![]() Western

Resources (NYSE: WR) www.wr.com

Western

Resources (NYSE: WR) www.wr.com

|

|

WESTAR

WIND |

ELECTRICITY

– KGE AND KPL

![]()

These two regulated electric utilities produce and sell retail electricity in Kansas and wholesale electricity nationwide with generating capacity of 5,604 megawatts. The utilities operate more than 6,300 miles of transmission lines, with 26 interconnects. Currently the companies serve about 636,000 customers in Kansas.

We completed our search for a strategic partner for this segment by formulating an agreement to join our electric businesses with those of Public Service Company of New Mexico. We placed 148 megawatts of new generating capacity into production and sold more than 25 million megawatthours of electricity. www.wr.com/energy_services.html

INVESTMENTS

– WESTAR INDUSTRIES

![]()

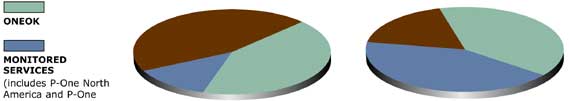

| MONITORED SERVICES INVESTMENTS | |

|

Protection

One (NYSE: POI), including PowerCall

and Network Multifamily These companies serve more than 1.5 million customers in the United States, Canada, the United Kingdom and Western Europe. Westar Industries owns 85% of Protection One. Protection One’s cash flow increased about 8% in 2000. Protection One acquired PowerCall Security, consolidated its customer service and administrative functions and strengthened its internal sales and marketing programs. www.protectionone.com Westar owns 100% of Protection One Europe. Westar purchased Protection One Europe from Protection One in February 2000. Sales totaled $106 million and customers rose to 133,000. Westar owns about 29% of Guardian International. Sales were about $18.3 million for 2000, and cash flow grew 9%. Guardian serves about 26,700 customers, primarily in Florida and New York City. www.guardianinternational.com |

|

| ONEOK (NYSE: OKE) | |

|

ONEOK serves about 1.4 million natural gas distribution customers in Kansas and Oklahoma. ONEOK’s unregulated operations include interests in 24 natural gas processing plants and related gathering systems, marketing operations in 28 states and transportation pipelines and storage facilities in Kansas, Oklahoma and Texas. Earnings for this company were up 42% in 2000. Growth through acquisitions of unregulated assets, valued at more than $850 million, were key to this performance. Westar Industries received about $33 million in dividends from this investment, and our 45% ownership stake appreciated about 90% to more than $1 billion at year end. www.oneok.com |

|

| WESTAR COMMUNICATIONS AND OTHER INVESTMENTS | |

|

A wholly owned subsidiary, Westar Communications provides Kansans with wireless communication services and accessories. Westar Communications grew to 9,069 paging customers in 2000. www.wr.com/paging_services.html We sold much of our unregulated investment portfolio in 2000 and gains on the sale of our interests in Hanover Compressor Company, Paradigm Direct and other holdings contributed approximately $1.06 per share to earnings. Year-end market value of our investments, excluding ONEOK, was about $137 million. A rights offering for Westar Industries is expected to be completed in 2001. Westar Industries holds the company’s investments in Protection One, Protection One Europe, ONEOK, unregulated international generation interests and an investment in the utility to be created by the merger of the electric businesses of PNM, KGE and KPL. |

|

![]()

![]() *

Line of business measures are shown at 100%, i.e., monitored services

and natural gas numbers reflect total company numbers, even though Western

Resources owns only 85% and 45%, respectively, of those companies.

*

Line of business measures are shown at 100%, i.e., monitored services

and natural gas numbers reflect total company numbers, even though Western

Resources owns only 85% and 45%, respectively, of those companies.

Strategic

Partner | Financial Highlights | Chairman’s

Letter

Community Activism | Company Profile |

Directors & Officers | Comparative

Data

Shareholder Information | Form

10-k | Home

© 2000-2001 Western Resources, All Rights Reserved