Salomon Smith Barney 12th Annual Global Entertainment, Media, and Telecommunications Conference Remarks by

Scottsdale, Arizona

January 7,

2002

John B. Morse, Jr.

Chief Financial Officer and Vice President-Finance

Good morning and thanks Bill for that introduction.

These meetings unfortunately fall at a very inopportune time for us at The Post – our Board meeting is also this week. Don Graham sends his regrets – despite his protestations to the contrary, Don really does enjoy the opportunity to meet with the investment community and hear what’s on your mind.

Those of you who have heard us in the past know that we offer ourselves up as the contrarians of the media business – no presentation that we give, for example, comes without a “warning” about our focus on the long-term and the absence of earnings forecasts – whether it be for the quarter or for the year.

But being a contrarian goes far beyond that – it goes to management, to business strategy and to operations. Perhaps there is no better example in our Company than the person sitting next to me, Tom Might, who is head of our Cable Division. You will be hearing from Tom a bit later this morning and I think you will find his contrarian ways in the cable business very interesting and, most importantly, rewarding for our shareholders.

Those of you who were with us in New York a month ago heard Don jokingly refer to his traditional role of raining gloom and doom on anyone who might view the company with “irrational exuberance.”

But, perversely, this time around, even he has to admit that – despite the current advertising picture –we feel pretty good about our prospects. Relative to the very poor year we had in earnings per share in 2001, we think both the immediate and long-term future look reasonably good for us, unless the ad climate deteriorates still further.

Our optimism is occasioned by two factors. First, our cable division, which has been paying the price to execute its unique strategy for digital and cable modems, is beginning to reap the rewards we expected – and that we alerted you to on a number of occasions.

Second – again as we predicted – Kaplan is now enjoying the growth for which its aggressive investments and acquisitions over the past few years set the table.

While these two businesses are not yet as important in terms of their contribution to the company’s bottom line as, say, our broadcasting group, they’re big enough that any meaningful growth they achieve will have a significant impact on the results of the company as a whole.

We’ll talk more about these two units in a moment – let me first take a look at our three advertising-based businesses.

Whether it be The Post, Newsweek, or Post-Newsweek Stations, the ad environment is unbelievably bad, and we have no comfort to offer on that score.

Company-wide, through November, advertising revenue was down 14 percent year-to-date.

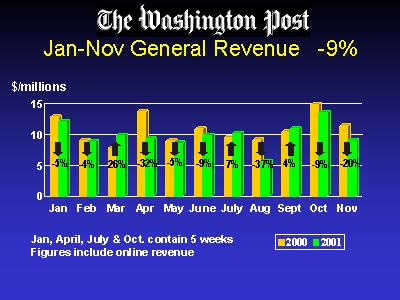

I’m now going to show you a series of slides with month-by-month comparisons, mainly to indicate the unfavorable trends continue. If you have trouble reading the numbers, you can find this presentation on our web site.

At The Post, advertising revenue is down 13 percent year-to-date (including online results). The newspaper continues to suffer from the implosion of recruitment, its single largest advertising category, previously accounting for 25 percent of total ad revenues.

Through November, recruitment is off 38 percent. Our Mega Employment section, an important indicator of the strength of the recruitment market, was held in September and came in 43 percent below last year’s figure. Tech employment, once our largest employment ad category, is now smaller than healthcare.

The rest of classified, on the other hand, is up a little over 6 percent through November, with the growth coming from Property Management and Real Estate. The new and used Automotive categories are holding steady with last year.

Retail is off 9 percent, with the biggest declines coming from food/drug/liquor, electronics, and department stores. On the other hand, home furnishings accounts are doing relatively well.

General, a smaller category, is down almost 9 percent. Corporate campaigns, the financial segment, technology, and travel are all suffering.

The gloomy advertising figures shouldn’t obscure the fact that The Post has turned in a stellar journalistic performance following the terrorist attacks.

On September 11, The Post put out an extra and immediately began deploying correspondents around the world. Bob Woodward and defense reporter Tom Ricks led the team in Washington. By now, what you might call our bureau in Afghanistan has grown to include much of our current and recent foreign staff.

September 11, notwithstanding, clearly the most dramatic, unexpected and remarkable event of 2001 was a price increase of The Post. We went from twenty-five cents to thirty-five cents! But before you get too excited at the revenue prospects, read the small print here and you’ll see that it applies to newsstand sales Monday to Saturday only.

Our rationale?? We felt we had to do this before the dime became obsolete. I wouldn’t look for another single-copy increase any time soon – after all, the old price had been in effect since 1981.

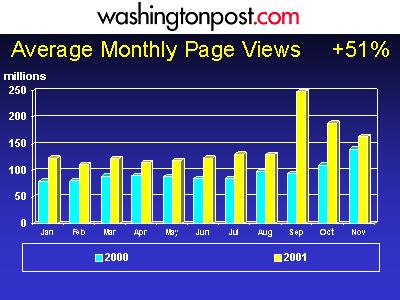

People seeking the most up-to-date, reliable information also are relying more and more on washingtonpost.com, which experienced tremendous growth last year.

Fueled in part by September 11 and the war on terrorism, the site’s average monthly page views increased 51 percent year-over-year through November.

In addition, the average number of unique monthly viewers rose from over 2 million to more than 3.4 million year-over-year, a gain of 66 percent. This is now one of the top 5 national news sites, with an audience 75 percent of which is from outside the Beltway and which was at or above that of USA Today for most of 2001.

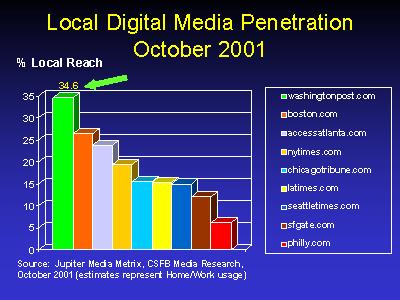

washingtonpost.com’s local penetration also continues to grow at a remarkable rate. In October, the site reached home-market penetration of 35 percent, more than 9 percentage points higher than any other local site.

This penetration represents growth of 38 percent from one year ago – no doubt a bounce from September 11.

On the financial side, WPNI continues to do all right – and this despite the dot-com collapse and the severe advertising slow-down affecting all media companies. Led by strong classified growth, washingtonpost.com remained on track to post double-digit revenue growth in 2001.

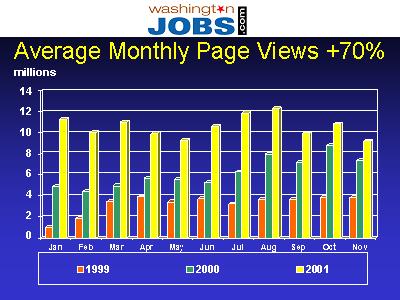

WashingtonJobs.com remains the cornerstone of the site’s revenue base. Page views are up 70 percent year-to-date,

and double-digit revenue growth is expected for this part of the business as well.

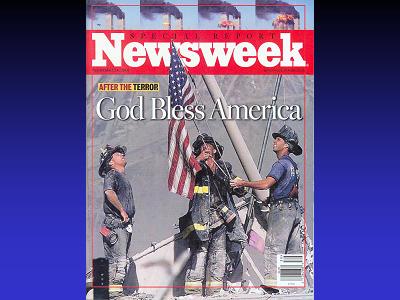

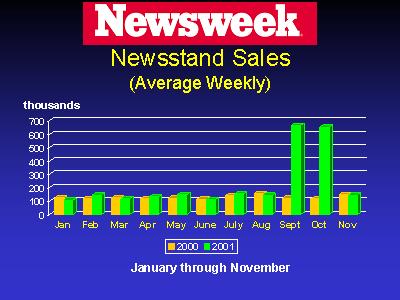

September 11 and its aftermath also provided powerful evidence that news magazines are alive, well and vitally important to our readers. For example:

Within 48 hours of the attacks on the World Trade Center and the Pentagon, Newsweek published a special edition. We distributed 2 million copies to newsstands by the end of the week, and the issue was a virtual sell-out.

The first regular issue after the attacks sold in excess of 2-and-a-quarter million copies – by far the largest newsstand sale in Newsweek’s 68-year history.

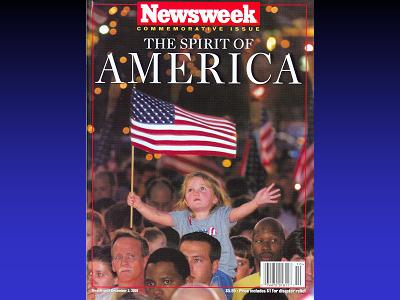

On September 27, Newsweek published yet another special issue, which is still on newsstands. We sold more than 1 million copies.

Newsstand sales have settled down since the initial few weeks, but all circulation indicators remain very encouraging. Renewals are well ahead of budget, and new subscription orders are strong.

As you would expect, circulation turned in a strong financial performance in 2001. And thanks to our healthy subscription business, we’ve been able to cut back on some mailings.

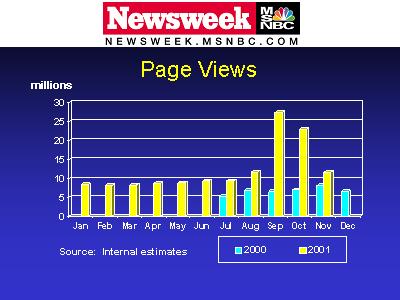

We’re seeing the same positive results on the web. Thanks to Newsweek’s alliance with MSNBC, we’re in business with one of the strongest news sites on the Internet.

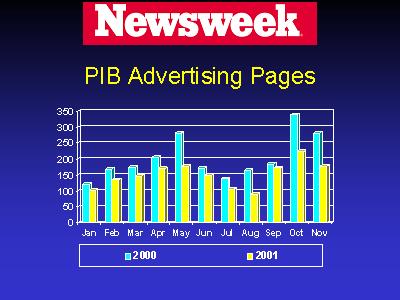

The advertising side of Newsweek presents a far less pretty picture. Magazine advertising in general was weak before September 11, and the terrorist attacks prompted a further pullback on the part of major national clients.

Activity picked up somewhat in recent weeks, but Newsweek was down nearly 25 percent in total pages for the year – although net rates held up surprisingly well.

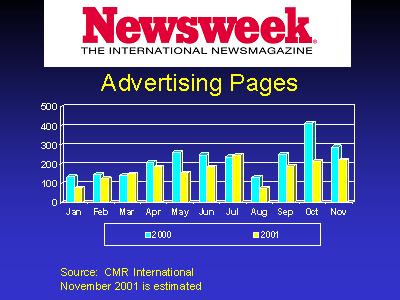

Newsweek International, which relies heavily on airline, travel, and related advertising, faced an especially difficult year. In order to maximize profitability in the perennially competitive international market, we’re looking at a significant restructuring of internal operations and the outsourcing of some key functions.

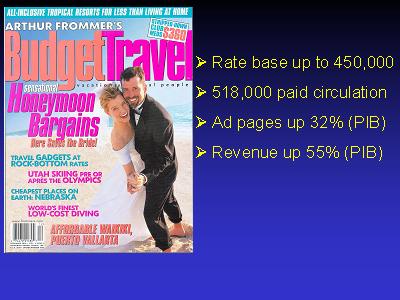

On a brighter note, 2001 was a great year for Arthur Frommer’s Budget Travel magazine. Circulation has climbed and the ad picture is equally positive.

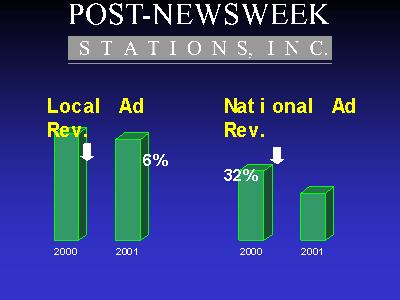

Post-Newsweek Stations is suffering along with the rest of the television industry; however, we’re doing better than any other publicly reporting group broadcaster. Year-to-date, revenue is down 15 percent.

Local is holding up pretty well – off only 6 percent – but national is down 32 percent.

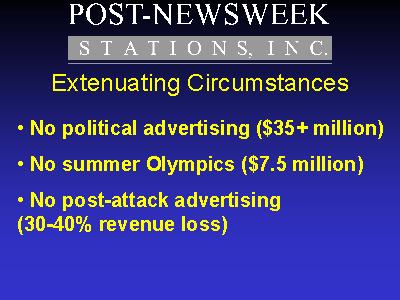

You need to factor in a number of items when evaluating these results. First, we didn’t have the benefit of the political and Olympics revenue. Through November of 2000, PNS had posted a record-breaking $35-million-plus in gross political revenues. And the 2000 summer Olympics generated another $7.5 million in gross revenues.

The events of September 11 also were costly for our stations, which went for several days without commercials. We estimate a revenue loss of 30-to-40 percent for the month, compared to a typical September.

Like the first crocus of spring, we can report that WKMG in Orlando, which has struggled since we acquired it in 1997, is under new management. In the latest ratings book, it tied for news leadership at 11:00 p.m., and we have high hopes for continued improvement.

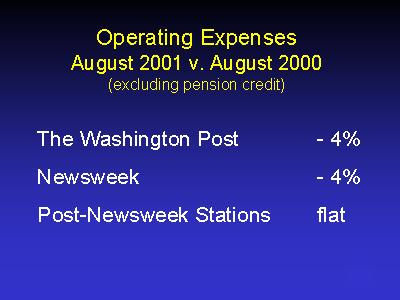

Given the bleak revenue picture media-wide, all of our ad-based businesses are doing everything possible to control expenses.

One way to gauge the impact of our cost-reduction efforts is to look at expenses for these three businesses in August 2000, compared with August 2001 (the last normal month before September 11). As you can see, expenses were running behind or even in each of these divisions.

Unlike many companies, however, we didn’t bulk up during the good times, so we have less excess to lose now – and none of it is fat. Still, hard times can inspire even more creative ways to operate with greater efficiency. And we’re seeing the benefits of our intense focus on keeping costs down while maintaining our traditional quality.

For example, at The Post, expenses for the first three months of 2001 were up 1 percent. In the last three months, they were down 6 percent (excluding the pension credit). Headcount is down by 2 percent year-to-date through targeted early retirement incentives and attrition on the business side. Newsprint expense is down by 4 percent through November, driven largely by lower consumption.

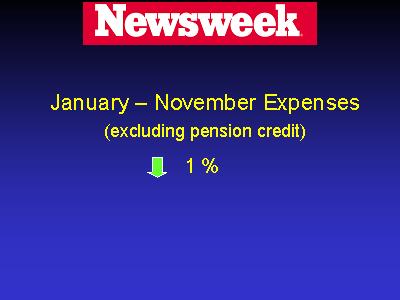

At Newsweek, total expenses year-to-date are down 1% despite the huge manufacturing and distribution expenses associated with the extra editions. One dark and continuing worry is postal rates.

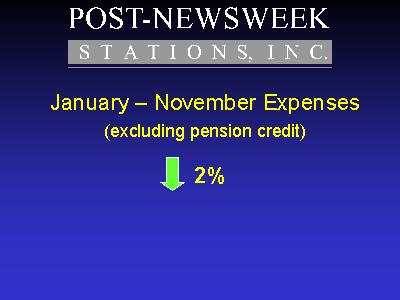

Expense control is a top priority at Post-Newsweek Stations, too. Here, for the first three months of 2001, expenses decreased 1 percent. In the past three months, they were down 6 percent. Headcount is flat.

Year-to-date, expenses are down 2 percent, and we expect expenses for the full year to end up below what Post-Newsweek spent in 1998.

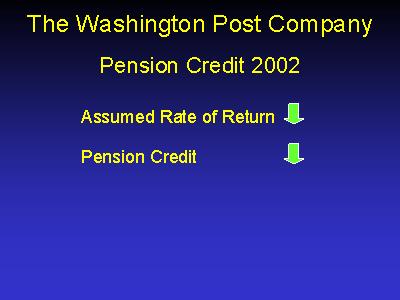

Finally, on the expense front, I should point out one change that will have a negative impact on operating results of these three businesses in 2002. We will most likely lower both the discount rate and the assumed rate of return on our pension assets to reflect the real-life investment climate.

This will reduce the pension credit, with a corresponding negative impact on operating income. We’ve often pointed out the significance of the pension credit to our reported results. It’s of significantly less value than other sources of income, although it does reduce the amount of pension expense the company will incur in the future.

Let’s turn now to Kaplan.

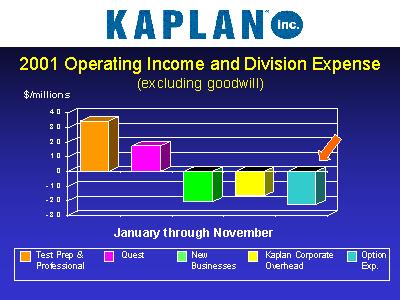

Kaplan has become a multifaceted education business. The whole is getting pretty big – revenue was almost $500 million in 2001. Operating income, excluding goodwill amortization, increased by almost $17 million in the first nine months of 2001. But to understand Kaplan, you need to understand its various pieces.

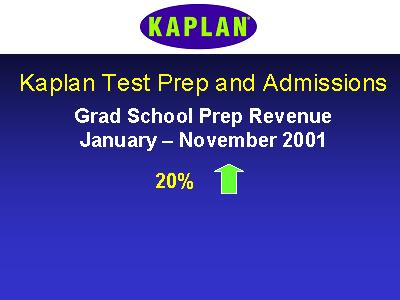

Kaplan Test Prep and Admissions is still the biggest and best performing Kaplan business. It’s growing at a surprising rate, with exceptional momentum in the grad school segment, where revenue is up 20 percent year-to-date.

This is one business that stands to benefit from the economic downturn. With high-ticket job offers drying up, prospective students have decided that now is a good time to enhance their skills with a graduate degree.

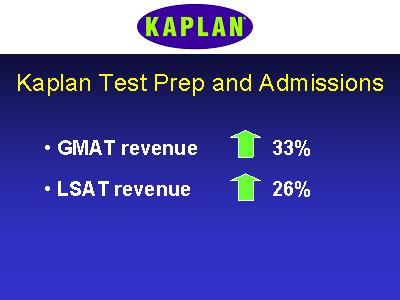

For example, GMAT revenue grew 33 percent over the same period last year. LSAT revenue is up 26 percent.

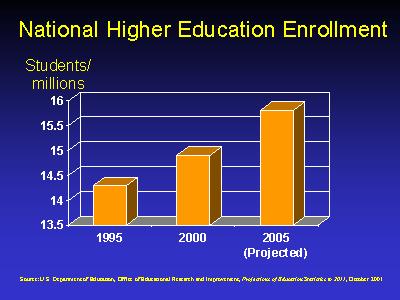

Kaplan also is benefiting from a demographic boom that will see a greater acceleration of young people going to college and grad school. The growing emphasis on student testing to measure school performance also will help Kaplan.

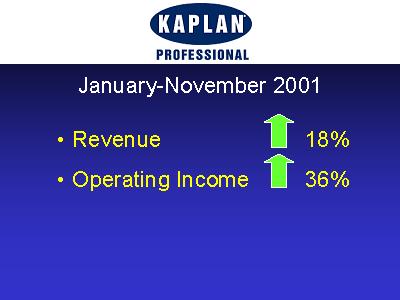

Kaplan Professional has held up well in an extremely challenging economic climate. This operation provides professional training in fields such as financial services, real estate, and IT. Through November, revenue is up 18 percent and operating income is 36 percent over last year.

Quest Education, which we acquired in the summer of 2000, continues to exceed expectations. We wish every acquisition turned out as well as Quest. We paid $173 million for a public company with revenue of $115 million and operating income of $16 million.

In 2001, about 6,000 students will graduate from Quest schools with a bachelor’s or associate degree, or a certificate to prepare them for entry-level employment in the rapidly growing fields of allied health, IT, or paralegal.

At the end of November, Quest was serving approximately 16,000 active students, a 12 percent increase from November 2000.

On a pro forma basis, revenue is up 18 percent through November, and operating income increased 22 percent.

Most of Kaplan’s profit derives from these three large businesses (Test Prep, Kaplan Professional and Quest). But we’ve been reporting to you for some years about our involvement in online education and Score!. And I’ll bring you up to speed on recent developments.

Kaplan’s distance learning unit, The Kaplan Colleges, is doing well. It consists of three schools: Concord Law School, Kaplan College, and The College for Professional Studies. They have more than 10,000 students enrolled. Year-to-date, revenue is up 31 percent and has broken the $10 million mark.

We think these businesses have encouraging growth potential. For example, our online financial planning program, which began in February 2001, has enrolled more than 1,200 students in ten months.

Concord Law School, which Kaplan launched in 1998, turned the corner on profitability in 2001. With more than 800 students, it’s now the second-largest part-time law school and the fastest-growing law school in the country.

Score!, which consists of after-school educational centers, had significant growth in 2001. Revenue is up 40 percent over 2000, with same-center sales up 7 percent. Losses are down for the year.

We learned a lesson, however – and it’s that Score! is vulnerable to swings in the economy. Accordingly, in 2002 we’ll focus on introducing new products to existing customers rather than opening a large number of centers.

Overall and most importantly, Kaplan has done what we promised. It has become the second-largest division of the company. Its core businesses are solidly profitable. And the company is positioned for solid growth in 2002 and beyond.

We have only one caveat: the amounts we’re reserving for Kaplan’s stock compensation program. The details of this program have been described in our annual reports and 10Ks. The amounts we’ll pay out are unknown at this point because an outside valuation is part of the process. If Kaplan becomes a large profit center, accruals will go up. But, of course, that’s good news for Kaplan and good news for our shareholders.

And there is more good news – it comes from our cable division, and here is Tom Might to discuss these results.

Click here for Mr. Might's remarks

# # #