In 2015, Intelsat built a strong foundation for future growth. Our next generation satellite platform, Intelsat EpicNG SM, moved through the factory as 2015 progressed. We successfully launched the first Intelsat EpicNG satellite, Intelsat 29e, in late January of 2016, and we now embark upon our NEXT GENERATION of corporate development — or IntelsatNG.

Against a backdrop of a global community demanding connectivity anywhere and to everything, satellite solutions are poised for use in a greater number of applications than ever before and on an unprecedented scale. This dynamic resurgence in satellite communications technologies provides Intelsat with the opportunity to command a much bigger seat at the global telecommunications table.

Against a backdrop of a global community demanding connectivity anywhere and to everything, satellite solutions are poised for use in a greater number of applications than ever before and on an unprecedented scale. This dynamic resurgence in satellite communications technologies provides Intelsat with the opportunity to command a much bigger seat at the global telecommunications table.

Intelsat delivered on plan for the year with $2.35 billion in revenue and $1.85 billion in Adjusted EBITDA1 in 2015. As of December 31, 2015, backlog of $9.4 billion was four times 2015 annual revenue. Our backlog continues to provide the visibility into future revenue and cash flows that allows us to invest in our fleet and pursue our long-term business strategy. While ongoing headwinds will continue to impact our business in 2016, the launches of Intelsat 29e, Intelsat 31, Intelsat 36, and Intelsat 33e during this period will position us for a return to growth.

Intelsat delivered on plan for the year with $2.35 billion in revenue and $1.85 billion in Adjusted EBITDA1 in 2015. As of December 31, 2015, backlog of $9.4 billion was four times 2015 annual revenue. Our backlog continues to provide the visibility into future revenue and cash flows that allows us to invest in our fleet and pursue our long-term business strategy. While ongoing headwinds will continue to impact our business in 2016, the launches of Intelsat 29e, Intelsat 31, Intelsat 36, and Intelsat 33e during this period will position us for a return to growth.

We seek to maximize our opportunity in this environment, even as we transition through the challenges that are pressuring our near-term revenue performance. Our plan is designed to execute on our operational priorities, while continuing to support our customer sets as we transition through certain headwinds, and continue to build our globalized network.

We seek to maximize our opportunity in this environment, even as we transition through the challenges that are pressuring our near-term revenue performance. Our plan is designed to execute on our operational priorities, while continuing to support our customer sets as we transition through certain headwinds, and continue to build our globalized network.

As I began my tenure on April 1, 2015 as CEO, I set our company’s focus on five operational priorities that are essential to prepare Intelsat for the opportunities ahead. We made notable progress on each of these priorities in 2015.

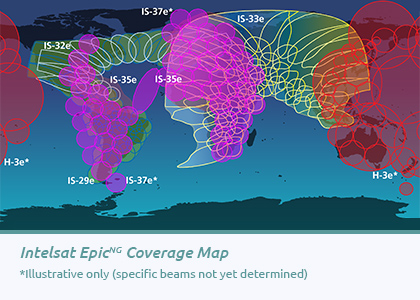

Our first priority is to maintain our design and manufacturing schedule for the next generation Intelsat EpicNG fleet, and other satellites in our plan, to ensure availability of new inventory to drive revenue growth. In service to this priority, we continued the development of our high throughput satellite (“HTS”) Intelsat EpicNG fleet, with no delays to our schedules, and announced the seventh satellite in the series, Horizons 3e (“H-3e”), which will complete the global HTS overlay of our traditional fleet. Additionally, we launched and placed into service Intelsat 34, reinforcing our third video neighborhood in Latin America, where we deliver many of the top 100 channels to the continent.

Our first priority is to maintain our design and manufacturing schedule for the next generation Intelsat EpicNG fleet, and other satellites in our plan, to ensure availability of new inventory to drive revenue growth. In service to this priority, we continued the development of our high throughput satellite (“HTS”) Intelsat EpicNG fleet, with no delays to our schedules, and announced the seventh satellite in the series, Horizons 3e (“H-3e”), which will complete the global HTS overlay of our traditional fleet. Additionally, we launched and placed into service Intelsat 34, reinforcing our third video neighborhood in Latin America, where we deliver many of the top 100 channels to the continent. OneWeb, the low earth orbit (“LEO”) satellite venture whose mission is to provide affordable internet access for everyone, will deploy in Ku-band, which comprises a significant portion of Intelsat’s in-orbit spectrum. This creates a natural alliance where there is unequaled opportunity to create value through the interoperability of the two orbits and access to consumer-scaled ground networking technology.

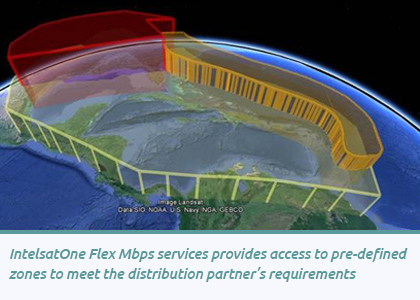

OneWeb, the low earth orbit (“LEO”) satellite venture whose mission is to provide affordable internet access for everyone, will deploy in Ku-band, which comprises a significant portion of Intelsat’s in-orbit spectrum. This creates a natural alliance where there is unequaled opportunity to create value through the interoperability of the two orbits and access to consumer-scaled ground networking technology. We introduced IntelsatOne Flex, a customizable, managed infrastructure service that allows Intelsat’s distribution partners to easily and cost effectively provide services incorporating high throughput technologies. By leveraging our global footprint and layers of beams over strategic regions, we are able to differentiate our capacity while also accelerating our customers’ ability to grow in new applications and new regions. In 2016, we will expand IntelsatOne Flex from the maritime and aeronautical verticals to include the government and enterprise sectors.

We introduced IntelsatOne Flex, a customizable, managed infrastructure service that allows Intelsat’s distribution partners to easily and cost effectively provide services incorporating high throughput technologies. By leveraging our global footprint and layers of beams over strategic regions, we are able to differentiate our capacity while also accelerating our customers’ ability to grow in new applications and new regions. In 2016, we will expand IntelsatOne Flex from the maritime and aeronautical verticals to include the government and enterprise sectors.  We continue to position ourselves for long-term growth opportunities serving the U.S. military with commercial capacity and services. Our subsidiary, Intelsat General Corporation (“Intelsat General”), embedded a staff member in a recently created Commercial Integration Cell at the United States Strategic Command’s Joint Space Operations Center. We are also marketing new service offerings under the IntelsatOne Flex umbrella to accelerate adoption of mobility and fixed networks for government applications.

We continue to position ourselves for long-term growth opportunities serving the U.S. military with commercial capacity and services. Our subsidiary, Intelsat General Corporation (“Intelsat General”), embedded a staff member in a recently created Commercial Integration Cell at the United States Strategic Command’s Joint Space Operations Center. We are also marketing new service offerings under the IntelsatOne Flex umbrella to accelerate adoption of mobility and fixed networks for government applications.  Our fifth priority is to optimize use of our spectrum rights and global presence to maximize market access and continuity, particularly in attractive regions, while maintaining investment discipline. In this regard, we began two new satellite programs, Intelsat 38 and Horizons 3e, which allow us to achieve our coverage and customer growth objectives by using alternative business models and structures, reducing our capital expenditure requirements.

Our fifth priority is to optimize use of our spectrum rights and global presence to maximize market access and continuity, particularly in attractive regions, while maintaining investment discipline. In this regard, we began two new satellite programs, Intelsat 38 and Horizons 3e, which allow us to achieve our coverage and customer growth objectives by using alternative business models and structures, reducing our capital expenditure requirements.The same five priorities outlined above underpin our efforts to better position our customer sets as we await the arrival of our new capacity into orbit.

Network services generated $1.1 billion of revenue in 2015, an 8% decline over 2014. Over the course of the year, older point-to-point services (some of which originated more than a decade ago) cycled off of our  network and transitioned to fiber services that are more efficient for those applications.

network and transitioned to fiber services that are more efficient for those applications.

Price competition on our traditional fleet accelerated through the year with oversupply of traditional satellite capacity. This environment continues to be highly competitive, given the introduction of high throughput services, such as Intelsat EpicNG which are now beginning to enter service.

We see further price erosion of traditional services pressuring revenue from new and renewing services in 2016. Our strategy during this period of oversupply is to:

As we move through 2016, we will place into service the first two of our Intelsat EpicNG satellites, Intelsat 29e and Intelsat 33e. These satellites have the type of high throughput capacity that is designed for the faster growing applications in our sector, such as broadband for the aeronautical and maritime mobility sectors, rural access for the wireless sector, high performance enterprise and, with new antenna technologies,

As we move through 2016, we will place into service the first two of our Intelsat EpicNG satellites, Intelsat 29e and Intelsat 33e. These satellites have the type of high throughput capacity that is designed for the faster growing applications in our sector, such as broadband for the aeronautical and maritime mobility sectors, rural access for the wireless sector, high performance enterprise and, with new antenna technologies,  the Internet of Things and the connected car. Combined, these represent approximately $2.6 billion in future industry-wide revenue growth potential by 2021 for the industry ($3.1 billion including government), for which our network services business will be a leading competitor.

the Internet of Things and the connected car. Combined, these represent approximately $2.6 billion in future industry-wide revenue growth potential by 2021 for the industry ($3.1 billion including government), for which our network services business will be a leading competitor.

Our media business delivered a solid year, with $882 million in revenue, slightly up over the previous year. This business benefited from new capacity on Intelsat 30 and Intelsat 34, which enhanced our Direct-to-Home (“DTH”) leadership in Latin America.

Our media business, of which 73% is delivered outside the United States, is a dynamic one. In the developed world, we promoted new innovations, enabling new, cutting edge viewer experiences such as “television anywhere” and Ultra High Definition(“UHD” or also known as, 4K) distribution. In other regions, we support the growth of customers who are only beginning to introduce high definition services. In 2016, we are scheduled to launch two satellites, Intelsat 31 and Intelsat 36, which will support the further penetration of high definition television on DTH platforms serving Latin America and Africa.

Our media business, of which 73% is delivered outside the United States, is a dynamic one. In the developed world, we promoted new innovations, enabling new, cutting edge viewer experiences such as “television anywhere” and Ultra High Definition(“UHD” or also known as, 4K) distribution. In other regions, we support the growth of customers who are only beginning to introduce high definition services. In 2016, we are scheduled to launch two satellites, Intelsat 31 and Intelsat 36, which will support the further penetration of high definition television on DTH platforms serving Latin America and Africa.

We continue to work closely with the world’s largest content producers to provide the right distribution networks and technology platforms. Our services allow our customers to maximize the potential audience for their content, and simplify the task of distributing in the multiple formats required by today’s content-centric population.

Our government business stabilized over the course of 2015, after two years of downward trends related to the U.S. government budget sequestration and troop withdrawals from the Middle East. At $385 million in 2015 revenue, the size of the business reflects the current tempo of operations of the U.S. Department of Defense, our primary customer.

Our government business stabilized over the course of 2015, after two years of downward trends related to the U.S. government budget sequestration and troop withdrawals from the Middle East. At $385 million in 2015 revenue, the size of the business reflects the current tempo of operations of the U.S. Department of Defense, our primary customer.

Although the budgetary constraints are not likely to dissipate any time soon, we continue to believe in the growth potential of this business. The customer’s interest in commercializing and outsourcing its requirements, from drone missions to flight operations for the government’s in-orbit fleet, will introduce new business models and requirements that may create sizeable opportunities over the long run.

Our Intelsat EpicNG satellites are well-suited to our government customer, given that our differentiating technology, our digital payload, shares common technology heritage with one of the most powerful government-owned fleets. When Intelsat 33e, our second Intelsat EpicNG satellite covering Europe, Africa, Middle East and Asia, is scheduled to enter service in late 2016, we expect to expand the service alternatives we have for this customer base.

Our network covers 99 percent of the earth’s populated regions. Beyond just our unique satellite-based infrastructure, we are constantly enhancing our network to include fiber, teleports and data and video platforms that allow our customers to grow where they desire and in whatever manner creates the greatest efficiency for their operations.

Increasingly, we are realizing that, given the size of the opportunities ahead, we need to stimulate the development of technologies across the satellite ecosystem that expand our set of solutions. To accomplish this, we are:

In 2015, we launched one satellite and advanced the Intelsat EpicNG program that truly represents the next generation of our development as a company. Two of our Intelsat EpicNG satellites are scheduled to launch in 2016, two in 2017 and one each in 2018 and 2019, completing the deployment of seven high throughput satellites. As these satellites enter service across the regions, they will bring high performance, efficiency and simplified access, unlocking increased potential for our customers, as well as our own services.

As Intelsat embarks on our next generation of corporate development, we are passionate about our mission. Our team is committed to creating value for our stakeholders by staying true to our business plan, enhancing our financial stability and returning to top-line growth.

Early in 2016, we were joined by our new Chief Financial Officer, Jacques Kerrest, who will lead Intelsat’s financial team and capital markets activities. He joins a team filled with optimism for the opportunities ahead. With our organization focused on services and initiatives to expand our leadership in large and fast-growing applications, Intelsat’s next generation of corporate development is well underway, providing a foundation as we position the company for future growth.

Thank you for your support of Intelsat.

Steven Spengler

Chief Executive Officer

1 In this shareholder letter, financial measures are presented both in accordance with GAAP and also on a non-GAAP basis.

EBITDA, Adjusted EBITDA (or AEBITDA), free cash flow from (used in) operations and related margins, adjusted net income and adjusted net income per diluted common share included in this commentary are non-GAAP financial measures. Please see the consolidated financial information found in our earnings release and available on our website for information reconciling non-GAAP financial measures to comparable GAAP financial measures.