Overview (cont’d)

Significant highlights for Dole Food Company, Inc. and its consolidated subsidiaries (“Dole” or the “Company”) for the year ended January 1, 2011, were as follows:

Operating income in 2010 was $194 million compared to $352 million in 2009. Earnings decreased in our fresh fruit segment, partially offset by stronger results in our fresh vegetables and packaged foods segments.

- Fresh Fruit. Operating income decreased primarily as a result of lower banana performance worldwide as a result of higher fruit costs from Latin America, lower local pricing in Asia and the absence of 2009 asset sale gains. Operating income was also impacted by $33 million of charges related to restructuring and long-term receivables and a net $27.3 million gain on an arbitration settlement involving faulty containers sold to Dole.

- Fresh Vegetables. Operating income increased significantly due to improved pricing, favorable product mix, lower product costs and higher volumes in our packaged salads business.

- Packaged Foods. Operating income was slightly higher due to better performance of FRUIT BOWLS® and frozen fruit operations in North America and improved pricing for concentrate worldwide, partially offset by higher costs impacting our worldwide packaged fruit operations.

Cash flows provided from operating activities were $148 million compared to $283 million in 2009. The change was primarily due to lower net income.

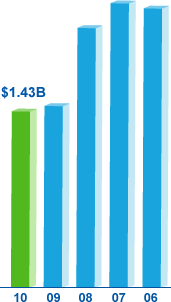

Dole reduced its total net debt* outstanding by $45 million during 2010. Net debt at the end of 2010 was $1.43 billion. Dole also reduced its interest expense by $42 million during 2010.

During the third quarter of 2010, Dole committed to a restructuring plan in its fresh fruit segment in Europe, Latin America and Asia. These restructuring efforts are designed to reduce costs by realigning fruit supply with expected demand. As part of these initiatives, Dole restructured certain farming operations in Latin America and Asia, reorganized its European operations and rationalized vessel charters. During the third and fourth quarters of 2010, Dole incurred $21.3 million of restructuring costs related to these initiatives, of which $11.1 million was paid or will be paid in cash. Related to these efforts, Dole expects to incur additional restructuring charges of $6.8 million and $0.4 million during fiscal 2011 and 2012, respectively. As a result of these various initiatives, beginning in fiscal 2011 Dole expects to realize annual cash savings in our fresh fruit segment of approximately $37 million. These savings are expected to result from lower production costs including lower labor costs on our farms and in our ports, enhanced farm productivity, lower distribution costs resulting from more efficient utilization of our shipping fleet, and lower selling and general and administrative costs as a result of streamlining our organization in Europe.

During 2010, there were also favorable developments in legal proceedings. To read more, please download our Form 10-K.

* Total net debt is defined as total debt less cash and cash equivalents.< Previous Page | Page 1 of 2

Dole reduced it’s total outstanding net debt by $45 million to $1.43 billion at the end of 2010.