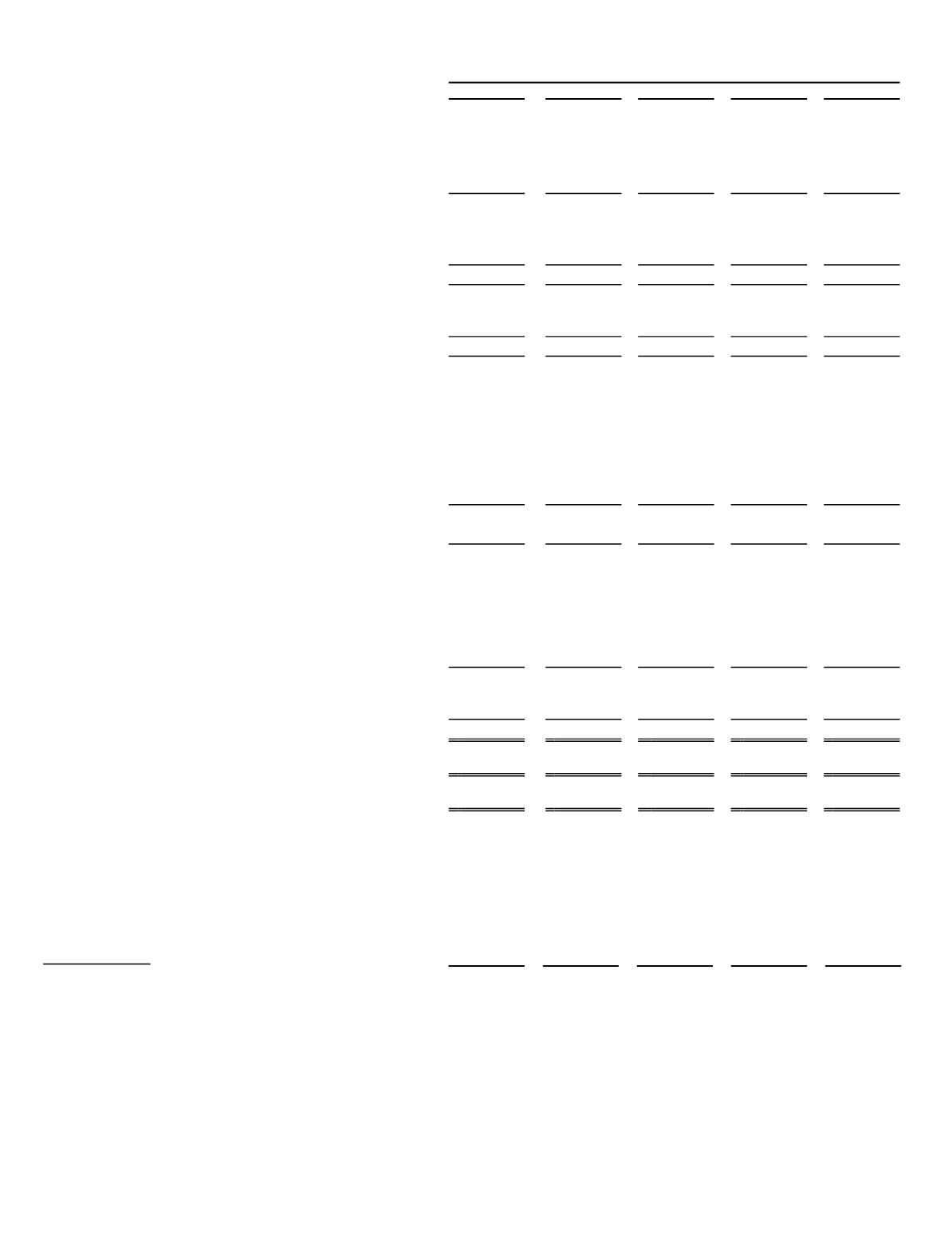

28

Year Ended December 31,

2013

2012

2011

2010

2009

(in millions, except share and per share data)

Statement of Operations Data:

Revenue

Services ........................................................................ $

281.4 $

305.1 $

303.9 $

262.3 $

151.9

Systems.........................................................................

80.9

182.3

121.5

126.5

148.2

Total revenue ......................................................

362.3

487.4

425.4

388.8

300.1

Direct cost of services revenue .....................................

156.3

178.3

171.0

152.2

84.1

Direct cost of systems revenue .....................................

67.0

148.9

103.2

98.6

102.1

Total direct cost of revenue .......................

223.3

327.2

274.2

250.8

186.2

Services gross profit .....................................................

125.1

126.8

132.9

110.1

67.8

Systems gross profit .....................................................

13.9

33.4

18.3

27.9

46.1

Total gross profit .......................................

139.0

160.2

151.2

138.0

113.9

Research and development expense .............................

34.3

36.6

37.1

30.1

22.3

Sales and marketing expense ........................................

28.5

30.7

29.4

23.9

16.0

General and administrative expense .............................

54.7

54.3

46.2

37.2

35.4

Depreciation and amortization of property and

equipment ................................................................

14.8

14.2

12.1

9.7

6.0

Amortization of goodwill and other intangible assets ..

4.6

4.4

5.5

4.7

0.9

Impairment of goodwill and long-lived assets..............

32.0

125.7

—

—

—

Total operating costs and expenses ...........

168.9

265.9

130.3

105.6

80.6

Patent related gains, net of expenses...................

—

—

—

—

15.7

Income (loss) from operations ...............................................

(29.9)

(105.7)

20.9

32.4

49.0

Interest expense......................................................................

(8.2)

(7.4)

(7.3)

(9.2)

(1.8)

Amortization of deferred financing fees ................................

(3.4)

(0.8)

(0.8)

(0.8)

(0.4)

Gain (loss) on early retirement of debt...................................

(0.2)

0.4

—

—

—

Other income (expense), net ..................................................

(0.3)

—

(0.4)

1.6

0.3

Income (loss) before income taxes.........................................

(42.0)

(113.5)

12.4

24.0

47.1

Benefit (provision) for income taxes......................................

(16.6)

15.5

(5.4)

(8.1)

(18.8)

Net income (loss) ................................................................... $

(58.6) $

(98.0) $

7.0 $

15.9 $

28.3

Net income (loss) per share — basic...................................... $

(1.00) $

(1.69) $

0.12 $

0.30 $

0.59

Net income (loss) per share — diluted

1

.................................. $

(1.00) $

(1.69) $

0.12 $

0.28 $

0.53

Basic shares used in computation (in thousands) ...................

58,611

57,889

56,722

53,008

47,623

Diluted shares used in computation (in thousands)................

58,611

57,889

58,581

56,032

53,946

1

Shares issuable via the convertible notes are included if diluted, in which case tax-effected interest expense on the debt is excluded

from the determination of Net income (loss) per share – diluted, see Note 3 presented in the Notes to Consolidated Financial

Statements.

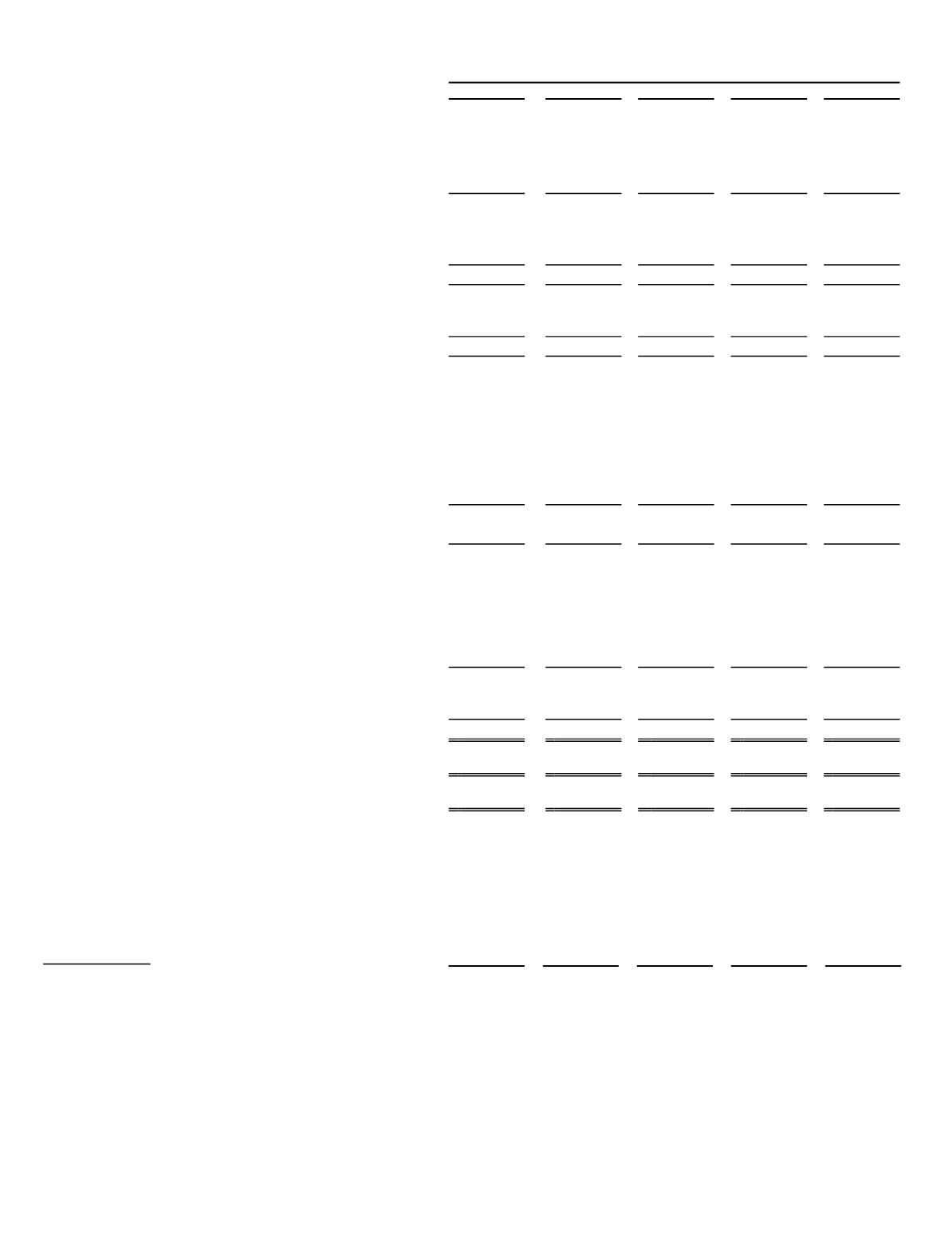

As of December 31:

2013

2012

2011

2010

2009

(in millions)

Balance Sheet Data:

Cash and cash equivalents...................................................... $

41.9 $

36.6 $

40.9 $

45.2 $

61.4

Working capital......................................................................

55.2

82.6

87.0

89.6

77.7

Total assets.............................................................................

321.5

413.7

489.6

462.8

472.2

Capital leases and long-term debt (including current portion)

147.5

167.6

140.8

160.5

183.0

Total liabilities .......................................................................

212.2

252.6

238.9

247.3

286.4

Total stockholders’ equity......................................................

109.3

161.1

250.7

215.5

185.8