Letter To Shareholders

To Our Shareholders,

During the most severe economic crisis since the Great Depression, Comerica remained focused on executing its strategy and delivering outstanding customer service. Indeed, we are staying on course throughout this economic cycle, making the adjustments needed to help ensure our future success.

We are guided by a vision to help businesses and individuals be successful, and by a strong commitment to the core values* which serve as our organization’s compass. As a result, we have not lost our way or our principles.

The way forward is paved by the careful, yet confident manner in which we have navigated the most challenging economic environment in modern history. This letter provides an overview of the concerted efforts we have taken to position our company for growth and the economic recovery ahead. It also includes some of our more notable 2009 achievements.

Comerica’s common stock rose 49 percent in 2009, outperforming all of our peers. We were the #1 performer in the 24-bank Keefe Bank Index (BKX). Our stock price performance also ranked #149 among S&P 500 companies

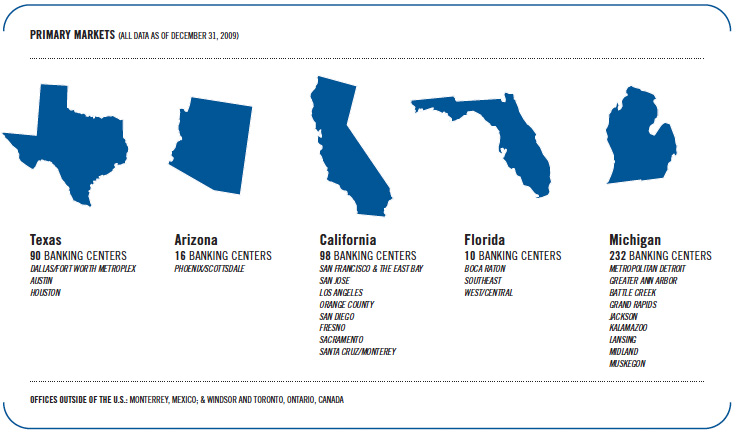

Our Primary Markets

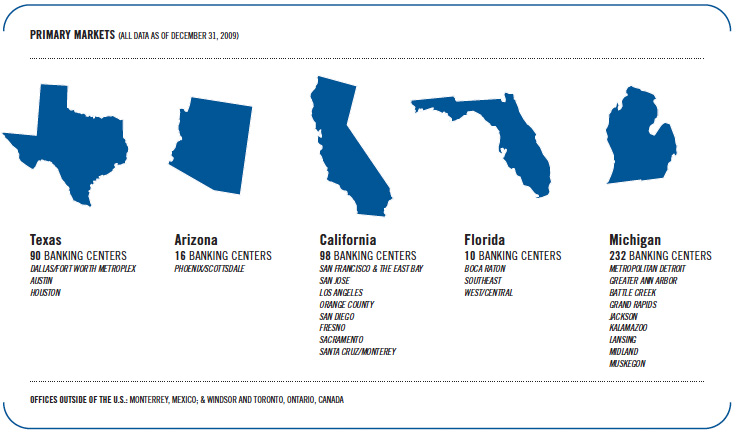

We are among the largest "Main Street" U.S. banking companies, based on assets of $59.2 billion at year-end 2009. Comerica was founded in 1849 in Michigan. We have had a presence in Texas for more than 20 years, in California for nearly 20 years, in Florida for some 30 years, and in Arizona for more than eight years.

We believe we are ideally positioned in our markets to develop new relationships, and expand existing ones, as economic conditions continue to improve.

Based on projections from the U.S. Census Bureau, California, Arizona, Texas and Florida are expected to account for over half of the U.S. population growth between 2000 and 2030. Population growth helps drive the economy, which should bode well for these states and for Comerica going forward.

While the Texas economy contracted somewhat in 2009, it continued to outperform the national economy. Texas had a shorter and shallower recession than most other states. It is less burdened than most by an overhang of unsold houses and the economy is well diversified. In fact, there are more

Fortune 500 companies headquartered in Texas than any other state. We have cultivated relationships with well over half of them and that number continues to grow.

We continue to leverage our standing as the largest banking company headquartered in Texas, as evidenced by the nearly 16 percent growth in average deposits in the state since 2007. We have strengthened our workforce in the Texas market to prepare for future growth in the state, which is the fastest growing by population in the country.

Within our Western market, predominantly California and also Arizona, we have added 74 banking centers and a corresponding $2.3 billion in deposits since 2004.

The California economy has shown signs of strengthening in 2009, with stability in home prices and increasing home sales. In September, our chief economist, Dana Johnson, unveiled a new monthly economic index to track current trends in the California economy. Comerica’s California Economic Activity Index has shown broad-based economic improvement in the state, with the exception of employment. With the national economy now in a modest expansion, it is expected that employment in California will start trending higher over the course of 2010.

As in Texas, we are seeing more middle market and small businesses taking steps to position their companies for the recovery ahead. We are assisting them in preparing for the future, as we have the resources and capacity in place to help them grow. We are appropriately positioned to increase our market share in California as the state economy continues to improve.

Michigan’s economy has been battling fierce headwinds for many years due to the deep cyclical decline in auto sales and, more recently, the restructuring of the domestic automobile industry. We have worked closely with our Michigan customers to help them through these difficult times.

There are strong indications that auto sales may be recovering. Stabilization of the Michigan economy may come gradually, but we are well positioned for the turnaround. Our 160-year presence in the state serves as a constant reminder to customers that we are a bank they can count on through all economic cycles. We also are the deposit market share leader in Michigan, based on Federal Deposit Insurance Corporation (FDIC) data as of June 30, 2009. The ranking is a reflection of the hard work of our dedicated colleagues and the trust we have earned from our customers in the state.

You can find a snapshot of our primary markets below.

Our Financial Performance

For the full-year 2009, we reported net income of $17 million and a net loss attributable to common shares of $118 million, or $0.79 per share. Included in the net loss attributable to common shares were preferred stock dividends to the U.S. Treasury Department of $134 million.

The disappointing financial results were, in large part, attributable to a $1.1 billion provision for loan losses, a $396 million increase from 2008. Nearly one-third of the 2009 provision was from our Commercial Real Estate line of business. About 15 percent of the 2009 Commercial Real Estate provision was related to our California local residential real estate portfolio. This portfolio focused on local, smaller residential developers, which built starter and first-time move-up homes. We have reduced the portfolio by 76 percent since 2007, and have not added any new business in this segment in a number of years.

Like the industry as a whole, we saw weak loan demand across our geographic markets in 2009. This mirrored the sharp slowdown in commercial and industrial loan growth that was evident in all 10 post-World War II recessions. Overall, business customers in 2009 had lower sales volumes, which resulted in lower financing requirements. Also, they continued to decrease inventory levels as they cautiously managed their businesses in a weak environment. Consumers, likewise, remained cautious in 2009.

We continued to look for opportunities in 2009, obtaining over $37 billion in new and renewed loan commitments, with a focus on developing and expanding relationship customers.

We expect loan demand will continue to be subdued in early 2010, as historically it has taken several quarters after a recession has ended for loan demand to return. We are positioned to expand lending as the economy expands, and businesses expand their inventories and sales volumes.

We had very strong customer deposit generation in 2009, with average core deposits increasing $973 million.

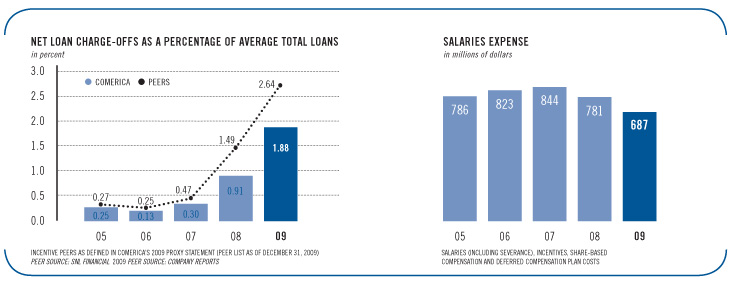

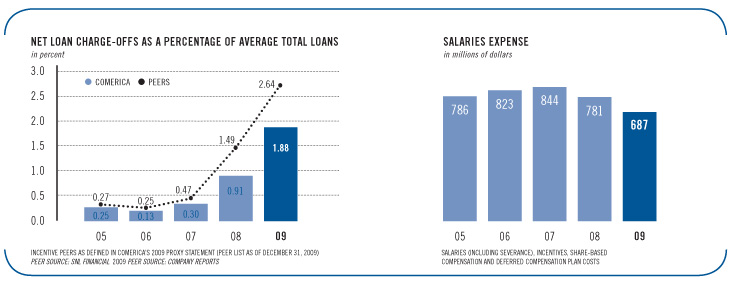

We continue to adhere to our underwriting policies and principles. We worked hard in 2009 to quickly and proactively identify problem loans. As has been our practice for many years, we conduct quarterly in-depth reviews of our watch list loans, and build our reserves credit by credit. We did not loosen our credit standards at the peak of the cycle. The results can be seen in the strong performance relative to our peers (see left chart below).

Our net interest margin came under pressure in 2009 from our asset-sensitive balance sheet as loans re-priced much faster than deposits in a declining rate environment. We believe that the net interest margin will improve in 2010 and that our balance sheet is well positioned for a rising interest rate environment.

We maintain a strong focus on expense management. This was especially evident in 2009, as noninterest expenses decreased 6 percent from a year earlier. Our largest expense item is salaries, so management of staff levels is key (see the right chart below).

Full-time equivalent staff decreased by 8 percent from 2008, even as we added 10 new banking centers in 2009.

At the end of 2009, we began to see some encouraging signs, including improved credit metrics, continued strong deposit growth, a slower pace of decline in loan demand, and a notable increase in the net interest margin. These positive developments lead us to believe our core fundamentals will continue to show improvement in 2010.

Our Balance Sheet Strength

Our strong liquidity and capital levels have assisted us in weathering the difficult economic environment. Our Tier 1 capital ratio was 12.46 percent at December 31, 2009. The quality of our capital continues to be solid, with a tangible common equity ratio of 7.99 percent, which remains among the highest in our peer group.

Given our strong capital position, I am often asked when Comerica will end its participation in the U.S. Treasury Department’s Capital Purchase Program. As you will recall, in November 2008 we issued $2.25 billion in preferred stock and a related warrant to the Treasury Department.

A top corporate priority for us is to redeem the preferred stock at such time as is feasible, with careful consideration given to the economic environment.

Late in 2009, Comerica elected to continue to participate in the FDIC Transaction Account Guarantee Program. Doing so provides Comerica customers with a full guarantee, without any dollar limitation, on funds held in all of Comerica’s noninterest- bearing transaction accounts through June 30, 2010.

Our Three Strategic Lines of Business

Comerica is a relationship-based "Main Street" bank. We are not a complex, transaction-oriented "Wall Street" bank. We have stayed close to our customers through the ups and downs of the economy. Our strong relationship focus sets us apart from the competition. It’s about getting to know our customers and their businesses, and offering them the solutions that meet their distinct financial needs.

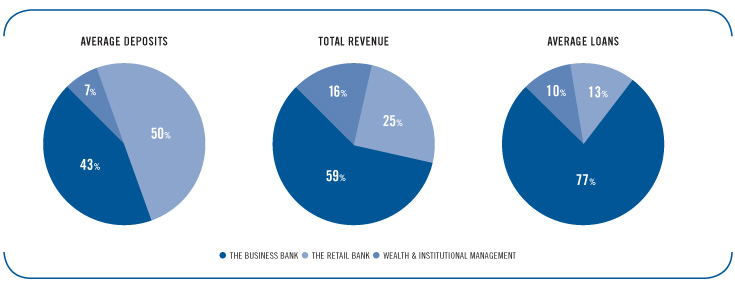

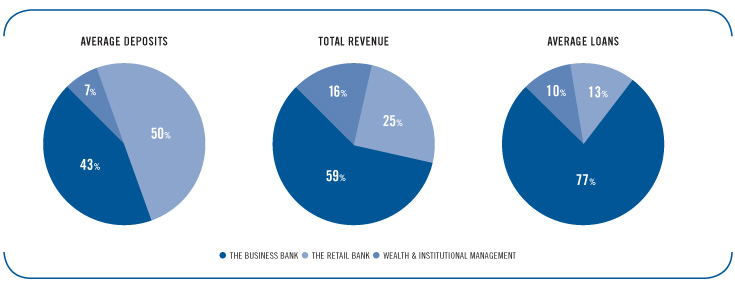

We have three strategic lines of business: the Business Bank, the Retail Bank, and Wealth & Institutional Management.

Our Business Bank provides companies with an array of credit and non-credit financial products and services. We are among this nation’s top commercial lenders.

In 2009, our Business Bank again demonstrated its expertise in forming strong relationships with corporate customers. Experienced and seasoned staff helped our customers navigate a difficult economic terrain.

For example, relationship managers

helped find solutions for their customers’ credit needs when the State of California resorted to issuing warrants in lieu of payments during the state’s budget crisis. Our middle market banking group in Michigan successfully managed difficult situations faced by customers, including auto suppliers looking to wind down, sell operations or re-tool for the future. In Texas, our corporate banking team leveraged its knowledge and experience working with clients and prospects in the cyclical energy and heavy equipment industries.

With our technologically advanced treasury management and international trade services products, we provided companies with customized solutions that produced bottom-line results. In addition, our government electronic solutions group continued to support

the U.S. Treasury Department’s DirectExpress

® Debit MasterCard

®, a prepaid debit card for Social Security and Supplemental Security Income recipients. There are now nearly one million DirectExpress

® cardholders throughout the U.S. We also rolled

out our healthcare receivables automation solution for healthcare providers, assisting them in reducing costs and going electronic.

Our Retail Bank delivers personalized financial products and services to consumers, entrepreneurs and small businesses, and represents a key component of our deposit gathering strategy.

As consumers strived to save more in an uncertain economy, Comerica’s professional and dedicated retail bankers provided our customers with the information and tools they need to manage their money effectively now and for the future.

In 2009, our Retail Bank spearheaded the opening of a total of 10 new banking centers in Texas, California and Arizona. In addition, five banking centers were relocated in Texas, California and Michigan, helping ensure their optimum visibility and performance.

We enhanced our focus on new checking account relationships in 2009. For example, the average new checking account balance grew by more than 15 percent.

We also continued to leverage strategic partnerships to improve productivity, create scale and deliver a breadth of products to our Retail Bank customers.

Another notable success within our Retail Bank was our fall sales promotion, which we called the Comerica Small Business Sensible Stimulus Package. Small Business customers earned cash when they signed up for certain products and services aimed at improving their cash flows and managing their inventories in a challenging economic environment. This and other sales-focused campaigns in our Retail Bank helped increase transaction deposit balances and deepen customer relationships.

Our Wealth & Institutional Management division serves the needs of affluent clients, foundations and corporations, and represents a significant growth opportunity for us. We continue to leverage our existing customer base by bringing wealth management solutions to our Business Bank and Retail Bank customers. In addition, our strong wealth management capabilities, especially in terms of banking, trust and asset management, have allowed us to grow our organization though new customer acquisition.

In 2009, in partnership with our Retail Bank, our Wealth & Institutional Management division coordinated the licensing of certain banking center personnel to become securities licensed financial specialists. Doing so provides for an enhanced customer experience while expanding delivery of wealth management solutions to banking center clients.

In order to provide greater efficiencies, align our product offerings and improve our overall customer experience, we reorganized several divisions within Wealth & Institutional Management in 2009. The leadership of our personal

and institutional trust divisions was combined into one Comerica Trust Company. In addition, the leadership of our asset management divisions, including Wilson, Kemp & Associates, World Asset Management, Inc. and Comerica Asset Management, was combined into one Comerica Asset Management organization.

The charts below provide a quick look at the 2009 performance of our Business Bank, Retail Bank, and Wealth & Institutional Management segments.

Our Commitments to Community, Financial Literacy, Diversity and Sustainability

In 2009, Comerica further strengthened its commitments to community, financial literacy, diversity and sustainability.

In a difficult economy, Comerica provided more than $9 million to not-for-profit organizations nationwide. Our employees once again supported United Way agencies in our markets, raising more than $2.2 million for the United Way and Black United Fund. Our colleagues also donated their time and talents through their volunteerism, with nearly 54,000 volunteer hours recorded in 2009.

In 2009, Comerica was able to reach thousands of individuals, including those of low and moderate incomes, through a number of financial literacy programs. These initiatives included in-school savings programs, as well as general training on

the basics of banking, budgeting, retirement planning, credit management and entrepreneurship. For example, third-grade students in need of financial assistance in Dallas and Austin received school supplies before attending their first day of class in September. Parents and their children shopped and purchased school supplies with play "Comerica dollars" at events designed to teach students about money management.

We see diversity as a core value and a key business driver. We recognize the importance of reaching out to, and building relationships with, diverse communities. Comerica has 16 diversity business outreach teams focused on attracting and strengthening sustainable customer relationships within diverse markets. We know that by successfully serving the financial needs of these diverse markets, we contribute to the success of our customers, communities and Comerica.

Our comprehensive approach to diversity is recognized nationally.

DiversityInc magazine ranked Comerica #30 on its "2009 Top 50 Companies for Diversity" list, and #5 on its "2009 Top 10 Companies for Supplier Diversity" list.

Hispanic Business magazine ranked Comerica #5 on its "2009 Diversity Elite 60" list.

Black Enterprise magazine placed Comerica on its 2009 "40 Best Companies for Diversity" list. Finally,

Latina Style magazine has placed Comerica #23 on its "Latina Style 50" list, which identifies American corporations that are providing the best career opportunities for Latinas. We certainly appreciate all of the recognition.

We continued to make solid progress on our corporate sustainability initiatives in 2009.

Comerica was ranked #1 among S&P 500 companies for the quality of its 2009 response to the Carbon Disclosure Project’s (CDP) annual survey. For the second year in a row, Comerica was named to the CDP’s Carbon Disclosure Leadership Index, which rates firms according to the level and quality of their disclosure and reporting on greenhouse gas emissions and climate change strategy data. Comerica’s Index score of

91 was #1 in the Financials sector and #1 overall among S&P 500 companies.

We published our Inaugural Sustainability Report in September 2009. The report, available on our Web site at

www.comerica.com, was based on the Global Reporting Initiative framework, and included a wealth of information on Comerica’s sustainability programs and performance.

We opened several new banking centers in 2009 which were constructed according to a new prototype designed to achieve Leadership in Energy & Environmental Design (LEED) certification from the U.S. Green Building Council. The Fossil Creek banking center in Fort Worth, Texas received its LEED certification in May 2009.

Looking Ahead

We will continue to make the prudent adjustments necessary to position our company for growth in the years ahead. In doing so, we will stay true to the values and principles which have guided us through one of the most tumultuous economic periods in our nation’s history.

We are in the right markets, and have the right people, to deliver the quality products and services that are our hallmark. Our experienced relationship managers know and understand our customers, providing us with a winning strategy for future success that is based on skill.

Our solid capital will continue to position us well for future growth. It also will enable us to pursue additional opportunities to expand new and existing relationships, and make further investments in our growth markets.

Sincerely,

Ralph W. Babb Jr.

Chairman and Chief Executive Officer

We are guided by a vision to help businesses and individuals be successful, and by a strong commitment to the core values* which serve as our organization’s compass. As a result, we have not lost our way or our principles.

We are guided by a vision to help businesses and individuals be successful, and by a strong commitment to the core values* which serve as our organization’s compass. As a result, we have not lost our way or our principles.

As in Texas, we are seeing more middle market and small businesses taking steps to position their companies for the recovery ahead. We are assisting them in preparing for the future, as we have the resources and capacity in place to help them grow. We are appropriately positioned to increase our market share in California as the state economy continues to improve.

As in Texas, we are seeing more middle market and small businesses taking steps to position their companies for the recovery ahead. We are assisting them in preparing for the future, as we have the resources and capacity in place to help them grow. We are appropriately positioned to increase our market share in California as the state economy continues to improve.

We see diversity as a core value and a key business driver. We recognize the importance of reaching out to, and building relationships with, diverse communities. Comerica has 16 diversity business outreach teams focused on attracting and strengthening sustainable customer relationships within diverse markets. We know that by successfully serving the financial needs of these diverse markets, we contribute to the success of our customers, communities and Comerica.

We see diversity as a core value and a key business driver. We recognize the importance of reaching out to, and building relationships with, diverse communities. Comerica has 16 diversity business outreach teams focused on attracting and strengthening sustainable customer relationships within diverse markets. We know that by successfully serving the financial needs of these diverse markets, we contribute to the success of our customers, communities and Comerica.