Key Growth Initiatives

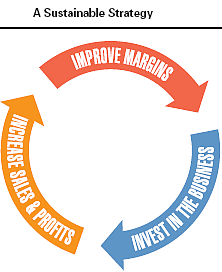

Four key initiatives are underway to continue our growth of sales and profits.

![]() A restructuring program to improve our global supply chain was announced in 2005 and will extend through 2008. This plan is reducing our complexity and creating an organization more focused on growth opportunities. Our goal is to reduce annual costs by $50 million.

A restructuring program to improve our global supply chain was announced in 2005 and will extend through 2008. This plan is reducing our complexity and creating an organization more focused on growth opportunities. Our goal is to reduce annual costs by $50 million.

![]() We are building consumer interest by revitalizing our consumer brands. Currently underway is the revitalization of McCormick brand spices and seasonings in the United States. Along with new products, new labels and new flip-top caps, we are introducing new store shelving systems to make shopping easier for the consumer and restocking easier for grocers.

We are building consumer interest by revitalizing our consumer brands. Currently underway is the revitalization of McCormick brand spices and seasonings in the United States. Along with new products, new labels and new flip-top caps, we are introducing new store shelving systems to make shopping easier for the consumer and restocking easier for grocers.

![]() Significant progress has been made transforming our U.S. industrial business. We’re simplifying and focusing our resources on growing with large customers who have the greatest potential to add profitable sales. From 2005 to 2008, we expect to increase operating income margin, excluding restructuring charges, by 2.5 to 3.5 percentage points.

Significant progress has been made transforming our U.S. industrial business. We’re simplifying and focusing our resources on growing with large customers who have the greatest potential to add profitable sales. From 2005 to 2008, we expect to increase operating income margin, excluding restructuring charges, by 2.5 to 3.5 percentage points.

![]() We are leading and staying on top of the latest trends through innovation. Consumer demand for convenience, freshness, ethnic flavors and more, guides both our new product development and our acquisition strategy.

We are leading and staying on top of the latest trends through innovation. Consumer demand for convenience, freshness, ethnic flavors and more, guides both our new product development and our acquisition strategy.

Consumer Business

From locations around the world, our consumer brands reach nearly 100 countries.

Customers: A variety of retail outlets that include grocery, mass merchandise, warehouse clubs, discount and drug stores, served directly and indirectly through distributors or wholesalers.

Products: Spices, herbs, extracts, seasoning blends, sauces, marinades and specialty foods. We supply both branded and private label products.

Market position: A 40-60% market share in primary markets, more than twice the size of the next largest branded competitor. As the market leader, we can more efficiently develop and support our brands.

Competitors: More than 250 other brands in U.S. and more in international markets. Some are owned by large food manufacturers, while others are supplied by small privately owned companies.

Growth opportunities: Developing innovative products, increasing marketing effectiveness, expanding distribution and acquiring leading brands and niche products.

Industrial Business

We provide a wide range of products to multi-national food manufacturers and restaurants.

Customers: Food manufacturers and the food service industry. Food service customers are supplied both directly and indirectly through distributors.

Products: Seasoning blends, natural spices and herbs, wet flavors, coating systems and compound flavors.

Market position: A leading supplier to many of the large multi-national food manufacturers and restaurants. We have one of the broadest ranges of flavor solutions in the industry and expertise in sensory, culinary and other areas.

Competitors: Tend to specialize in one or several ranges of products. Some competitors are publicly held flavor companies, while others are small privately owned firms.

Growth opportunities: Supporting the global expansion of customers, building current and new strategic partnerships, developing consumer-preferred, value-added products.