- 2011 Highlights

- Letter to Shareholders

- Driving Shareholder Value

- Business Highlights

- Board / Management

- Shareholder Information

In each and every aspect, our 2011 results were simply superb. While admittedly lifted by the disruption of our principal competitor’s supply chain following the March 2011 tragedy in Japan, our organization’s collective ability to seize the resulting opportunity was nothing short of remarkable. Even absent this phenomenon, our results would have met or surpassed each of our key performance measures.

While not immune to the financial crisis that lurches from one Western country to the next, we fared better than our tobacco peers and virtually all other global consumer products peers.

2011 Results and Brand Performance

Cigarette volume of 915.3 billion units rose by 1.7% versus 2010, or by 0.5% on an organic basis.

The key organic volume growth markets in absolute terms versus the prior year were Algeria, Argentina, Indonesia, Japan, Korea and Turkey. Our solid volume performance was partially offset by the detrimental impact of the imposition of severe austerity measures, resulting consumer hardships and high unemployment levels in several southern countries of the European Union, particularly Greece, Portugal and Spain. The disruptions caused by the Arab Spring also led to an erosion in volume in Egypt, Libya, Syria, Tunisia and our duty free business.

Our market share performance was solid and improved as the year unfolded. Our total share of the international market, excluding the People's Republic of China and the U.S., grew by 0.3 percentage points to 28.1%. Aggregate share in our top 30 income markets grew by 1.2 points to 36.3%, with a stable performance in non-OECD markets and growth in OECD markets.

Marlboro, the world’s only truly global premium cigarette brand, continued to gain share, particularly throughout Asia and Latin America. Our efforts behind the brand’s new architecture, described in more detail later in this Annual Report, are clearly bearing fruit, with the brand displaying renewed momentum in numerous markets. Despite its significant progress, Marlboro continues to shed market share in some key markets, and this will need to be corrected going forward.

Our other international brands, namely L&M, Parliament and Chesterfield, are also performing solidly, with share gains recorded by each brand. Parliament, in particular, had a spectacular year, with volume up by 12.1% versus 2010.

L&M’s progress in the European Union continued unabated, and the brand enjoyed solid progress elsewhere, most notably in Saudi Arabia, Thailand and Turkey. Even in Russia, where it has suffered numerous years of volume erosion, the brand has recently shown signs of a solid turnaround.

A remarkable achievement is that every single one of our top ten brands recorded volume growth in 2011.

Reported net revenues, excluding excise taxes, reached a record level of $31.1 billion, up by $3.9 billion, or by 14.3%, ahead of the prior year. Excluding the favorable impact of currency and acquisitions, net revenues grew by 9.2% versus 2010. Pricing and volume/mix were the key drivers of our growth versus 2010.

Adjusted operating companies income (OCI) of $13.7 billion surged by $2.2 billion or 19.2% versus the prior year. Excluding currency and acquisitions, adjusted OCI was up by 14.0% versus the prior year. Our adjusted OCI margin, excluding currency and acquisitions, reached a level of 44.2%, an increase of 1.9 points versus 2010, with all four business segments registering solid growth.

We had set a productivity target of $250 million for 2011, which we comfortably surpassed. Our one-year gross productivity and cost savings target for 2012 is $300 million.

Adjusted diluted earnings per share (EPS) of $4.88 were up by 26.1%, versus 2010. On a constant currency basis, adjusted diluted EPS grew by 21.2%, versus 2010.

Free cash flow of $9.6 billion increased by $908 million over the level achieved in 2010, or 5.3% excluding currency. Free cash flow expressed as a percentage of reported net revenues, excluding excise taxes, reached a level of 31.0%, a ratio that was superior to that of our tobacco and other consumer product peers.

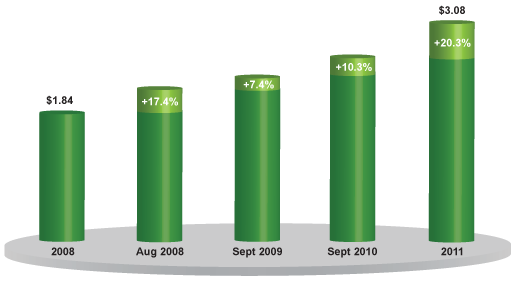

Dividends for all years are annualized rates. The 2008 annualized rate is based on a quarterly dividend of $0.46 per common share, declared June 18, 2008. The 2011 annualized rate is based on a quarterly dividend of $0.77 per common share, declared September 14, 2011.

This strong cash flow performance enabled us to generously reward shareholders with a dividend increase in 2011 of 20.3%, to an annualized level of $3.08 per share, and share repurchases of $5.4 billion. Since our Spin-off from Altria Group, Inc. in March 2008, we have increased the dividend by an impressive 67.4%.

As testament to the strength of our balance sheet, we successfully negotiated an increase and extension of our credit facilities at favorable terms and issued a number of bonds in 2011, including one transaction that, at the time of its issuance, matched the lowest-ever coupon ascribed to a 30-year bond for a U.S. corporate issuer. As a result of these capital market activities, the weighted-average all-in financing cost of our total debt was 4.4% in 2011, compared to 5.0% in 2010. The weighted-average time to maturity of our long-term debt has increased from 7.0 to 8.2 years at the end of 2010 and 2011, respectively.

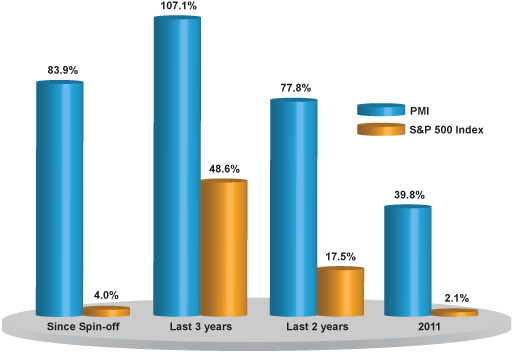

Note: “Since Spin-off” is for the period March 28, 2008 – December 31, 2011, “Last 3 years” is for period January 1, 2009 – December 31, 2011, “Last 2 years” is for period January 1, 2010 – December 31, 2011. PMI pro forma for additional $0.46 per share dividend paid in April 2008 impacts the period March 28, 2008 – December 31, 2011. Exchange rates are as of March 28, 2008, January 1, 2009, January 1, 2010, January 1, 2011 and December 31, 2011. Source: FactSet, compiled by Centerview

Our 2011 total shareholder return (TSR) in U.S. dollar terms was up by a strong 39.8%, well ahead of our PMI peer group (14.0%) and the S&P 500 Index (2.1%) and ahead of our tobacco peer group (30.2%). Since our Spin-off, PMI’s TSR has consistently outperformed that of the S&P 500 Index.

Elsewhere in this Report, you will read about the various elements of our business that, individually and collectively, have contributed to our strong shareholder returns.

The Fiscal and Regulatory Environment

On the all-important excise tax front there was overwhelmingly sound progress. Past experience has typically shown that whenever large excise tax increases have been implemented, government revenue falls short of expectations, and border sales and illicit trade are encouraged at the expense of the tax-paid market, as was most notably the case in Mexico in 2011. Despite the sovereign debt crisis and ongoing deficits, no country has yet announced an excise tax increase for 2012 that we would deem to be manifestly excessive, and we expect rationality to prevail going forward. We do expect some countries in Europe to increase general VAT rates this year, but overall we believe that such increases should be manageable.

On the regulatory front, we experienced the setback of the enactment of plain packaging legislation in Australia. While we, together with other members of the industry, went to unprecedented lengths, domestically and internationally, to safeguard our trademarks and defeat this terribly flawed act, we regretfully lost the battle. Our efforts will now focus on seeking a reversal through litigation on several fronts, as well as significant financial compensation.

Business Development, Research & Development and

Environmental Health & Safety

On the business development front, we closed on a number of small transactions, for example in Australia, New Zealand and Jordan. The most meaningful deal was the acquisition of the worldwide intellectual property rights to some very promising reduced-risk technology developed by a team of scientists led by Professor Jed Rose, Ph.D., a leading expert in the field of nicotine addiction research.

Significant progress was achieved in Research & Development (R&D). Our sustained efforts to draw up an integrated plan addressing reduced-risk product development, risk assessment, the regulatory framework and product commercialization have moved forward by leaps and bounds.

Last year also witnessed a restructuring of our R&D resources to concentrate all work going forward behind our reduced-risk, or Next Generation Product (NGP) initiatives and our overall plan to launch an NGP within the next three to four years.

Despite the complexity of catering to the surge in demand from Japan, we achieved solid progress on all key manufacturing performance indicators, including yield, waste, quality indices and safety measures. While improvements were noted on up-time and fleet crash rates, these two indices remain priorities going forward.

The Organization

Numerous actions were taken last year to enhance our organizational effectiveness. Together with the appointment of three new members to the Senior Management Team, we significantly enhanced the leadership caliber and managerial resources in several key geographies and further deployed resources to fully capture opportunities.

Our Employee Opinion Survey, completed in June 2011, revealed material and, in certain circumstances, outstanding progress in almost all areas surveyed. Morale is high, not surprisingly, one would say, given our results and stock price performance. However, it is my sense that the positive spirit that reigns goes far beyond this rationale.

There has been a huge leap forward in product innovation, the quality and breadth of our marketing tools, our consumer and retail trade engagement activities, the merging of our marketing and sales force resources into integrated commercial organizations and, more generally, in our collective entrepreneurial spirit and our speed to market. There is more discipline and focus and a growing confidence that, despite our challenges, our growth prospects are excellent.

We are privileged to have secured the services of both Kalpana Morparia and Robert Polet as new Board Directors. Kalpana’s significant understanding of the financial services industry, and Robert’s considerable experience in the global luxury and consumer packaged goods industries, will undoubtedly add further force to what constitutes an already formidable Board.

The Year Ahead

We enter 2012 with significant momentum and solid plans in place to secure further growth. Economic uncertainty, currency volatility and the year-on-year comparison of our business performance in Japan are obvious challenges, but I am convinced we have the talent and collective resources to deal with them. In the meantime, we can all take a brief moment to reflect upon what, by any measure, was a great year for our company. In this regard, I would like to extend my warmest thanks to all our employees. Their immense dedication, unparalleled professionalism and boundless enthusiasm are a constant source of inspiration, and they deserve our deepest gratitude.

Louis C. Camilleri

Chairman of the Board

and Chief Executive Officer

March 5, 2012

Louis C. Camilleri

Chairman of the Board

and Chief Executive Officer

PMI Operations Center

Lausanne, Switzerland