|

|

|

|

|

|

|

|

|

|

Successfully

extending a 104-year-old business into new markets, new applications and

new products demonstrates The Equifax Difference at work — continually

pushing the business to a higher level of service and value for customers

and shareholders and ultimately benefiting the consumer.

Successfully

extending a 104-year-old business into new markets, new applications and

new products demonstrates The Equifax Difference at work — continually

pushing the business to a higher level of service and value for customers

and shareholders and ultimately benefiting the consumer.

Our Core Strength

Growth business. It is a term usually reserved for start-ups and emerging

markets, but at Equifax, we have a growth business that even at 104 years

old is still setting records. In fact, our Information Services business

has been finding ways to grow bigger and serve more customers for more

than a century by aggregating increasing amounts of data, utilizing even

more sophisticated technology and introducing an array of innovative products.

Today, Information Services remains as viable as ever. In times of economic expansion, this business grows in tandem with increased spending and investment. In times of recession, Information Services is even more relevant as it provides businesses and lenders the tools to better assess risk and enhance credit decision-making — abilities that are essential to managing successfully through an economic downturn.

Our core U.S. credit reporting business has for the past decade posted a compound annual growth rate of 14 percent. And, even during the sluggish economy of 2002 when so many businesses faltered, U.S. credit reporting achieved four percent volume growth, in part due to strong demand from mortgage services customers.

A

key strategy over the past decade has been to increase the breadth and

depth of data through affiliate acquisition. This effort advanced substantially

in 2002 with the acquisition of key assets from CBC (Credit Bureau of

Columbus), our second largest affiliate. As a result, we have more data

under our control and are able to serve our customers more effectively

and efficiently with direct sales, products and support.

A

key strategy over the past decade has been to increase the breadth and

depth of data through affiliate acquisition. This effort advanced substantially

in 2002 with the acquisition of key assets from CBC (Credit Bureau of

Columbus), our second largest affiliate. As a result, we have more data

under our control and are able to serve our customers more effectively

and efficiently with direct sales, products and support.

Products That Work Harder

At Equifax, product innovation is synonymous with continued growth. We

were the first to offer Equifax Decision Power®, a decisioning platform.

Recently, we introduced significant enhancements to the Decision Power

product portfolio. Decision Power Insight™ is a new automated process

for screening banking's demand deposit account applicants. It combines

the power of decision-making technology and credit information from Equifax

with important closed-for-cause and negative deposit account information.

This new product gives financial institutions more knowledge that translates

into better risk management and increased profitability.

In

addition to enhanced decisioning products, Equifax Information Services

was among the first to develop a suite of solutions that addresses the

key issues of fraud, risk, bankruptcy and debt collection that face our

customers. In this tough economic environment, it is more important than

ever to gain insight into these high-risk areas. Products such as eIDverifier®,

PinnacleSM and Bankruptcy Navigator Index®

are helping customers detect subversive or fragile financial situations

so that they can address them before they impact the organization.

In

addition to enhanced decisioning products, Equifax Information Services

was among the first to develop a suite of solutions that addresses the

key issues of fraud, risk, bankruptcy and debt collection that face our

customers. In this tough economic environment, it is more important than

ever to gain insight into these high-risk areas. Products such as eIDverifier®,

PinnacleSM and Bankruptcy Navigator Index®

are helping customers detect subversive or fragile financial situations

so that they can address them before they impact the organization.

ANALYTICS FOR THE FUTURE

In the almost 10 years since we introduced Decision Solutions, we have

established a leading position in the analytics and modeling field. We

have set the standard for custom and generic models that help in managing

lending risks and in pursuing new market opportunities with greater insight.

We serve customers in such industries as telecommunications, mortgage

services and the automotive industry who use these models in tens of millions

of transactions every year to grow and manage their businesses more profitably.

As our information assets increase, along with our level of technological

innovation, analytics will afford us the opportunity to add even greater

value to our data and design additional customer-driven solutions.

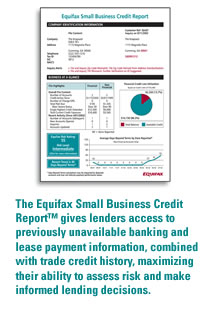

A New Growth Arena

Small businesses represent a major pillar of the American economy. The

more than 25 million small businesses in the country make up 99 percent

of all employers and 52 percent of the private workforce.*

By creating and continuing to build a proprietary database — already 16

million businesses strong — Equifax has introduced another industry first

and is poised to revolutionize credit reporting in the commercial arena

in the United States. In doing so, Equifax has the opportunity to dramatically

impact credit grantors' ability to make financing decisions for small

businesses, and, in turn, enable financing for an essential growing segment

of the economy.

Equifax can now offer credit reports on small businesses, similar to those that we offer on individual consumers. This product is the first in what is expected to be an expanding portfolio of small business products — products that can effectively tap into this market.

Global Value

The information services needs that Equifax meets every day are not limited

to the United States. Indeed, over the past 12 years, we have expanded

our operations beyond the United States and Canada to include 11 countries

in Europe and Latin America. Our commitment to the global markets we serve

remains strong as does our outlook for growth on all fronts.

*Source: Testimony of Hector Barreto, Administrator, U.S. Small Business Administration, before the Committee on Small Business, U.S. House of Representatives, 2/13/02.

2002 Annual Report

Home | The Equifax

Difference at Work | Letter to Shareholders

| Financial Highlights

Board of Directors | Financial

Review | Corporate Information

Information Services | Marketing

Services | Consumer Direct | Fraud,

Safety & Security