The 2015 results of Intelsat S.A. demonstrate our continued progress on financial and operating priorities to support our long-term growth strategy. Full year 2015 included a number of significant strategic accomplishments, including the successful launch of our Intelsat 34 satellite and subsequent to the year-end, launching the first satellite for our next generation Intelsat EpicNG SM platform, Intelsat 29e.

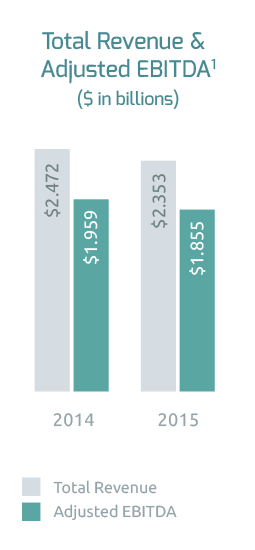

Our focus on maintaining strong AEBITDA margins is demonstrated in our strong margin during the year, despite the revenue decline. Our margins were supported by a higher percentage of on-network revenues in our government business as well as improved bad debt experience.

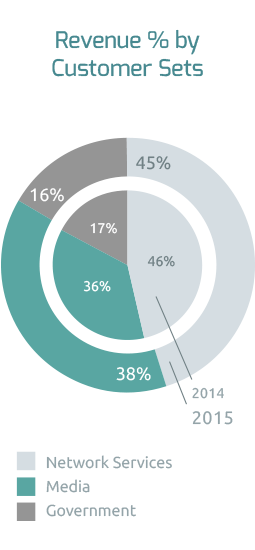

On-going business trends affected our revenue in 2015, including pricing pressure for certain regions and applications, particularly in our network services business, as well as rising geopolitical challenges resulting in currency-related pricing pressure, and some of our network services nearing the end of their lifecycle. These unfavorable trends more than offset growth in areas such as media services and aeronautical and maritime broadband mobility applications.

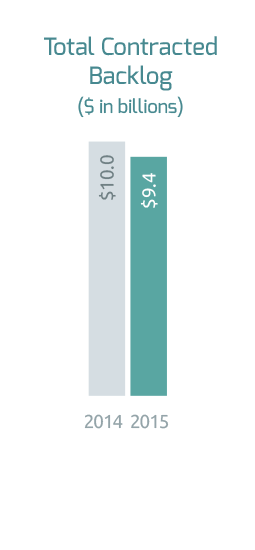

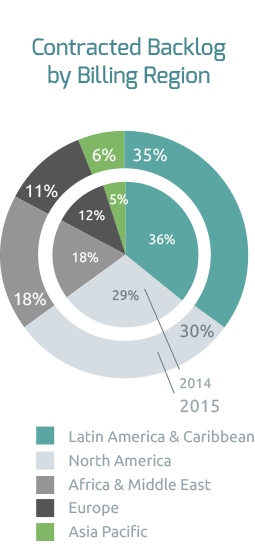

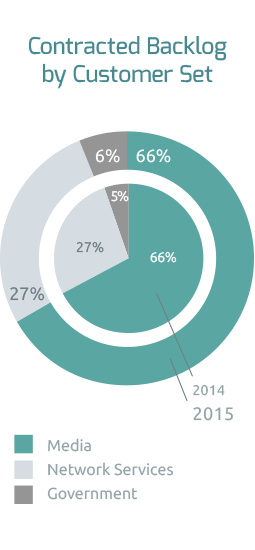

Contracted backlog ended the year at $9.4 billion, compared to $9.5 billion at September 30, 2015. At 4.0 times trailing annual revenue (from January 1, 2015 to December 31, 2015), our backlog continues to provide a foundation for predictable cash flow investment in our business.

In 2015, we invested $724 million in capital expenditures funded by operations, which continues our Globalized Network positioning. The capital expenditures in 2015 supported on-going building projects for 9 satellites, including Intelsat 34, which launched during the year.

During 2015, Intelsat repurchased $25.0 million in aggregate principal amount of Intelsat (Luxembourg) S.A.’s 6 3/4% Senior Notes due 2018. In connection with these repurchases, we recognized a gain on early extinguishment of debt of $7.1 million in the fourth quarter of 2015, consisting of the difference between the carrying value of the debt purchased and the total cash amount paid, and a write-off of unamortized debt issuance costs.

In the beginning of 2016, Intelsat retained Guggenheim Securities, LLC to assist the Company in connection with various financing and balance sheet initiatives, including, among other things, evaluating the level of secured debt and balance sheet management opportunities. There can be no assurance that our retention of Guggenheim Securities, LLC will result in our pursuing or completing any specific transaction.

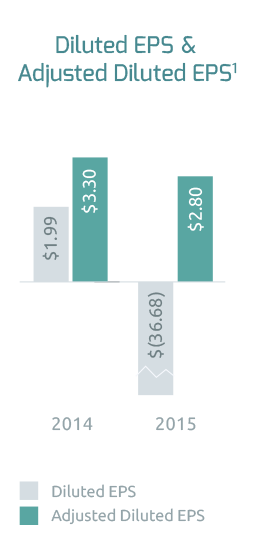

1In this annual performance review, financial measures are presented both in accordance with GAAP and also on a non-GAAP basis. EBITDA, Adjusted EBITDA (or “AEBITDA”), free cash flow from (used in) operations and related margins, adjusted net income and adjusted net income per diluted common share included in this commentary are non-GAAP financial measures. Please see the consolidated financial information found in our earnings release and available on our website for information reconciling non-GAAP financial measures to comparable GAAP financial measures.