Management’s Discussion and Analysis

The purpose of the Management’s Discussion and Analysis (MD&A) is to provide an understanding of McCormick’s financial results and condition.

A Global Business

McCormick & Company is a global leader in the manufacture, marketing and distribution of spices, herbs, seasonings and other flavors to the entire food industry. Our major sales, distribution and production facilities are located in North America and Europe. Additional facilities are based in Mexico, Central America, Australia, China, Singapore, Thailand and South Africa. In 2006, 38% of sales were outside the United States.

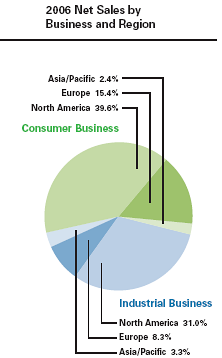

We operate in two business segments, consumer and industrial. Consistent with market conditions in each segment, our consumer business has a higher overall profit margin than our industrial business.

Across both segments, we have the customer base and product breadth to participate in all types of eating occasions, whether it is cooking at home, dining out, purchasing a quick service meal or enjoying a snack.

Our Financial Objectives

With good visibility into our business prospects and operating environment, growth objectives are used as internal goals and to provide a financial outlook for our shareholders. In 2006, annual objectives were set to grow sales 3-5% and earnings per share on a comparable basis 8-10% through 2008.

Our business generates strong cash flow which has increased in the past 10 years. Actions to grow net income and improve working capital should lead to further gains. We have consistently paid dividends and expect to increase dividends at a rate similar to the increase in earnings per share. Additional cash is being used to fund strategic acquisitions and capital projects. An active share repurchase program is lowering shares outstanding and improving value for McCormick shareholders.

A Sustainable Strategy

Our strategy – to improve margins, invest in our business and increase sales and profits – is as effective now as it was in 1998 when we developed it.

During the past five years, this strategy has led to average annual sales growth of 7% with acquisitions driving approximately one quarter of the increase. Gross profit margin has risen from 38.0% in 2001 to 41.0% in 2006 and driven higher operating income and net income.

We are increasing margins with cost-savings programs, new capabilities and processes introduced through our B2K program, acquisitions of high-margin brands and the introduction of higher-margin, more value-added products.

A portion of the cost savings is being used to fund product development and advertising. During the past five years, we have increased research and development expense more than 60%. In 2006, we spent $58 million in advertising to consumers compared to $25 million in 2001. These are effective investments that are driving sales and profit growth at McCormick.

During the past five years, 84% of

cash from operations directly

benefited shareholders in the form of

dividends and share repurchase.