40

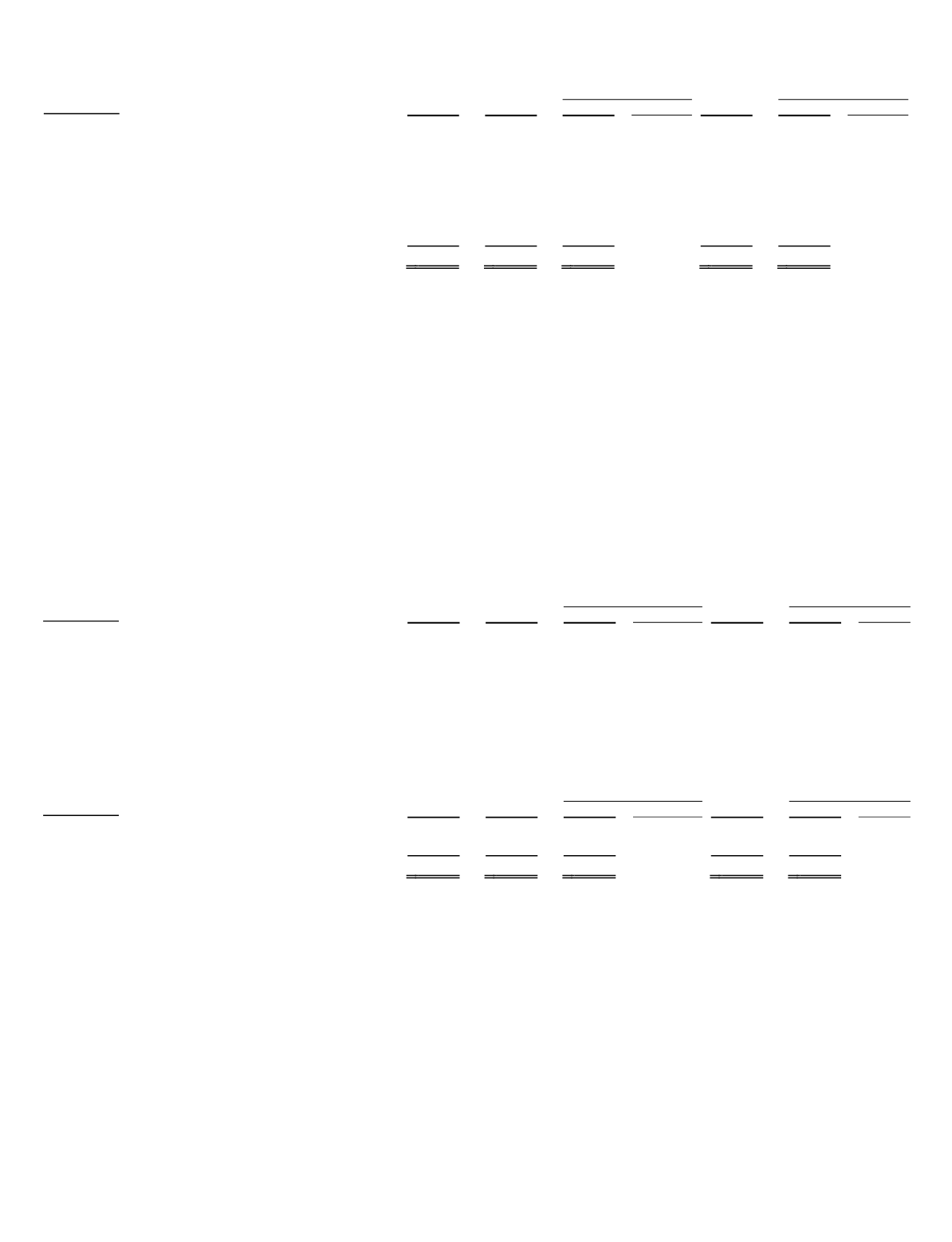

Interest and Financing Expense

2013 vs. 2012

2012 vs. 2011

($ in millions)

2013

2012

$

%

2011

$

%

Interest expense incurred on bank and other notes

payable .................................................................... $ 3.0 $ 2.1 $ 0.9 43% $ 1.9 $ 0.2 11%

Interest expense incurred on convertible notes

financing .................................................................

4.8

4.7

0.1

2%

4.7

— —

Interest expense incurred on capital lease obligations .

0.6

0.6

— —

0.9

(0.3) (33%)

Amortization of deferred financing fees ......................

3.4

0.8

2.6 325%

0.8

— —

Less: capitalized interest ..............................................

(0.1)

(0.1)

— —

(0.2)

0.1 50%

Total interest and financing expense .................. $ 11.7 $ 8.1 $ 3.6 44% $ 8.1 $

— —

Interest expense is incurred on borrowings under our bank facilities, other debt, and capital lease obligations. Financing expense

reflects amortization of deferred up-front financing expenditures at the time of contracting for financing arrangements, which are

being amortized over the term of the note or the life of the facility.

Interest and financing expenses were higher in 2013 compared to 2012 due to interest on the higher average borrowing balance

under our new Senior Credit Facility, full-year interest on the mid-2012 microDATA promissory notes, a higher interest rate on $50

million of new convertible notes due 2018 that were exchanged in the second quarter in 2013 for notes due 2014, the accelerated

amortization of deferred financing fees upon refinancing of the 2012 bank term loan, and accelerated amortization deferred financing

costs for notes retired early. Interest and financing expense was about the same in 2012 as in 2011, reflecting little change in capital

structure or rates during the period. For additional details, see Liquidity and Capital Resources discussion below.

Our capital lease obligations include interest at various stated rates averaging about 5% per annum. Our interest under capital

leases fluctuates depending on the amount of capital lease obligations in each year.

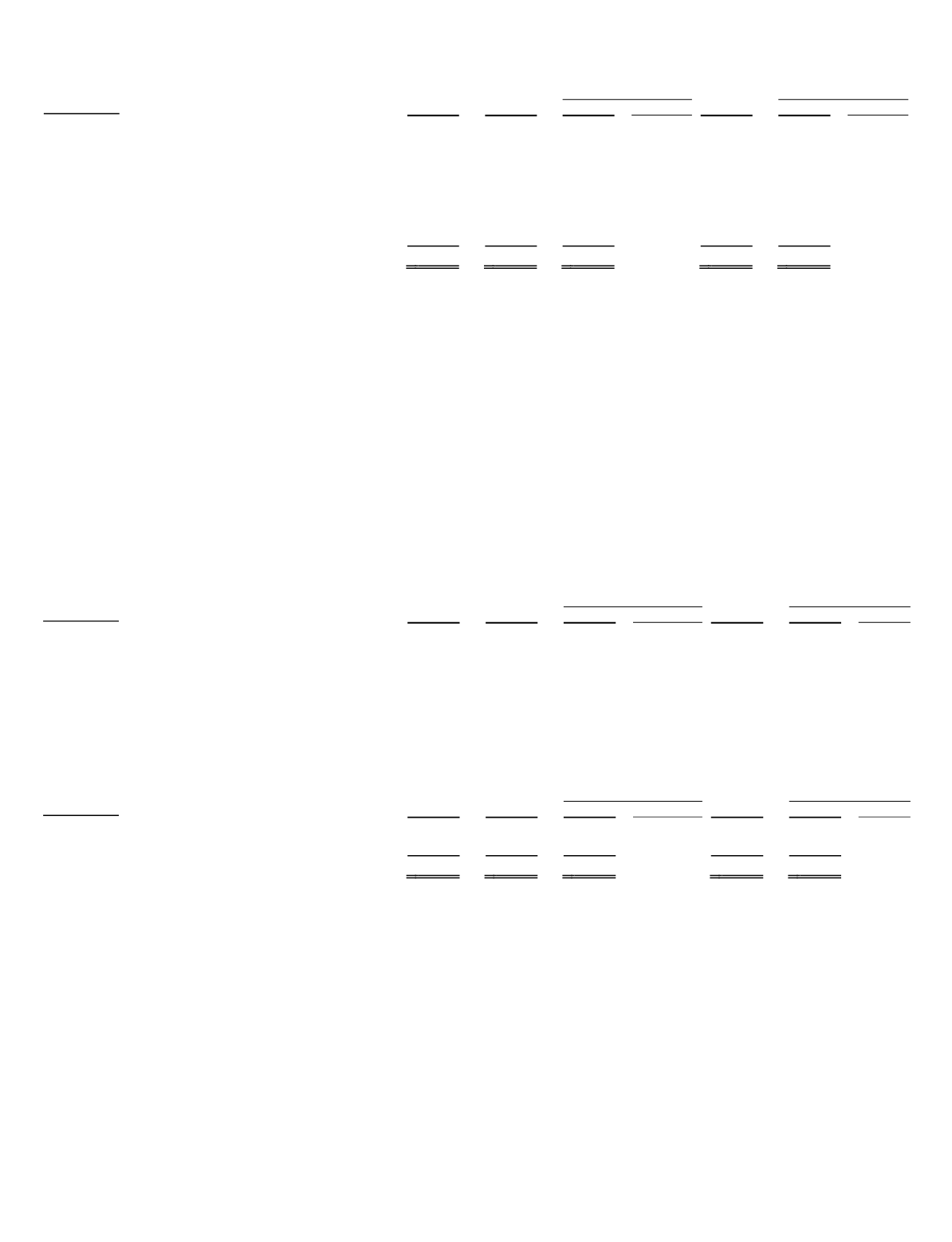

Gain (loss) on early retirement of debt

2013 vs. 2012

2012 vs. 2011

($ in millions)

2013

2012

$

%

2011

$

%

Gain (loss) on early retirement of debt........................ $ (0.2) $ 0.4 $ (0.6) (150%) $

— $

0.4 100%

During the fourth quarter of 2012, we repurchased and retired $10 million of the outstanding 4.5% Convertible Senior Notes due

in November 2014, and recorded a $0.4 million gain on retirement of debt. During 2013, we retired and repurchased an additional

$78.9 million of the outstanding Notes and recorded a loss of $0.2 million on the retirement of the debt.

Other Income (Expense), Net

2013 vs. 2012

2012 vs. 2011

($ in millions)

2013

2012

$

%

2011

$

%

Foreign currency translation/ transaction (loss) gain .. $ (0.1) $ (0.1) $

— NM

$ (0.1) $

— NM

Miscellaneous other (expense) income .......................

(0.1)

0.1

(0.2) (200%)

(0.3)

0.4 133%

Total other income (expense), net ..................... $ (0.2) $

—

(0.2) 100%

(0.4)

0.4 100%

Other income (expense), net, includes foreign currency transaction gain or loss resulting from exchange rate fluctuations,

adjustments to the estimate of payments due under acquisition earn-out arrangements, as well as interest income, realized gain or loss

on disposals of property and equipment, and realized gain or loss on marketable securities. Other income (expense), net also includes

the effects of foreign currency revaluation on our cash, receivables, and deferred revenues that are stated in currencies other than U.S

dollars.

Income Taxes

The Company accounts for income taxes in accordance with ASC 740, Accounting for Income Taxes. Deferred tax assets and

liabilities are computed based on the difference between the financial statement and income tax basis of assets and liabilities using

enacted tax rates. Upon the adoption of ASC 740 on January 1, 2007, the estimated value of the Company’s uncertain tax positions

was a liability of $2.7 million resulting from unrecognized net tax benefits which did not include interest and penalties and increased

to $4.8 million as of December 31, 2013. The Company recorded the estimated value of its uncertain tax position by reducing the

value of certain tax attributes. The Company would classify any interest and penalties accrued on any unrecognized tax benefits as a