Page 19 - 2017 AMETEK Annual Report (Interactive) Updated mobile

P. 19

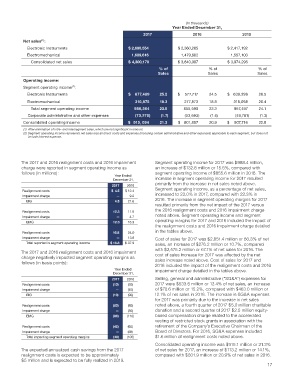

(In thousands)

Year Ended December 31,

2017 2016 2015

(1)

Net sales :

Electronic Instruments $ 2,690,554 $ 2,360,285 $ 2,417,192

Electromechanical 1,609,616 1,479,802 1,557,103

Consolidated net sales $ 4,300,170 $ 3,840,087 $ 3,974,295

% of % of % of

Sales Sales Sales

Operating income:

Segment operating income :

(2)

Electronic Instruments $ 677,489 25.2 $ 577,717 24.5 $ 639,399 26.5

Electromechanical 310,875 19.3 277,873 18.8 318,098 20.4

Total segment operating income 988,364 23.0 855,590 22.3 957,497 24.1

Corporate administrative and other expenses (73,270) (1.7) (53,693) (1.4) (49,781) (1.3)

Consolidated operating income $ 915, 094 21.3 $ 801,897 20.9 $ 907,716 22.8

(1) After elimination of intra- and intersegment sales, which are not significant in amount.

(2) Segment operating income represents net sales less all direct costs and expenses (including certain administrative and other expenses) applicable to each segment, but does not

include interest expense.

The 2017 and 2016 realignment costs and 2016 impairment Segment operating income for 2017 was $988.4 million,

charge were reported in segment operating income as an increase of $132.8 million or 15.5%, compared with

follows (in millions): segment operating income of $855.6 million in 2016. The

Year Ended

December 31, increase in segment operating income for 2017 resulted

2017 2016 primarily from the increase in net sales noted above.

Realignment costs $ 4.5 $ 12.4 Segment operating income, as a percentage of net sales,

Impairment charge — 9.2 increased to 23.0% in 2017, compared with 22.3% in

EIG 4.5 21.6 2016. The increase in segment operating margins for 2017

resulted primarily from the net impact of the 2017 versus

the 2016 realignment costs and 2016 impairment charge

Realignment costs 12.3 11.6

Impairment charge — 4.7 noted above. Segment operating income and segment

EMG 12.3 16.3 operating margins for 2017 and 2016 included the impact of

the realignment costs and 2016 impairment charge detailed

Realignment costs 16.8 24.0 in the tables above.

Impairment charge — 13.9 Cost of sales for 2017 was $2,851.4 million or 66.3% of net

Total reported in segment operating income $ 16.8 $ 37.9 sales, an increase of $276.2 million or 10.7%, compared

with $2,575.2 million or 67.1% of net sales for 2016. The

The 2017 and 2016 realignment costs and 2016 impairment

charge negatively impacted segment operating margins as cost of sales increase for 2017 was affected by the net

follows (in basis points): sales increase noted above. Cost of sales for 2017 and

2016 included the impact of the realignment costs and 2016

Year Ended impairment charge detailed in the tables above.

December 31,

2017 2016 Selling, general and administrative (“SG&A”) expenses for

Realignment costs (10) (50) 2017 were $533.6 million or 12.4% of net sales, an increase

Impairment charge — (40) of $70.6 million or 15.2%, compared with $463.0 million or

EIG (10) (90) 12.1% of net sales in 2016. The increase in SG&A expenses

for 2017 was primarily due to the increase in net sales

Realignment costs (80) (80) noted above, a fourth quarter of 2017 $5.0 million charitable

Impairment charge — (30) donation and a second quarter of 2017 $2.5 million equity-

EMG (80) (110) based compensation charge related to the accelerated

vesting of restricted stock grants in association with the

Realignment costs (40) (60) retirement of the Company’s Executive Chairman of the

Impairment charge — (40) Board of Directors. For 2016, SG&A expenses included

Total impacting segment operating margins (40) (100) $1.6 million of realignment costs noted above.

Consolidated operating income was $915.1 million or 21.3%

The expected annualized cash savings from the 2017 of net sales for 2017, an increase of $113.2 million or 14.1%,

realignment costs is expected to be approximately compared with $801.9 million or 20.9% of net sales in 2016.

$5 million and is expected to be fully realized in 2019.

17