35

x

Operating expenses.

Our operating expenses are primarily compensation and benefits, professional fees, facility costs,

marketing and sales-related expenses, and travel costs as well as certain non-cash expenses such as stock based

compensation expense, depreciation and amortization of property and equipment, and amortization of acquired intangible

assets.

x

Liquidity and cash flows.

The primary driver of our cash flows is the results of our operations. Other important sources of

our liquidity are our capacity to borrow, through our bank credit and term loan facility; lease financing for the purchase of

equipment; and access to the public equity market.

x

Balance sheet.

We view cash, working capital, and accounts receivable balances and days revenue outstanding as important

indicators of our financial health.

Results of Operations

Operation of acquired businesses has been fully integrated into our existing operations. Our acquisitions did not result in our

entry into a new line of business or product category; they added products, services and technical depth with features and functionality

similar to our previous operations. The comparability of our operating results from 2012 to 2011 is affected by the July 6, 2012

acquisition of microDATA, so where changes in our 2012 results of operations from those of 2011 are clearly related to the

acquisitions, such as revenue and increases in amortization of intangibles, we quantify the effects in the discussion that follows.

Revenue, Cost of Revenue, and Gross Profit

The following discussion addresses by segment our revenue, cost of revenue, and gross profit. See discussion of segment

reporting in Note 21 to the audited Consolidated Financial Statements presented elsewhere in this Annual Report on Form 10-K.

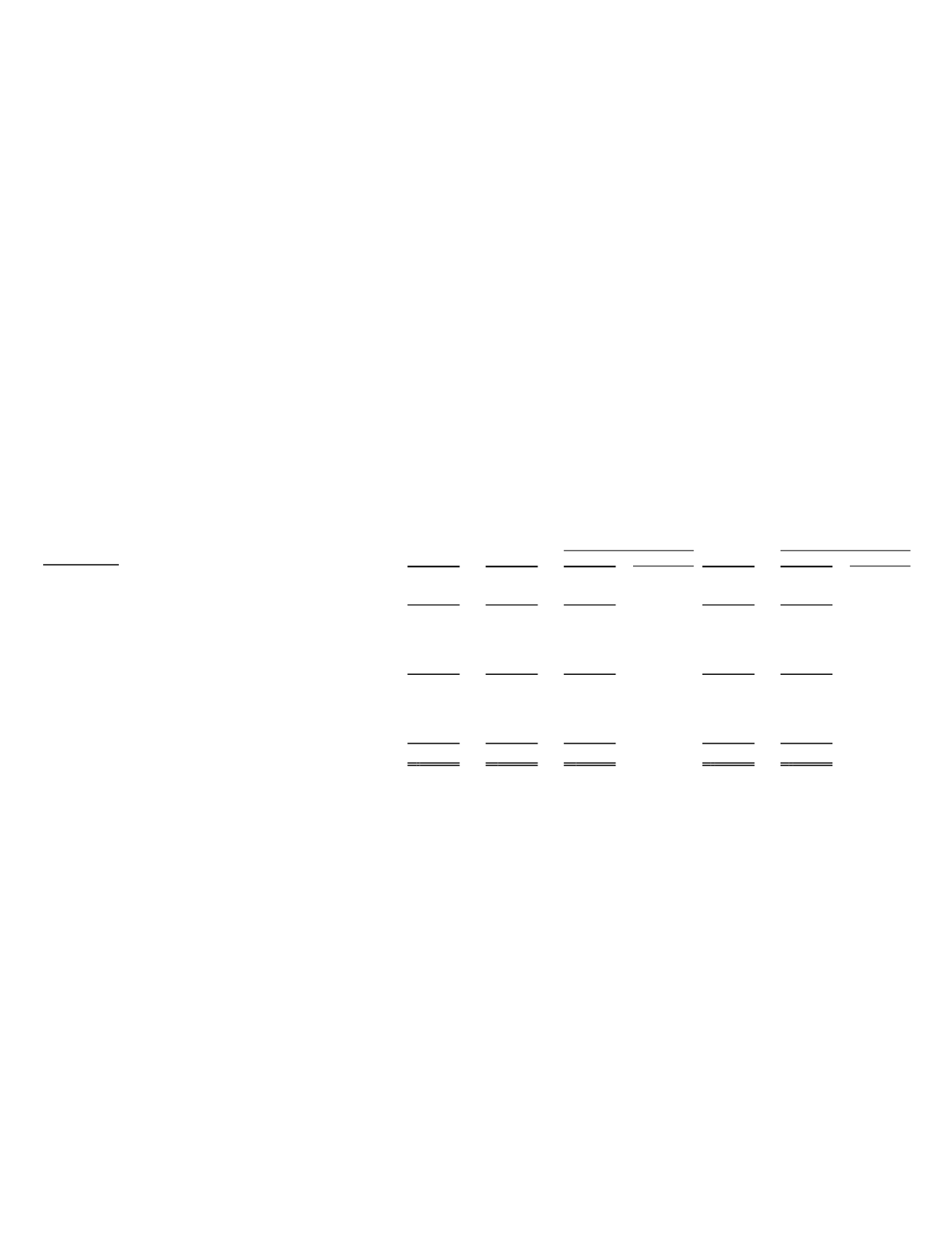

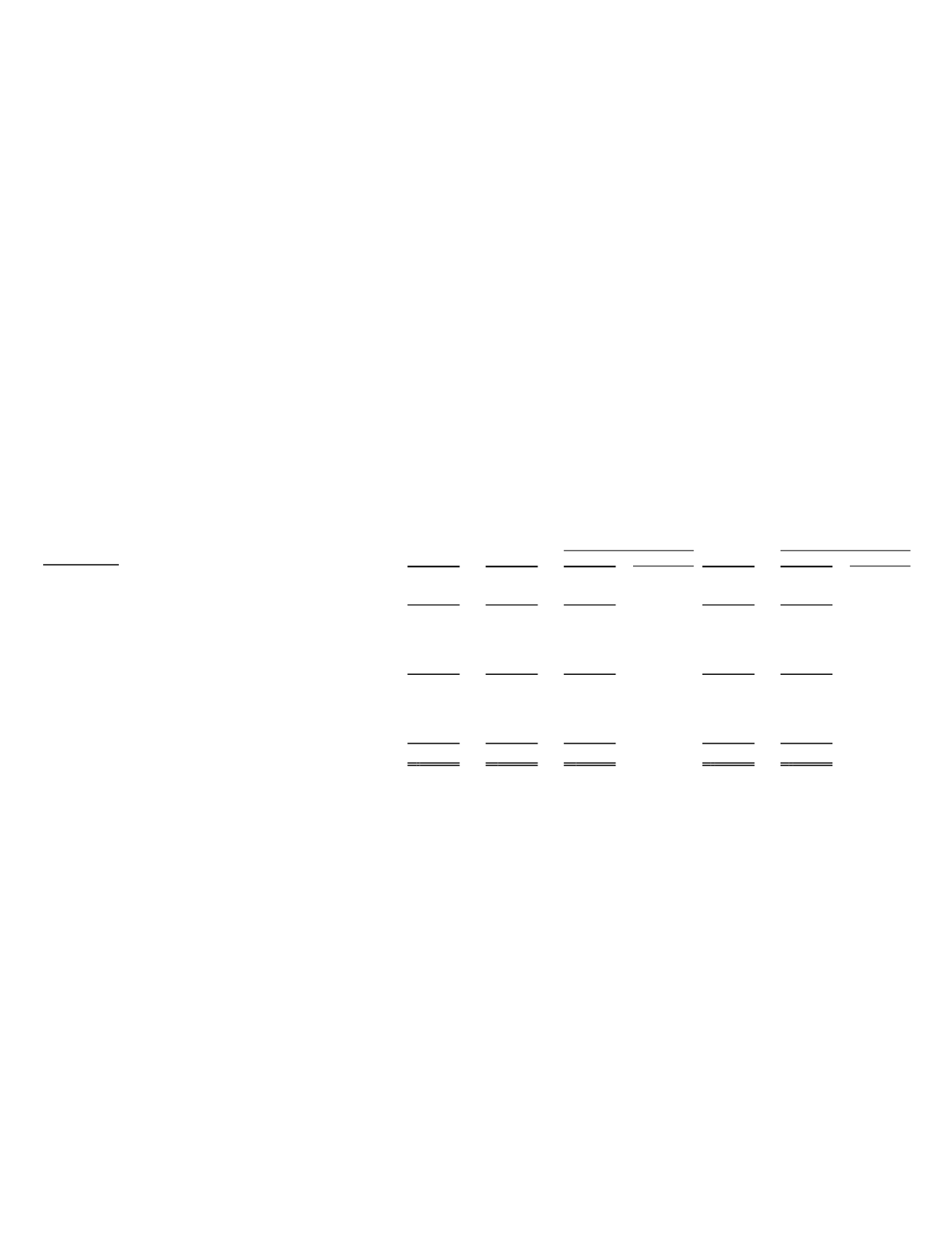

Government Segment:

2013 vs. 2012

2012 vs. 2011

($ in millions)

2013

2012

$

%

2011

$

%

Services revenue ......................................................... $ 131.1 $ 146.1 $ (15.0) (10%) $ 129.2 $ 16.9 13%

Systems revenue.......................................................... 61.1 158.6 (97.5) (61%) 105.0 53.6 51%

Total Government Segment revenue ................. 192.2 304.7 (112.5) (37%) 234.2 70.5 30%

Direct cost of services ................................................. 92.3 107.9 (15.6) (14%) 90.0 17.9 20%

Direct cost of systems ................................................. 50.4 133.7 (83.3) (62%) 89.9 43.8 49%

Total Government Segment cost of revenue...... 142.7 241.6 (98.9) (41%) 179.9 61.7 34%

Services gross profit.................................................... 38.8 38.2

0.6 2% 39.2 (1.0) (3%)

Systems gross profit .................................................... 10.7 24.9 (14.2) (57%) 15.1

9.8 65%

Total Government Segment gross profit

$ 49.5 $ 63.1 $ (13.6) (22%) $ 54.3 $ 8.8 16%

Segment gross profit as a percent of revenue

....

26%

21%

23%

The primary customers of this segment are U.S. government agencies including Department of Defense (“DoD”), domestic and

foreign space programs, and the contractors that supply products and services to government customers. TCS is a prime contractor on

several multi-year, multi-billion dollar contracts, some of which are indefinite-delivery, indefinite quantity, or IDIQ, contracts,

through which this segment generates much of its revenue. From 2006 through the first quarter of 2014 we were one of six vendors

selected by the U.S. Army to provide secure wireless communication solutions under a Worldwide Satellite Systems (“WWSS”)

contract vehicle. Since 2006, we received funded orders totaling over $700 million. We rely on funding by the U.S. government for

the programs in which we are involved. These funding levels follow the cycle of general public policy and political support for this

type of spending. Moreover, although our contracts often contemplate that our services will be performed over a period of several

years, the Executive Branch must propose and Congress must approve funds for a given program each government fiscal year and

may significantly change — increase, reduce or eliminate — funding for a program. A decrease in expenditures, the elimination or

curtailment of a material program in which we are involved, the expiration of a contracting vehicle (like the WWSS contract vehicle)

or changes in payment patterns of our customers as a result of changes in U.S. government spending, could have a material adverse

effect on our operating results, financial condition, and/or cash flows.

Government Services Revenue, Cost of Revenue, and Gross Profit:

Our government services revenue is generated from professional communications engineering and field support, cyber security

training, program management, help desk outsource, network design and management for government agencies, as well as operation

of teleport (fixed satellite ground terminal) facilities for data connectivity via satellite, including resale of satellite airtime. Systems

maintenance fees are usually collected in advance and recognized ratably over the contractual maintenance periods. Government