|

|

| FELLOW SHAREHOLDERS | ||||||

|

Deeply rooted in this solid, midwestern foundation, Commercial Federal has developed a clear vision for the future: “COMMERCIAL FEDERAL BANK IS THE BANK OF CHOICE IN THE COMMUNITIES WE SERVE.” Our more than 2,800 employees are dedicated to achieving this vision through our mission of providing: “BETTER BANKING. EVERY DAY.” |

||||||

|

||||||

| EXCEEDED EARNINGS EXPECTATIONS THROUGHOUT 2001 | ||||||

|

Through the consistent execution of our business plan, we increased revenues, managed credit exposure, controlled expenses, improved operating efficiencies and exceeded our earnings targets in each quarter of 2001. With our disciplined financial focus, quality balance sheet, loyal employees and solid client relationships, the Company is positioned for long-term growth. We continue to see great progress in our core earnings as a result of the time, effort and financial resources invested in significantly improving our delivery systems, sales culture and customer service skills. These investments will continue to yield bottom-line benefits, long-term value and consistent earnings growth. Fueled by dramatic strides to restructure the Company, Commercial Federal is a more aggressive and agile financial services competitor. |

||||||

|

||||||

| UNIQUELY POSITIONED IN DEMOGRAPHICALLY DESIRABLE MARKETS | ||||||

|

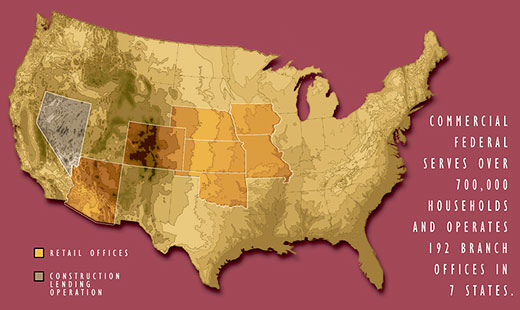

Strong communities need strong financial institutions. Commercial Federal is a leading partner in the business community of each market we serve. As one of the largest financial institutions in the Midwest, we serve more than 700,000 households from a platform of 192* branch offices in Arizona, Colorado, Iowa, Kansas, Missouri, Nebraska and Oklahoma. We offer a full range of consumer and commercial products, including residential and consumer loans, checking and savings accounts, commercial operating and commercial real estate loans, cash management services, and investment and insurance products. Uniquely positioned in high-growth midwestern markets, we are large enough to offer a broad, diverse financial product mix, but small enough to deliver personalized, superior service. Commercial Federal has a firm footprint in the thriving Midwest, serving more than 60 communities. This region of the country is traditionally buffered from the economic volatility affecting the coastal regions. Like the employees who serve them, our clients are loyal. The Company enjoys an envied reputation for service to clients and their communities. Eighty percent of our branch offices are located in robust urban areas. These markets boast a five-year average projected population growth of 6%, compared with the national average of 3.5%. The cities of Denver, Des Moines, Kansas City and Omaha are home to half of our offices. Commercial Federal enjoys a solid market share in each of those markets. All four cities have strong, diverse economies, offering steady employment opportunities. The population includes an abundance of young, well-educated workers earning incomes higher than the national average. Projected household income growth for the next five years in our markets is 26%, compared with 20% for our peer banking group. To achieve our vision, Commercial Federal will continue to deliver outstanding value and service to our clients, promote an engaging and challenging workplace for employees and provide long-term value to our shareholders. *Assumes planned sale of four Minnesota branches in second quarter of 2002 |

||||||

| EXECUTIVE LEADERSHIP | ||||||

Strengthening the executive leadership team with new talent accelerates our organization’s ability to move forward, capturing the opportunity to expand market share and grow revenues from existing clients.

|

||||||

| FINANCIAL PERFORMANCE | ||||||

The

Company posted solid earnings results in 2001. We exceeded consensus analysts’

estimates in all four quarters of 2001 and posted a 21% increase in our

stock price. Net income for 2001 was $97.7 million, or $1.93 per diluted

share. This compares with a net loss of $18.7 million, or $0.33 loss per

share, for the preceding pro forma 12-month period ending December 31, 2000.

The Company’s return on average tangible equity for the year was 16.30%,

while return on average assets was .76%. In 2001, the Company made significant

strides in completing the restructuring initiatives begun in 2000 and established

a strong earnings record to build upon in 2002. The

Company posted solid earnings results in 2001. We exceeded consensus analysts’

estimates in all four quarters of 2001 and posted a 21% increase in our

stock price. Net income for 2001 was $97.7 million, or $1.93 per diluted

share. This compares with a net loss of $18.7 million, or $0.33 loss per

share, for the preceding pro forma 12-month period ending December 31, 2000.

The Company’s return on average tangible equity for the year was 16.30%,

while return on average assets was .76%. In 2001, the Company made significant

strides in completing the restructuring initiatives begun in 2000 and established

a strong earnings record to build upon in 2002.Core earnings are comprised mainly of net interest income and income resulting from non-interest sources, such as retail fees and charges. In 2001, net interest income, after the provision for loan losses, reached $268.5 million. The net interest rate spread for 2001 was 2.61%, compared with 2.48% for the preceding pro forma 12-month period ending December 31, 2000. Growth was experienced in non-interest income during the year as the Company successfully implemented strategies to enhance retail fees and charges. For 2001, total retail fees and charges were $53.5 million, up 11% from $48.1 million for the previous 12 months. |

||||||

| HIGHLY DISCIPLINED RISK MANAGEMENT | ||||||

The

Company has worked diligently to change the mix of its loan portfolio over

the past 18 months. We have focused on increasing our spreads and revenues

through the addition of higher margin loans – commercial, construction and

consumer – while at the same time reducing our overall mortgage loan position.

At December 31, 2000, these higher margin loans totaled $3.5 billion. At

December 31, 2001, this total had increased to $3.8 billion, up 7%. The

Company has worked diligently to change the mix of its loan portfolio over

the past 18 months. We have focused on increasing our spreads and revenues

through the addition of higher margin loans – commercial, construction and

consumer – while at the same time reducing our overall mortgage loan position.

At December 31, 2000, these higher margin loans totaled $3.5 billion. At

December 31, 2001, this total had increased to $3.8 billion, up 7%.

As the Company adds diversity to the asset side of its balance sheet, managing risk is a critical component to successfully shifting the portfolio mix. Toward this end, the Company added John S. Morris to the senior management team as Chief Credit Officer. With 16 years of credit management experience, John routinely analyzes and monitors the Company’s credit risk exposure by borrower, loan product, geography and industry concentration. All loan underwriting and pricing is being strengthened as a result of his expertise, enabling us to achieve our objective of a diversified portfolio of high-quality loans with better terms and pricing. The Company’s interest rate risk profile continues to improve. We restructured our balance sheet to reduce interest rate risk. While earnings are sensitive to sudden interest rate changes, we purposely design our balance sheet and our income stream to avoid significant impact from factors outside of management’s control, whether these are interest rate movements or economic cycles. Maintaining a balanced interest rate risk position is one of management’s primary objectives. |

||||||

| SALES CULTURE BUILDS SOLID CLIENT RELATIONSHIPS | ||||||

|

||||||

| STRONGER COMMERCIAL BANKING PLATFORM | ||||||

We generated significant growth in all lines of commercial lending in 2001 including commercial operating, commercial real estate, residential construction and commercial construction. We built a strong foundation to expand the commercial banking portfolio, growing relationships to 16,400 clients, a 9% increase. Commercial deposits increased by 9% and the loan portfolio grew by 14% in 2001. The indirect lending unit, based in Des Moines and led by Vice President Jeff Vander Linden, captures loans from 300 automobile dealerships in Iowa, Nebraska, Missouri and Kansas. Production for the year topped $260 million, and attracted 16,000 new account cross-sale opportunities for the Company. As part of our long-term commitment to further develop commercial banking relationships, the Company launched a full-service cash management program during the fourth quarter of 2001. The new Internet-based cash management tool, Business Banker Online, is the showpiece of the service. Business Banker Online provides business owners access to full-service electronic banking. Capabilities include funds transfers, debit of consumer accounts, electronic payment of vendors, payroll direct deposits and wire transfers, among other services. We are continuing to build the division infrastructure and broaden our client base in existing markets. A priority for 2002 is the fine-tuning of a needs-based consultative sales culture with an emphasis on deepening client relationships to enhance profitability. |

||||||

| RECORD MORTGAGE BUSINESS IN 2001 | ||||||

Mortgage lending operations are under the direction of Senior Vice President Rick A. Campbell, who has 25 years in the mortgage business. The mortgage lending and servicing units had a record year in 2001. Commercial Federal originated $1.2 billion in single-family residential loans in 2001 and purchased an additional $2.5 billion through its correspondent and broker network. The Company ended the year with a mortgage loan servicing portfolio for other institutions of 134,000 loans totaling $9.5 billion. |

||||||

| A PROUD HERITAGE OF COMMUNTIY COMMITMENT | ||||||

Commercial Federal has fostered a 115-year legacy of striving to make the communities we serve better places to live and work. Foremost is a commitment to financing and promoting affordable housing in the cities, towns and neighborhoods where we conduct business. An example of this commitment is Commercial Federal’s participation in the Affordable Housing Program of the Federal Home Loan Bank system. Working with the Federal Home Loan Bank of Topeka, John J. Griffith, First Vice President and Community Investment Officer, and his staff have directed Commercial Federal’s sponsorship of approximately 235 applications for funding. This resulted in 130 grants totaling $20 million over the past ten years. These grants made possible the rehabilitation and construction of nearly 5,900 units of affordable housing within the Nebraska, Kansas, Oklahoma and Colorado market areas. These projects included single-family ownership opportunities through the provision of down payment and closing cost assistance, as well as multi-family developments offering housing for senior citizens, the developmentally disabled, the homeless and other special-needs populations. Through the Company’s participation in the Affordable Housing Program, Commercial Federal has established itself as a significant partner in providing much-needed affordable housing in the communities and neighborhoods we serve. |

||||||

| DEDICATED TO BEING THE EMPLOYER OF CHOICE | ||||||

|

Commercial Federal’s vision is built upon an enduring strength of the Company – our 2,800 employees. A key objective of our vision is to become the Employer of Choice in our communities. Employees are the most sustainable and important competitive advantage for the Company now and in the future. Because of the personal commitment of our employees, clients are drawn to Commercial Federal, remain with us and increase the amount of business they do with us. We are dedicated to training, coaching, recognizing and rewarding employees who devote their efforts to understanding our clients’ current and future needs, recommending the best financial services and products to meet those needs and delivering them in the most convenient fashion. Each of our employees is equipped to help make financial dreams come true for our clients, while providing unsurpassed levels of service. At the same time, the Company is committed to helping our employees reach their personal and professional aspirations.

Robert Hutchinson is leading the launch of a corporate-wide leadership program. We are committed to developing a leadership culture at all levels of the organization. The program cultivates an environment that stimulates and welcomes change for continuous improvement, clearly communicates action plans and fosters an atmosphere of collaboration and teamwork. We are dedicating resources to attracting and retaining top talent by offering competitive compensation packages and incentive programs based on profitability. We are designing clear-cut career paths, nurturing a sales culture and linking every position and function to fulfilling our mission of providing “Better Banking. Every Day.” Being the Employer of Choice brings the best we have to offer our clients. It creates personal challenges, opportunities, recognition and a gratifying work environment where all team members are devoted to helping clients achieve their financial dreams. Ultimately, it will translate into increased productivity and superior performance. |

||||||

| FUTURE OUTLOOK | ||||||

| Competing in today’s highly competitive financial

services marketplace requires a commitment to identifying and developing

the components of achieving success over the long term.

As our 2001 results demonstrate, we have identified key strategies for building shareholder value. Commercial Federal’s management team is committed to realizing our vision to be the Bank of Choice in the communities we serve by developing our employees and exceeding our clients’ expectations. Driven by our comprehensive business plan, we are building upon our strong foundation to further enhance the value of your investment in our Company. Thank you for your confidence, encouragement and continued support.

Sincerely, |

||||||

| |