

In just four years,

AutoNation has built a company that retails more new cars and light

trucks than any other company in America -a $20.6 billion-a-year

giant that's more than three times the size of its nearest competitor.

Yet, as the following long-term strategic plan will show, AutoNation's

growth opportunities remain numerous in the nearly $1 trillion-a-year

U.S. automotive market.

That's because there's a collection of high-margin

business opportunities that already exists today inside AutoNation

and its vast network of dealerships. In addition to selling new

vehicles, AutoNation also:

- Sells more used vehicles than any other retailer, selling $3.9

billion worth in 2000

- Earns nearly as much gross margin from its $2.3 billion-a-year

parts and service business as it does from selling new vehicles

- Generates 14% of its gross margin from its $432 million-a-year

finance and insurance business

A diversified specialty retailer. This is AutoNation.

The Goal: Earnings-Per-Share

Growth

AutoNation's long-term strategy calls for extending

its leadership in new vehicles and growing the part of its business

that accounts for the majority of its gross margin - used vehicles,

parts and service, and finance and insurance. AutoNation's goal is

to maximize the performance of each of these categories to achieve

an annual earnings-per-share growth target of 10% to 12%, beginning

in 2002. The Company will achieve this level of operational excellence

by leveraging AutoNation's scale and by capitalizing on advantages

and opportunities that are characteristic of the Company's automotive

retailing business.

These high-margin opportunities exist throughout

the automotive industry's cycles, and play off the fact that AutoNation

enjoys a customer base of vehicle owners that grows with each year.

Also, because they account for nearly two-thirds of the Company's

gross margin, improvements in these businesses have an important effect

on results.

This is why AutoNation is driving programs and

initiatives through its dealerships that keep store personnel focused

on selling more vehicles, performing more parts and service work,

and selling more finance and insurance products through effective

marketing programs and improved methods of operation.

Tapping Advantages Beyond

Size

To seize on these opportunities, and to stay focused

on earnings-per-share growth, AutoNation's long-term strategy leverages

more than the Company's considerable scale. It capitalizes on AutoNation's

steady cash flow and flexible cost structure.

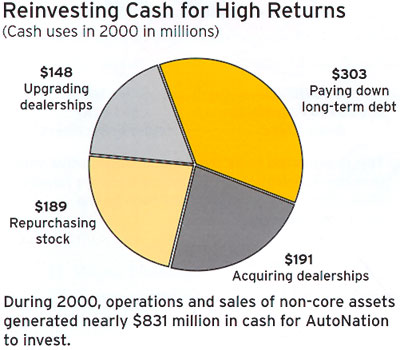

AutoNation is constantly seeking the highest return

for its cash. In 2000, AutoNation generated $441 million of cash from

operations to invest, plus additional cash it had raised through the

sale of non-core assets. The Company reinvested this cash in improving

stores, acquiring dealerships, buying back company shares and reducing

long-term debt. These opportunities become more numerous as AutoNation

drives costs out of its business and expands its operating margins.

AutoNation uses its flexible cost structure to

adjust to market conditions, redirecting resources to high-margin

opportunities. For example, when car-buying patterns shift away from

new vehicles, AutoNation dealerships can adjust inventories and advertising

budgets in favor of used vehicles. At the same time, AutoNation can

shift resources to the promotion of tune-ups, front-end alignments

and other maintenance services offered from its 8,200 service bays.

The flexible cost structure also supports AutoNation's ongoing emphasis

on expense control, as it did in 2000 when $100 million was taken

out of the Company's store and corporate expense.

|