depreciation of assets, mostly offset by the asset gain from the sale of our manufacturing facility in Paisley, Scotland.

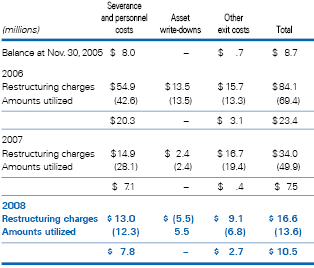

In 2006, we recorded $54.9 million of severance costs and special early retirement benefits associated with our voluntary separation program in several functions in the U.S.; closures of manufacturing facilities in Salinas, California; Hunt Valley, Maryland; Sydney, Australia; Paisley, Scotland; and Kerava, Finland; and reorganization of administrative functions in Europe. In addition, we recorded $15.7 million of other exit costs associated with the consolidation of production facilities and the reorganization of the sales and distribution networks in the U.S. and Europe and contract termination costs associated with customers and distributors in connection with the closure of the business in Finland. The $13.5 million of restructuring charges for asset write-downs is primarily accelerated depreciation related to the closure of manufacturing facilities in Salinas, California and Hunt Valley, Maryland, the closure of the plants in Paisley, Scotland and Kerava, Finland and inventory writeoffs as a result of the plant closings. These expenses were partially offset by net gains on the disposition of assets.

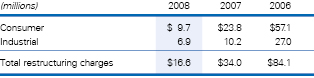

The business segment components of the restructuring charges recorded in 2008, 2007 and 2006 are as follows :

The restructuring charges recorded in the consumer business include severance costs and special early retirement benefits associated with our voluntary separation program in several functions in the U.S., Europe and Canada; consolidation of certain manufacturing facilities in Europe; the reorganization of distribution networks in the U.S. and the U.K.; and closure of manufacturing facilities in Salinas, California (offset by the asset gain), Sydney, Australia, and Kerava, Finland.

The restructuring charges recorded in the industrial business include severance costs and special early retirement benefits associated with our voluntary separation program in several functions in the U.S. and Europe; closures of manufacturing facilities in Hunt Valley, Maryland, and Paisley, Scotland (offset by the asset gain) including other exit and inventory write-off costs and accelerated depreciation of assets.

|

|

During 2008, 2007 and 2006, we spent $0.8 million,

$42.2 million and $39.5 million, respectively, in cash on the restructuring plan. From inception of the project in November 2005, $84.1 million in cash has been spent on the restructuring plan, including the $14.4 million cash received from the Salinas sale in 2008 and $9.2 million cash received on redemption of our Signature investment in 2006.

The major components of the restructuring charges and the remaining accrual balance relating to the restructuring plan as of November 30, 2006, 2007 and 2008 follow:

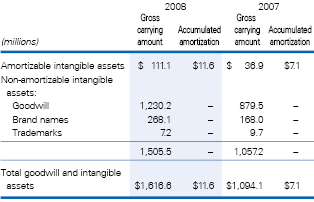

4. GOODWILL AND INTANGIBLE ASSETS

The following table displays intangible assets as of November 30, 2008 and 2007:

Intangible asset amortization expense was $5.9 million, $3.2 million and $1.8 million for 2008, 2007 and 2006, respectively. At November 30, 2008, amortizable intangible assets had an average remaining life of approximately

14 years.

|