Page 23 - 2017 AMETEK Annual Report (Interactive) Updated mobile

P. 23

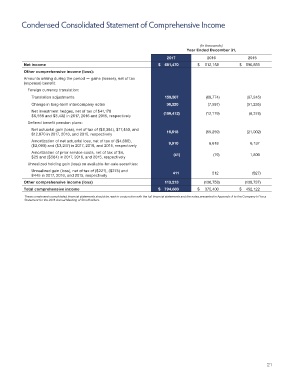

Condensed Consolidated Statement of Comprehensive Income

(In thousands)

Year Ended December 31,

2017 2016 2015

Net income $ 681,470 $ 512,158 $ 590,859

Other comprehensive income (loss):

Amounts arising during the period — gains (losses), net of tax

(expense) benefit:

Foreign currency translation:

Translation adjustments 159,507 (68,774) (67,245)

Change in long-term intercompany notes 36,320 (7,597) (51,235)

Net investment hedges, net of tax of $41,178 (109,412) (12,179) (6,374)

$6,558 and $3,432 in 2017, 2016 and 2015, respectively

Defined benefit pension plans:

Net actuarial gain (loss), net of tax of ($8,384), $17,450, and 16,518 (55,259) (21,002)

$12,870 in 2017, 2016, and 2015, respectively

Amortization of net actuarial loss, net of tax of ($4,680), 9,910 6,618 6,137

($2,090) and ($3,247) in 2017, 2016, and 2015, respectively

Amortization of prior service costs, net of tax of $4, (41)

$25 and ($564) in 2017, 2016, and 2015, respectively (79) 1,809

Unrealized holding gain (loss) on available-for-sale securities:

Unrealized gain (loss), net of tax of ($221), ($275) and 411 512 (827)

$445 in 2017, 2016, and 2015, respectively

Other comprehensive income (loss) 113,213 (136,758) (138,737)

Total comprehensive income $ 794,683 $ 375,400 $ 452,122

These condensed consolidated financial statements should be read in conjunction with the full financial statements and the notes presented in Appendix A to the Company’s Proxy

Statement for the 2018 Annual Meeting of Stockholders.

21