What does an apron have to do with car insurance? – An apron is hard work. – An apron is pride in what you do. – An apron is not quitting until you’ve made something better. What does an apron have to do with car insurance? For us — Everything!

What does an apron have to do with car Insurance?

Designed to be thought provoking and, for most, rhetorical, we featured this question to open the newest visual expression of the evolving Progressive brand. Brands in some form are an emotive consumer response, and a brand owner’s best efforts are directed toward shaping that response to match the character of the company. We see Progressive from the inside-out as a company with strong values, a clear sense of purpose, a refreshingly positive work culture focused on the customer, and a demonstrated sense of innovation in the auto insurance space — insight not so easily expressed to others with the same veracity as observed by those of us in an advantaged position. However, our best research suggests these qualities are highly valued by consumers and additive to the product-centric dimensions proffered by Flo.

We set out to answer the question using the apron Flo has worn in close to 100 commercial appearances, and borrowed the universality of the apron as a tool for helping make things and making things better. We blended the two into a visual presentation that we believe portrays Progressive in the disarmingly humble, but highly credible, light of a company that works every day to make things better. Thus answering our own question with a straightforward — Everything!

There’s considerably more depth to this initiative and interested readers are directed to progressive.com. Regardless, expect to see more, but only selectively so, as we add this important dimension to our marketing efforts for 2014.

Making things better

In 2013 we made a lot of things better and, while accepting that this task is never done, I’d enjoy sharing a few of them with you.

Notwithstanding a long history of underwriting results that have met or exceeded our targets, we did get to make them even better this year. Written premiums grew close to 6% and topped $17 billion for the year, continuing a numeric progression of topping $15 billion in 2011 and $16 billion in 2012. I can envision more rapid sequences, but I like the direction. We have every reason to be pleased with a 93.5 combined ratio, and the resulting pretax underwriting income of $1.1 billion, both markedly better than last year. Completing our revenue and income model, we added $422 million in investment income and $318 million of net realized gains, along with a $130 million increase to our unrealized gains balance, now standing at $1.5 billion. The all-in measures of net income per share and, our preferred, comprehensive income per share were $1.93 and $2.06, respectively, both better than the equivalent result last year by 30% and 16%, and our return on shareholders’ equity using both measures approximated 18% and 19%. On these important financial dimensions, I’m happy to say I think we made things better in 2013.

By the time this letter is posted, these results will be well known. Let’s take a look at the story behind the numbers. In some ways 2013 was for Progressive’s auto product line a year of two contrasting market dynamics. The first was the extended earn-in period of the fairly significant and geographically wide-spread rate increases we took in mid-2012, the reasons for which I highlighted in this letter last year. While unquestionably necessary to maintain our unbending commitment to meeting or exceeding our profitability targets, this discipline also comes with a large dose of frustration. At a time when our marketing efforts were producing record numbers of new prospects, as they did for the entire year, our rate competitiveness — a highly complex notion which spans across 51 rating jurisdictions, two channels of distribution, and numerous products — was not as productive in converting them into customers as we would like. Our premium growth was more a function of the increase in average rate per customer on a year-over-year basis, not as we prefer from increasing numbers of customers. In fact our new business conversion rate against the higher prospects was down significantly and, even more frustratingly, some of our current customers chose to shop and change based on rate at renewal. Customer retention is so obviously the key to many positives in our business and our decade long assault on intense measurement and actions designed to increase policy life expectancy for each customer took an unwelcomed hit. One might ask — then why do it? While acknowledging there are alternatives, the constancy of the central elements of our business model has been tested over short and long time periods and is in so many ways the DNA of Progressive. I have reprinted in the insert my articulation of our business model, in part incorporated in last year’s letter.

Our Business Model

Target Profitability. For us, a 96 combined ratio is not a “solve for” variable in our business model equation, but rather a constant that provides direction to each product and marketing decision and a cultural tipping point that ensures zero ambiguity as to how to act in certain situations. Set at a level we believe creates a fair balance between attractive profitability and consumer competitiveness, it’s deeply ingrained and central to our culture.

With clarity as to our business constant, we seek to maximize all other important variables and support with appropriate axioms:

Grow as fast as we can subject to our ability to provide high-quality service. Our preferred measure of growth is in customers, best measured by policies in force.

Extend policy life expectancy. Our preference is for the flexibility of shorter policy periods, highlighting however, the importance of retaining customers at policy renewal. Our focus is inclusive of all points throughout a customer’s tenure and is a never-ending focus, tailored for every customer segment. Our use of Net Promoter® scoring provides for a much more dynamic measure, which is highly correlated to policy life expectancy, and is an internal acceptable proxy for our ultimate goal of extended life expectancy.

Clarity as to our objectives means other elements of the business model must be appropriately designed to strongly support, but not necessarily amplify, the risk of maximizing all things at the same time. Our articulation of our most critical investment objective is a good example:

Invest in a manner that does not constrain our ability to underwrite all the profitable insurance available to us at an efficient premiums-to-surplus leverage. We often refer to underwriting capacity as the protected asset and for us it is a clear determination of where the risk of leverage is best allocated.

The importance of net income, earnings per share, and return on equity is never lost on us, but we view achieving strong, long-term performance of these measures as stemming from our consistent focus on the primary elements of our business model.

Since, I have already suggested two market dynamics, it’s a good guess the second was more favorable.

At slightly different rates, both our Agency and Direct auto channels were reporting double digit growth in new business applications by roughly mid–third quarter and showing healthy signs of reduced retention losses and increased Net Promoter® Scores. Unfortunately, consumers may be at a disadvantage when comparing insurance rates at a single point in time since the lowest might be just about to change, discoverable upon renewal offer, and higher rates may present more stability. That, however, is the basis of a competitive market which for all its failings, currently provides consumers with a very easily accessed and competitive market for auto insurance, and one in which we enjoy competing. For the last third of the year, the continued willingness of agents to quote us and the strong flow of prospects was capitalized on in both our Agency and Direct distributions, and premium growth at about the same rates as earlier in the year was logged in the second half, but for reasons that felt even better — increasing new customer counts.

This would not be the game plan that we would draw up as a preference, and we certainly favor the closing chapters. Our overall rate change for the year was minimal and, with the benefit of hindsight, we might have been able to be a little softer in 2012 and slightly stronger in 2013 — hindsight on future inflationary trends is a wonderful thing, just not very realistic for our purposes. Of course, we did make numerous adjustments during the year as best determined by the state product managers, and that process remains the heart and soul of our ability over any extended period as we seek profitable growth in every state in which we do business. We added a net 276,000 auto customers for the year and most of the increase was in the last four months overcoming the earlier deficit. This does not come close to our potential to add customers nor the demand we are experiencing for our product. So, while 2013 was better in many ways, some yet to come in this note, only half the year might best fit the definition, but for the 2014 outlook, the right half.

Our special lines products, including motorcycle, recreational vehicle, personal watercraft, and boat, have a great deal of seasonality in most states, and this year the weather conditions across the country were less than favorable for much of the potential use season. While that dampened losses, it also dampened policy growth in these products and, although the results were attractive, we had only marginal growth in policyholders — something we look forward to reversing in 2014.

Our Commercial Lines business had a solid year with more variability in results than we would like, but management was consistently on top of the issues and market conditions. While parts of the commercial market we serve, notably the business auto and contractor segment, have been reasonably predictable throughout the economic recovery, others have been highly variable with a feast or famine type usage (e.g., double shifts on major infrastructure jobs), presenting accident frequency patterns very hard to predict. Acknowledging the challenges, we like this business and seek to engage even greater numbers of customers by meeting their other business insurance needs in a manner similar to our approach with homeowners and renters insurance in Personal Lines.

We hope we made things better for shareholders by declaring both a variable dividend and a $1.00 per share special dividend in December 2013, both paid in February 2014. The annual variable dividend was completely consistent with our published methodology and resulted in an approximately $0.49 per share amount based on our post tax underwriting profit and our Gainshare factor of 1.21. Further, the Board of Directors confirmed the variable dividend calculation process for calendar year 2014 to be consistent with 2013. Our comfort in paying these dividends stems from our rigorous efforts to determine the capital we need for regulatory purposes to support our writings, including expected growth, and a layer of contingency capital adequate to cover the many possible contingencies we can envision for our business. Capital in excess of these combined layers is by design available for share repurchases, acquisitions, and shareholder dividends. Our philosophy continues to favor the return of capital above our estimated needs over any reasonable planning horizon.

Our complementary income stream, investing the often called “insurance float,” has performed very well, relative to our desired constraints and guidelines, during a prolonged period of low interest rates and did so again in 2013, posting a total return on our fixed-income portfolio of 1.7%. In fact, with interest rates so low, any desire for long-term increases has to be moderated by the potentially sudden and dramatic price depreciation that may be incurred in current holdings. We had a preview to this potential in the second quarter, but our short-duration position and heavier exposure to the front end of the yield curve provided some insulation to the interest rate increase and steepening yield curve. While our current recurring interest income by historical standards is frustratingly low at a pretax book yield of 2.6%, we remain confident in our preference for shorter duration positioning during times of extremely low interest rates, but will certainly benefit from a return to more substantial yields and are well prepared to act. We were more than happy to be among the boats on a rising 2013 tide for equities, and our approximately 14% allocation of the portfolio to equities — largely indexed — recorded a total return of 32.8%.

As selective signs perhaps suggest a slow strengthening of the economy, we would welcome an improved investment environment with interest rates more comfortably matching our longer-term investment income preference, but, by design, we are not dependent on it. We enter 2014 with a very strong and well-structured capital position, and an investment portfolio positioned to support our current and future objectives, and prospects for our underwriting business that always seem brighter based on the past year’s accomplishments.

More and Better

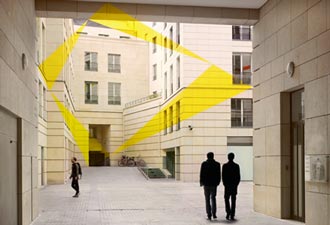

Snapshot®, our usage-based insurance program, contributed to making things better in 2013, in part by contributing over $2 billion to our auto written premium and in part by continuing to help us better understand much of what we didn’t know, we didn’t know as we introduced this rating breakthrough to the market. Least among the unknowns was the premise that driving behavior matters, and another year and significant data confirmed, in no uncertain terms, that observed and measured driving behavior is an extraordinarily powerful basis for matching a rate with the risk presented. Perhaps higher on the list of unknowns was the willingness and degree of engagement customers would be comfortable with when it comes to auto insurance. Historically, a low engagement product after quotation and payment, excluding any claims activity, we are now asking consumers to actively select an option requiring the insertion of a device into the automobile, at their discretion track progress, and in time return the device. Needless to say, not all devices are installed and not all returned, but our focus on these new dimensions to our business and our communication with customers is improving every day. To highlight the notion of engagement, the art in this year’s annual report is entirely dependent on the viewer’s active engagement since the works, including the one commissioned for our campus which is reproduced on the cover of this report, can only be fully appreciated by the observer finding the exact viewing spot and thus point-of-view. We hope, as with Snapshot, the engagement has disproportionate benefits for most.

We had a very good year increasing the percentage of customers accepting the increased level of Snapshot engagement. Notably, Internet customers were accepting at significantly higher rates than at initial introduction and year-end 2012. The most notable, which is far from a surprise, is the high acceptance rates among our customers using mobile devices to buy policies, to whom this seems apparently quite natural. This trend bodes well for us in 2014 and beyond.

Our advertising efforts for Snapshot now use the full gambit of options available to us: we have Flo communicating in multiple ways; we have the “Rate Suckers” campaign strongly suggesting if you’re not in you may be subsidizing the poor driving habits of others; and soon we will use the “Policy Box” to reinforce the key messages. Each has an appeal and a message designed to cover an ever wider spectrum of consumers and a priori concerns. Our research shows three groups of customers: those very encouraged by this type of option; those less persuaded but open; and those with little or no interest for reasons often regarding their perception of privacy. We remain confident that clearer concept communication, greater general awareness, high integrity execution, and changing societal expectations, all work to our and consumers’ advantage going forward. While it’s invigorating to be the pioneer in this extraordinary rating dimension, it may well prove even more rewarding to be the advantaged player when it’s a mainstream consumer expectation.

2013 saw significant progress on our efforts at managing and mining “Big Data” — Snapshot will be a primary beneficiary. As good as our understanding of our data is today, we see continued potential to extract greater value and improve our ability to accurately distinguish between consumer risk profiles. Continuing to evolve our products, including features like Snapshot, is at the very heart of what we do and a clear basis for how we see our ability to outperform in a competitive market. 2014 will be a year where many of the research initiatives of 2013 will come to market.

Each year it seems we need a new vocabulary for mobile computing and communication devices — once simply a phone and desktop, then add tablet and now an evolving array of screen sizes in between, tablets, phones, minis, etc. The common denominator is simple — people want to and do transact all forms of business when and where they want and on whatever device best suits the moment. Quoting, sales, payments, and document requests by mobile device all now represent strong double digit percentages, and in some cases approaching a quarter, of all such transactions. Our challenge is to provide an appealing, easy to use interface for our customers and prospective customers, regardless of the means by which they interact with us. Our efforts on quoting and buying have been at the forefront of our industry and those were enhanced in 2013 with car and driver combinations that meet 99% of consumer needs. Our mobile servicing efforts, for reasons no longer important, were not as responsive to customer preferences as we would desire for much of the year, but our intensive effort to redirect was released late in the year and now forms the basis for our mobile servicing initiative that is fully extensible for 2014. We can never stray far from where it all started, and Progressive’s website design and user experience still represents the base functionality for all else; as such, we were pleased to be again recognized by Keynote Competitive Research as the No. 1 website in the insurance industry for now our ninth year running.

One of the most dramatic differences in Progressive today versus a decade or so ago, and certainly for the better, is operating with the umbrella of a high profile brand. We are unquestionably challenged when occasionally pricing or servicing actions, perceived or real, don’t match the consumer’s perception of what our brand and their expectations of it call for and, in those cases with merit, it serves us well to reevaluate. However, by far the biggest difference is the consumer awareness, consideration, and preference for Progressive products and service — all measures we track with great interest. 2013 was a great year for our ongoing brand development with the Superstore creative campaign starring Flo performing at some of our best yet response levels. Additionally, we pulled the Policy Box off the shelf of the Superstore and using a witty, slightly boastful caricature of it, delivered targeted messages expanding our network of delivery options.

Our objective is not to become simply the decision brand for consumers when considering auto insurance, but also for complementary personal insurance products, primarily home and renter’s coverage. Our Progressive Home Advantage® Program (PHA), supported by the offerings of 11 unaffiliated underwriters, now serves over a million customers, most of whom have a bundled auto and home combination — clearly our retention focused objective. From modest beginnings, the PHA program has become a very significant part of our strategy to attract and retain customers — in some cases those who may not have previously considered us or may have felt the need to leave us when their needs expanded. Our interpretation of an independent survey of customer satisfaction with household insurance bundling, published in 2013, ranking Progressive higher than many traditional underwriters of both auto and home products, was confirming for us of our original premise and research results, that consumers are very comfortable bundling products from different underwriters, conditioned on a brand they can relate to, trust, and one that provides the ease of use we all want when assembling the pieces of our aggregate needs. Our transformation of Progressive from a transaction brand to a destination brand is well underway. The combination of excellent consumer-facing technology, a product array designed for all customer life stages, and a decision brand, makes for an effective portal to attract long-term customers and develop a relationship that meaningfully addresses their specific needs over their lifetime. The potential here is far greater than the to-date realization, but is exciting both in numeric reach and strategic breadth. More and more of our customers, especially our direct customers, are now multi-product customers with combinations of auto, special lines, home, or renters.

Our relationship with American Strategic Insurance (ASI), our key provider for the PHA experience through agents, flourished in 2013, with PHA available to Agency customers in 23 states and Washington D.C., with several more states planned for 2014. Working closely with ASI, our goal, as it is in general, is to design in the product features that make its use more consumer intuitive versus the all too often rough edges associated with different products attempting to work together. Our Agent’s customers are a tremendous source of the multi-product business we seek, and we fully appreciate the need to bring them a strong product portfolio to earn a greater share of this business. Our strong brand is now seen by most agents as a huge positive and a business-generating asset they value and can effectively leverage.

In 2013, our claims organization was able to make what was already a strong track record of extraordinary results in claims resolution even better — quality, efficiency, and customer experience all improved from previously very high benchmarks. In addition to normal claim volume, fires, tornadoes, flooding, hail, and late season snow storms all left their mark on the year, each demanding greater and immediate commitment of our people. Thankfully, the Atlantic hurricane season was not of much note. We opened nine new Service Centers during the year, expanding our footprint to sixty three countrywide. The quality of the claims experience provided at these facilities has from the very first implementation been a model that we believed consumers would come to expect if they only knew how easy it was to use and could take advantage of it. Our work in 2013 was directed squarely at communicating the benefits and increasing our responsiveness and availability so more customers could use the option. As a selected method of repair, the Service Centers now represent more than a third of our physical damage features in the areas served and one of the best benefits of being a Progressive customer. We believe, for those non-customers using the center, being involved in an accident with a Progressive customer is better than alternatives, as demonstrated by their subsequent switching behavior.

Loss and loss adjustment expense is such a dominant percentage of our economics that we never think of claims handling as anything other than directly integral to the business success. Even seemingly marginal gains in claim quality, efficiency, and customer experience translate disproportionately to continued attractive pricing and gains in customer retention. I’m happy to report 2013 was another very good year for our claims organization.