In 2014, Intelsat invested $645 million as capital expenditures for our global telecommunications network. We experienced lower than normalized capital expenditures in 2013 and 2014 due to a natural pause in our fleet replacement requirements.

The 2014 results of Intelsat S.A. (“Intelsat” or the “company”) demonstrate our continued progress on our financial and operating priorities to support our long-term growth strategy. Full year 2014 included a number of significant strategic accomplishments, including the successful launch of our Intelsat 30 satellite and achieving our net debt pay down target of approximately $475 million.

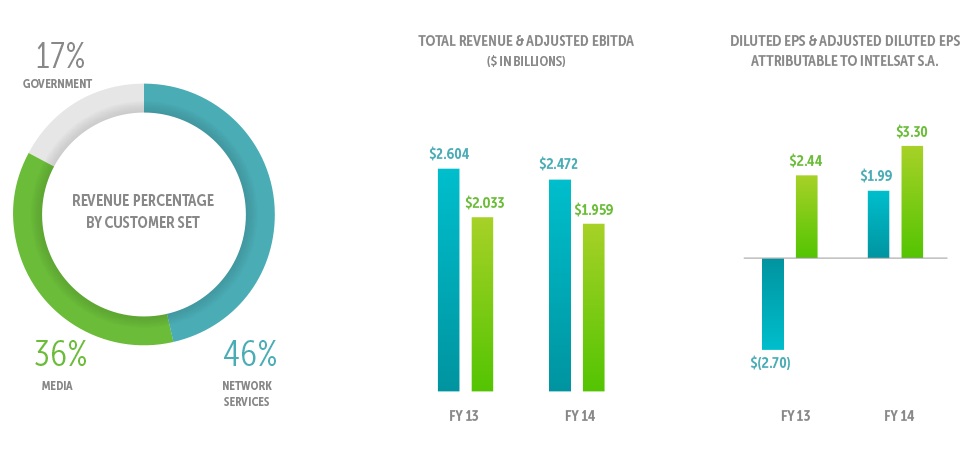

For the full year 2014, revenue was $2.472 billion, a five percent decline as compared to full year 2013. Adjusted EBITDA1 for the full year decreased by four percent to $1.959 billion, or 79 percent of revenue, as compared to $2.033 billion, or 78 percent of revenue, in 2013.

On-going business trends affected our revenue in 2014, namely pricing pressure for certain regions and applications, as well as reduced U.S. government spending, compounded with rising geopolitical challenges and services nearing the end of their lifecycle. These unfavorable trends more than offset growth in areas such as media services and aeronautical and maritime broadband mobility applications.

In 2014, we reduced our total debt by $475 million as our business generated $401 million in free cash flow from operations1.Ending cash balance at December 31, 2014 was $123 million.

Our fleet investment program is on schedule, with one expected satellite launch in 2015, Intelsat 34, a satellite supporting media applications in South America and mobility services over the North Atlantic, assigned to an Arianespace launch. Intelsat 31, a second satellite to be used primarily by DIRECTV® Latin America, is currently expected to launch in the first quarter of 2016 on a Proton launcher. The launch cycle for the Intelsat EpicNG program is scheduled to commence in the first quarter of 2016, with the first satellite, Intelsat 29e, launching on Arianespace.

Contracted backlog ended the year at $10.0 billion, compared to $10.1 billion at September 30, 2014. Beginning of year backlog for 2015 was $2.0 billion, as compared to $2.1 billion at January 1, 2014. The modest decrease reflects no sizeable new contracts or renewals naturally occurring during this period, as well as reduced government backlog, reflecting lower business activity from that sector and shorter renewal periods. At 4.0 times trailing annual revenue (from January 1, 2014 to December 31, 2014), our backlog continues to provide a foundation for predictable cash flow investment in our business.

In 2014, we redeemed the entire $500.0 million aggregate principal amount of Intelsat Jackson Holding S.A. 8 ½% Senior Notes due 2019 (the “2019 Senior Notes”). Our secured revolving credit facility had a $49 million outstanding balance at December 31, 2014. This balance was repaid in early 2015.

In this annual performance review, financial measures are presented both in accordance with GAAP and also on a non-GAAP basis. EBITDA, Adjusted EBITDA (or AEBITDA), free cash flow from (used in) operations and related margins, adjusted net income and adjusted net income per diluted common share included in this commentary are non-GAAP financial measures. Please see the consolidated financial information found in our earnings release and available on our website for information reconciling non-GAAP financial measures to comparable GAAP financial measures.