42

Liquidity and Capital Resources

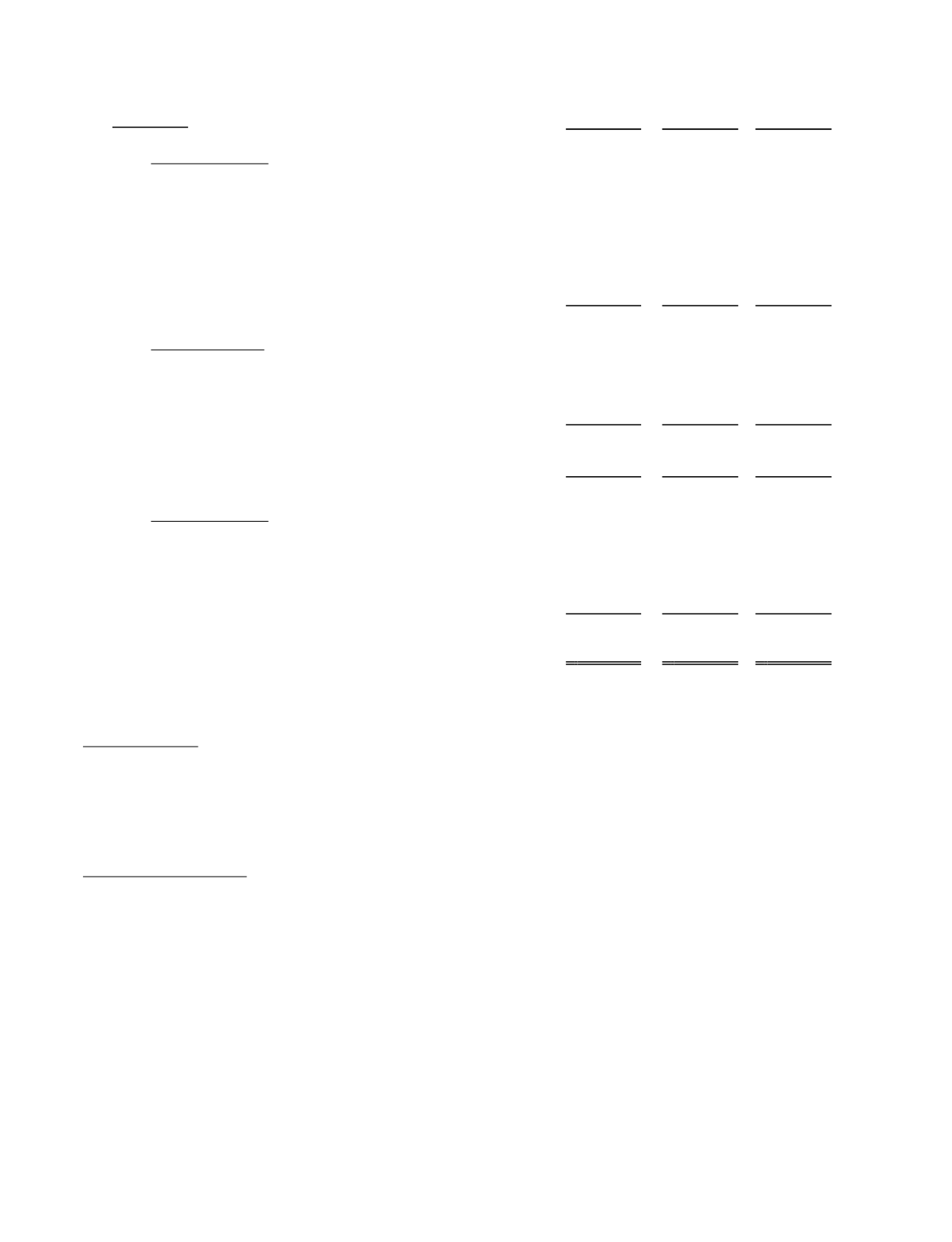

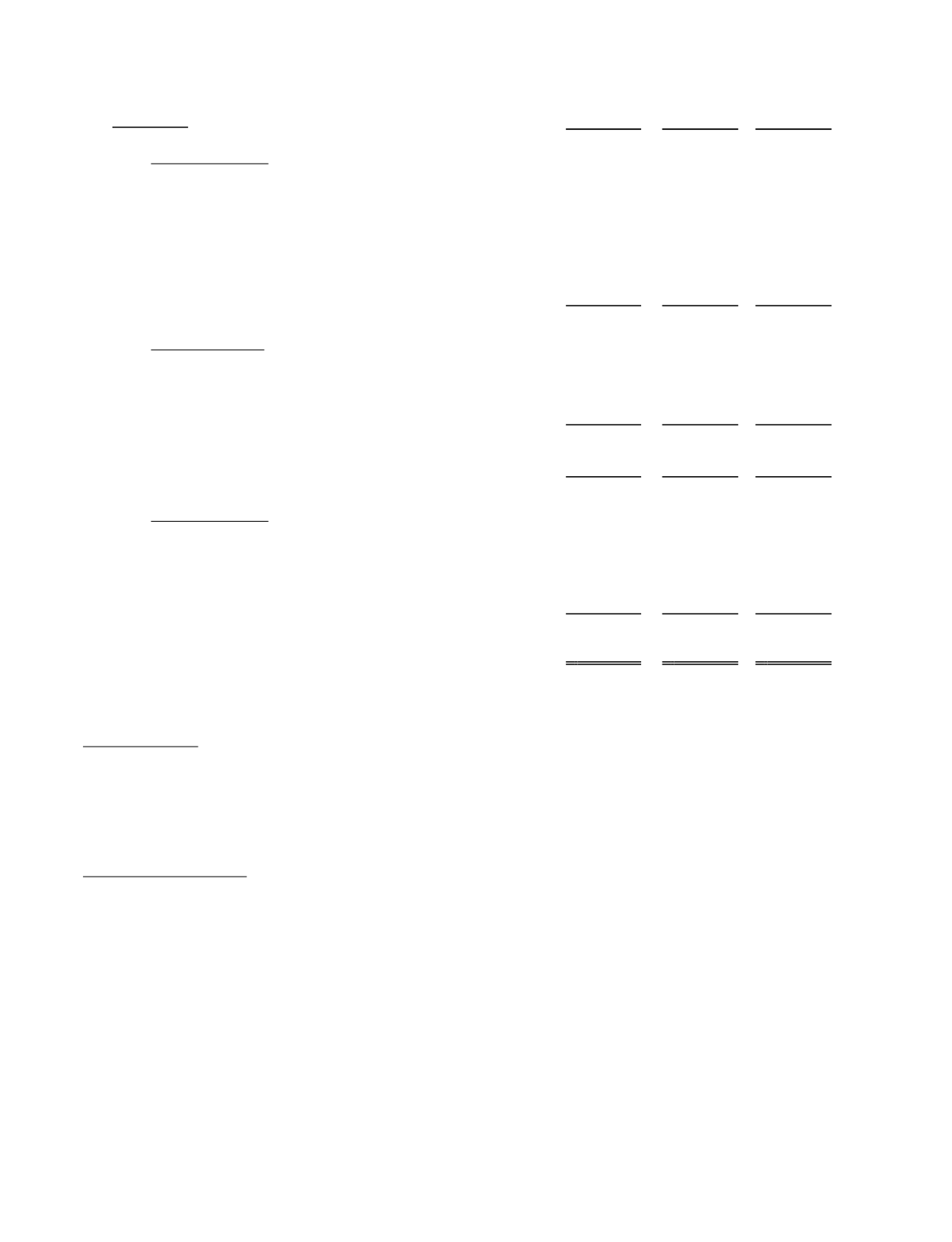

The following table summarizes our statements of cash flow for the years ended December 31:

($ in millions)

2013

2012

2011

Net cash and cash equivalents provided by (used in):

Operating activities:

Net income (loss) ............................................................................... $

(58.6) $

(98.0) $

7.0

Non-cash charges.....................................................................

36.4

37.0

41.4

Non-cash impairment of goodwill and long-lived assets .........

32.0

125.7

—

Deferred tax provision (benefit)...............................................

16.0

(15.7)

4.4

Excess tax provision (benefit) from share-based compensation

arrangements ......................................................................

—

1.5

(4.7)

Net changes in working capital including changes in other

assets ..................................................................................

22.4

(12.6)

(16.4)

Net operating activities

.......................................

48.2

37.9

31.7

Investing activities:

Acquisitions, net of cash acquired ...........................................

—

(20.8)

(16.1)

Proceeds (purchases) of marketable securities, net..................

(5.4)

4.0

16.1

Purchases of property and equipment............................

(16.7)

(22.7)

(26.4)

Capital purchases funded through leases.......................

6.0

4.9

5.3

Purchases of property and equipment, net of assets funded by

leasing ................................................................................

(10.7)

(17.8)

(21.1)

Capitalized software development costs ..................................

(2.0)

(1.9)

(2.4)

Net investing activities

........................................

(18.1)

(36.5)

(23.5)

Financing activities:

Payments on long-term debt and capital lease obligations.......

(91.1)

(55.6)

(25.0)

Proceeds from bank and other borrowings...............................

66.5

54.5

9.5

Earn-out payments related to 2009 acquisition ........................

—

(3.9)

(3.2)

Excess tax benefit from stock compensation plan ...................

—

(1.5)

4.7

Other financing activities.........................................................

(0.2)

0.8

1.5

Net financing activities

.......................................

(24.8)

(5.7)

(12.5)

Net change in cash and cash equivalents ...................................................... $

5.3 $

(4.3) $

(4.3)

Days revenue outstanding in accounts receivable including unbilled

receivables ...............................................................................................

72

72

71

Capital resources: We have funded our operations, acquisitions, and capital expenditures primarily using cash generated by our

operations, debt and capital leases, and issuance of public equity. At December 31, 2013, our liquidity included $61.9 million cash,

cash equivalents, and marketable securities and $30 million of unused borrowing availability under our bank line of credit. We also

had $14.6 million of undrawn bank delayed draw term loan capacity under our June 2013 Senior Debt facility for retirement of the

remaining notes due in 2014, and up to an additional $18.9 million available on March 31, 2015 for further borrowings for general

corporate purposes if certain covenant requirements are met.

Sources and uses of cash: At December 31, 2013, our cash and cash equivalents balance was $41.9 million and when added to

marketable securities, our total liquid funds were $61.9 million, up $10.4 million from $51.5 million at year-end 2012. Cash,

equivalents, and marketable securities at year-end 2012 were $8.6 million lower than at December 31, 2011.

Operating activities

: Cash generated by operations was $48.2 million in 2013 compared to $37.9 million in 2012, up $10.3

million. Lower year end working capital was mainly due to a decrease in accounts receivable relating to the timing of revenue and

customer payments under business agreement terms, decreased inventory, a decrease in accounts payable and accrued expenses due to

timing of vendor payments, and lower unbilled receivables and deferred revenue due to timing of percentage of completion projects.

Cash generated by operations was $37.9 million in 2012 compared to $31.7 million in 2011, up $6.2 million despite higher working

capital. Higher year end working capital was mainly due to an increase in accounts receivable relating to the timing of revenue and

customer payments under business agreement terms, increased inventory, a decrease in accounts payable and accrued expenses due to

timing of vendor payments, partly offset by lower unbilled receivables and deferred revenue due to timing of percentage of completion

projects. Cash from operating profits during 2013, 2012, and 2011 has been largely sheltered from income taxes due to the use of loss

carry-forwards generated in prior years.

Investing activities

: Fixed asset additions, excluding assets funded by leasing, were approximately $10.7 million, $17.8 million,

and $21.1 million for 2013, 2012, and 2011, respectively. Also, investments were made in development of software for resale which