Fellow Shareholders:

U.S. Bancorp has created momentum by remaining disciplined with our business strategy and investing for our future

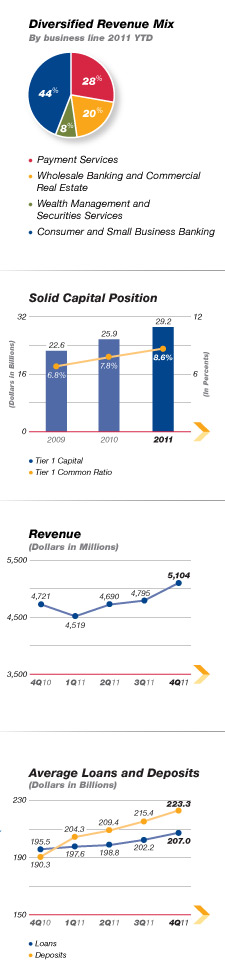

U.S. Bancorp ended 2011 on a high note, reporting both record net revenue and record net income. We experienced notable growth in deposits, loans and commitments year-over-year, and credit quality continued to improve. Our capital position remains very strong as we continued to generate significant capital each quarter through solid and predictable earnings. Indeed, 2011 marked another year of robust and sustainable financial performance — at the very top of our peer group — and we achieved these results despite a very challenging and uncertain economic and regulatory environment. We begin 2012 as a stronger company than we were just one year ago.

U.S. Bancorp has differentiated itself from the peer banks throughout the economic downturn, validating our franchise strengths, including our remarkable employees, our focus on customer satisfaction, the company policies of prudent risk controls, the management and use of our shareholders’ capital and our disciplined, efficient operations. These results have made us the beneficiary of a continuing flight to quality, as customers — as well as employees, prospects and investors — seek out U.S. Bancorp as a very solid company in which to place their financial trust.

While we are pleased with our financial results, we also recognize that our nation’s economy is still in the midst of a very slow recovery. Yes, there are clear areas of improvement, but some of our regions and customers are still struggling and, despite some improvement, the unemployment level is still too high and the housing market is still without direction. We expect to remain steadfast in working through these challenges with our customers and our communities — for our collective and future success.

Contextual information is often as enlightening as the financial data. Therefore, on the pages following this letter, we tell you more about our strategies and accomplishments, new products and services and some examples of how we work with our customers. We will focus on our continuing momentum and showcase our talented employee leaders.

Unsettled regulatory and legislative climate continues

The myriad rules, regulations, legislation and government scrutiny following the economic downturn represent efforts by the Administration, the regulators and the Congress to strengthen the financial services industry and prevent another crisis for our industry and for our country. These efforts are being repeated on a global scale which create a “trebling effect”, making it more challenging to determine the “new normal” for banking rules and policies in the future. This new paradigm also requires us to spend increasingly more time, personnel and resources managing the regulatory oversight process, adding significantly to our cost of doing business. That being said, U.S. Bancorp has set in place a structure to manage and monitor the regulatory environment and to develop and deliver a comprehensive, corporate-wide roadmap that ensures that our company effectively meets all regulatory requirements. Of primary importance is the Dodd-Frank act, a 2,300-plus page legal mandate with 1,500 provisions, 16 titles and hundreds of anticipated rules that affect many of our business lines and, inevitably, our customers.

While current regulatory reform in our industry is nothing less than transformational, our management team and Board of Directors foresee opportunities to make strategic moves to effectively position U.S. Bank in a new regulatory environment as an advantaged competitor. We also see an emerging role for U.S. Bancorp as an industry leader with a strong, measured and thoughtful voice to help rebuild the reputation of the banking industry which, along with its more than 2.4 million employees, serves our country.

Growing markets and businesses through acquisitions

In the past year, we have made a number of strategic bank and non-bank acquisitions. All have opened new markets to us, strengthened existing markets and/or built additional scale in profitable business lines. It is the strategy that we have followed for the past several years — and it has worked well. Corporate trust businesses, payments capabilities and card portfolios are high on our list, as well as smaller bank asset purchases. We have demonstrated that we can acquire and integrate acquisitions efficiently, smoothly and without disruption to our continuing organic momentum.

Over the past year, U.S. Bancorp has taken strategic advantage of two FDIC-assisted bank acquisitions. Our purchases have been low-risk transactions: well-priced banks in growth markets that help us get closer to achieving our goals of being in the top three in market share in targeted, growing markets. In January of 2011, we acquired the banking operations of First Community Bank of Albuquerque, New Mexico from the FDIC, adding the 25th state to our branch footprint. In January 2012, we agreed to buy the $272 million-asset BankEast in Knoxville, Tennessee, further strengthening our footprint in the attractive Tennessee market. In total, we have acquired approximately $37 billion in assets in six FDIC-assisted transactions during the downturn.

We also announced several payment and trust-related acquisitions during the past year, including a portfolio of approximately $700 million of credit card assets, the institutional trust business of Union Bank, a unit of UnionBanCal Corporation of San Francisco and the Indiana corporate trust business of UMB Bank N.A. All will allow us to continue to gain scale in these businesses, and we expect to see additional opportunities in payments and corporate trust in the coming years. In all, U.S. Bancorp has acquired more than $3.2 billion in card assets and $1.1 trillion in trust assets under administration during the downturn.

As we have noted many times before, we won’t miss a compelling opportunity, but we will not put our future growth and shareholders’ capital in harm’s way simply to become a bigger bank.

Welcome our newest U.S. Bancorp directors

We are delighted to welcome Doreen Woo Ho and Roland Hernandez to our Board. Doreen’s extensive commercial and consumer banking background, along with her first-hand experience in the California banking market, will be an excellent asset to our company. Roland’s broad retail consumer insights and extensive corporate governance experience will make him a great addition to U.S. Bancorp’s Board of Directors.

Doreen is President of the San Francisco Port Commission, the governing board responsible for the San Francisco, California, waterfront. She also served more than 35 years in the banking industry. Roland is the Founding Principal and Chief Executive Officer of Hernandez Media Ventures, a company engaged in the acquisition and management of media assets. He also served as Chairman, President and Chief Executive Officer of Telemundo Group, Inc., a Spanish-language television and entertainment company.

Rewarding our shareholders

Returning capital to shareholders in the form of dividends and buybacks is of the utmost importance to our company, and raising the dividend continues to be the top priority for me, our management team and our Board of Directors. Our strong capital levels, liquidity and ongoing profitability are key to our ability to return capital. In fact, we have already reached the capital level we believe we need to achieve to satisfy Basel III regulatory requirements — levels that will not be required until 2019. Going forward, coupled with regulator approval, this gives us the added flexibility to invest in our business and return excess capital — rewarding our shareholders through higher dividends and share buybacks. We have submitted our request to the regulators for increases in both our dividend and share buyback program and should receive their response by mid-March.

Prospects for the future

Despite the continuing economic uncertainty here and in Europe, this management team, Board of Directors and 63,000 highly engaged U.S. Bancorp employees join me in looking to the future of this company with confidence. U.S. Bancorp has been resilient and successful throughout an historic economic downturn; our diverse business mix, sound strategies and prudent business model — as well as our determination to “do the right thing” — put us in an excellent position for the years ahead.

Sincerely,

Richard K. Davis

Chairman, President and Chief Executive Officer

February 23, 2012