Tenneco moved decisively in 2008 to deal with an unprecedented deterioration in the global economy and the severe downturn in the automotive industry, carefully balancing cost management with laser-like focus on customer service.

Tenneco moved decisively in 2008 to deal with an unprecedented deterioration in the global economy and the severe downturn in the automotive industry, carefully balancing cost management with laser-like focus on customer service.

The company implemented restructuring and operational flexing programs that will:

• close three manufacturing plants in North

America and an engineering facility in Australia;

• eliminate 2,250 positions worldwide;

• suspend matching contributions to employee

401(k) programs; and

• cut spending on information technology,

sales and marketing.

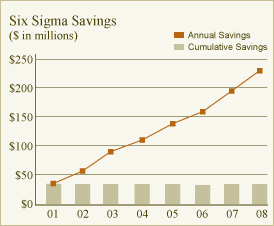

Other actions included adapting work hours, adjusting employee compensation, cutting discretionary spending in all areas and maximizing Six Sigma and Lean manufacturing programs. Here’s a closer look at how Tenneco is responding.

Cost and Cash Management

In North America, Tenneco announced the closing of its elastomer plant in Milan, Ohio, and its just-in-time (JIT) emission control facilities in Emigsville, Penn. and Evansville, Ind. In addition to these and other restructuring actions, the company implemented numerous “flexing” actions at all of its North American manufacturing operations, primarily by taking numerous down days throughout the year in response to customers’ reduced production schedules.

Outside North America, labor agreements are often more complex and allow less flexibility in adjusting employment levels. In addition to reducing permanent staff, managers employed a number of other means, such as reducing the number of contract employees, offering sabbatical leave and using attrition by not replacing all employees who resigned or took early retirement.

Through negotiations with labor representatives, Tenneco also succeeded in reducing work hours and commensurate compensation at operations in Germany, the United Kingdom, Belgium, and Spain.

“Over the years, we have built good relationships, trust and a spirit of cooperation with our works councils,” says Wolfgang Fries, executive director, human resources, Europe. “We drew on the cumulative goodwill to negotiate cost reduction measures that will help provide long-term employment and still meet our cost reduction goals.”

Tenneco’s global aftermarket operations also responded to challenging market conditions by cutting costs and reducing inventories to help generate cash.

In North America, the aftermarket team met its annual revenue goal and exceeded prior year totals despite higher fuel costs earlier in the year, which negatively impacted consumers’ discretionary spending, and the negative economic developments in the fourth quarter. Despite stronger revenue, the North America aftermarket contended with increasing freight and material costs, which impacted earnings. To partially offset these increases and maximize financial results, the group managed costs by curtailing travel, cutting discretionary spending and making targeted reductions in other overhead costs.

“We were able to offset a sharp decline in the fourth quarter brought on by the recessionary economy by making strong gains in the previous months,” says Joe Pomaranski, vice president, North America aftermarket. “Much of the sales gain came from winning business from our competitors.”

The European aftermarket also reduced inventories and restructured its organization in response to market conditions. During the year, the group launched new emission control products and increased its market share, while extending its ride control line and maintaining sales levels.

Meeting Customer Commitments

Meeting Customer Commitments

A common element in these and other measures is a focus on maintaining Tenneco’s dedication to quality and ability to respond to customers’ current needs while continuing to develop advanced technology for future programs.

Serving General Motors almost exclusively, the ride control plant in Owen Sound, Ontario, Canada, adjusted throughout the year to wide swings in demand. Despite this uneven pattern, Owen Sound achieved a consistent high level of product quality, earning its third consecutive internal award, recognizing Owen Sound as the best overall quality performer among Tenneco’s North American ride control plants. It also won Tenneco’s Gold Standard Award for achieving near zero defects of 2 parts per million.

“We delivered a consistently high level of product quality through our excellent workforce," says Bob MacDougall, plant manager, Owen Sound. “Our team’s application of Lean manufacturing principles and Six Sigma quality assurance programs sets us apart.”

European operations developed a creative solution for reducing costs while meeting customer requirements. Tenneco rents space within one of its just-in-time (JIT) production facilities in France to another exhaust component manufacturer who supplies the same platform. While both companies assemble exhaust systems using their own components, Tenneco retains responsibility for sequencing both company’s exhaust systems into the customer's production line, as well as for all shared services and logistics.

“The decision to share our plant is a first for Tenneco in Europe and has significant advantages for the customer,” said Enrique Orta, executive operations director, emission control Europe. “We have enhanced our service and it also helped absorb a portion of the plant's fixed costs.”

Meeting customer commitments also required closely managing time and focusing engineering resources to deliver uninterrupted engineering support of existing and new customers.

“We had no magic solution to getting the job done despite staff reductions and budget constraints”, said Tim Bombrys, chief engineer, product engineering, North America ride control. “Our engineering team simply made extra effort, set priorities and did what was needed to meet customer requirements.”

Part of this engineering effort supported the acquisition of ride control assets in Kettering, Ohio, from Delphi. The transfer of operation required continued supply of products for existing platforms and the launch of several new platforms including engineering support for the Multi-tuned Valve that also went into production at two other North American plants.

In South America, Tenneco combined managing costs with focusing on customer needs. While employing measures such as reduced work weeks, the Brazilian team increased ride control market share by six points to 24 percent by maintaining existing customers and winning new business.

Tenneco remained the sole supplier for the new Ford Ka launched in 2008 and solidified its position as supplier for the Volkswagen Gol, Brazil’s top-selling vehicle for the last two decades.

“Technological innovation continues to play a key role in winning new business and growing our market share,” said Guillermo Minuzzi, managing director, South America.

Improving Engineering Efficiency

Improving Engineering Efficiency

Tenneco’s European operations achieved significant savings by increasing product standardization without compromising customers’ specific needs, using tools such as Tenneco’s Knowledge-Based Manufacturing and Engineering technology. This knowledge management tool captures and updates knowledge from the company’s most successful design and production processes and shares experience across engineering groups to significantly reduce development time and match product designs to manufacturing capabilities.

“We intensified standardization of emission control products over the last five years to achieve significant benefits,” says Alfred Baumann, manager, product release and standardization, emission control Europe. “We are also working with our North American counterparts to establish standard global emission control processes.”

In North America, engineers at the Grass Lake, Michigan emission control engineering center are using standardized procedures and Lean and Six Sigma techniques to improve testing and finite element analysis (FEA). As a result, Tenneco is benefiting in this cost- conscious environment from greater FEA output and more testing, using far fewer resources.

Global Purchasing Power

Tenneco's continuing emphasis on maximizing its global purchasing power also grew in importance as the challenges in 2008 intensified.

Global Supply Chain Management (GSCM) restructured its organization to provide Tenneco’s worldwide business units more direct, focused support while reducing manpower needs by about 15 percent. In addition, to improve economical sourcing, GSCM placed local managers in China and South Korea to enhance supplier development and the interface between commodity purchasing groups, business units and suppliers.

This improved efficiency was complemented by aggressively negotiating agreements on stainless steel, tubing and stampings contracts, as well as material substitutions where possible without compromising product performance and quality.

“No one could have predicted the unprecedented challenges that confronted our industry over the last twelve months, which required us to take actions that tested the resilience of our employees worldwide,” said Neal Yanos, executive vice president, North America. “I am impressed by their hard work, innovative thinking and actions, all of which have been key to our survival.”