68

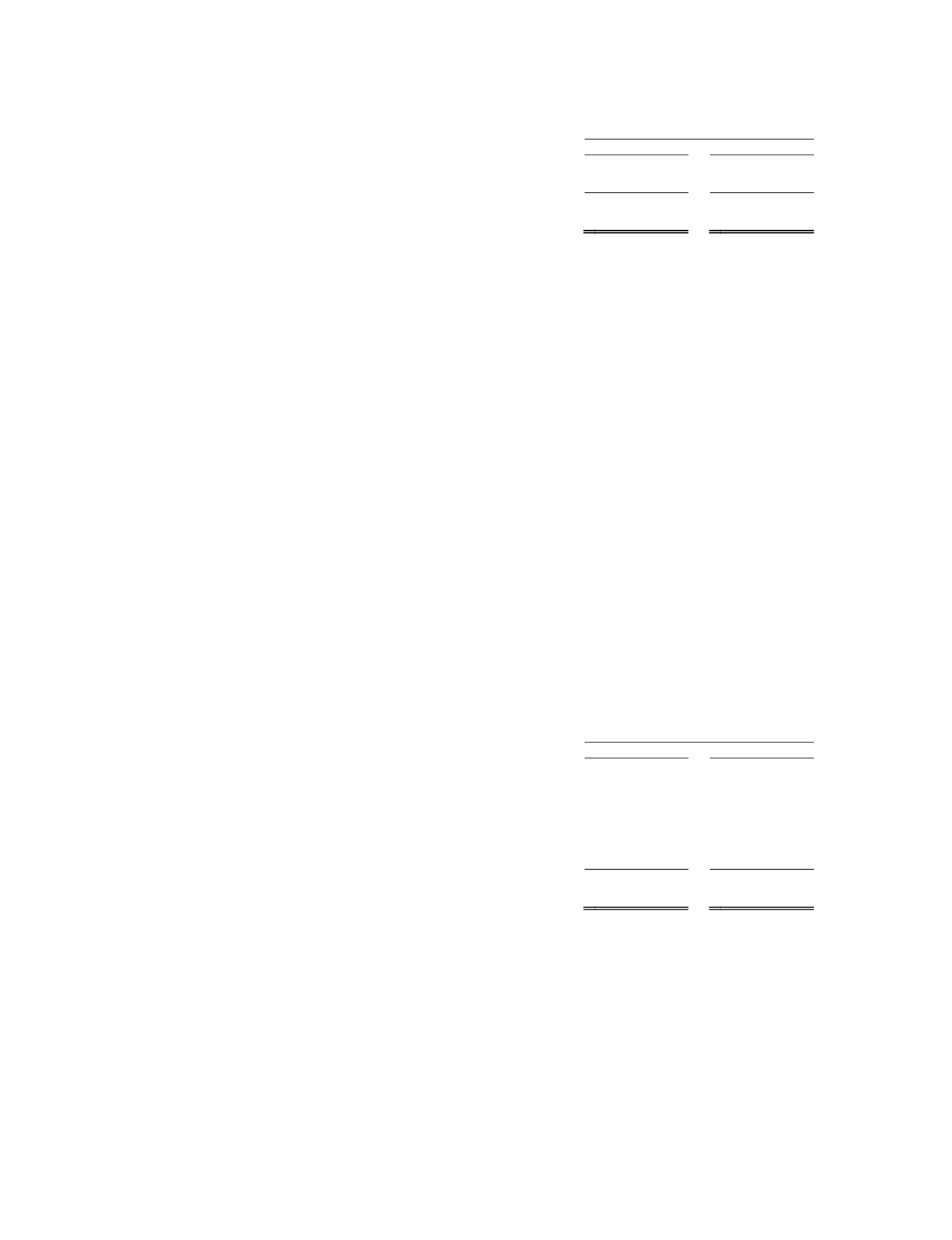

The following table sets forth information ongeneral and administrative expenses (in thousands):

YearEnded

December 31,

2013

2012

General and administrative expenses ............................................ $

13,173 $

11,190

Non-cash compensation expense related to equity awards ...........

1,745

1,325

Total general and administrative .............................................. $

14,918 $

12,515

General and administrative expenses for the year endedDecember 31, 2013were $13.2million and increased compared to

$11.2million for 2012 primarily due to higher personnel expenses. All amounts exclude non-cash compensation expense related to

equity awards.

Equity inNet Loss of Regulus Therapeutics Inc.

We recognized $1.4million for equity innet loss of Regulus for the year endedDecember 31, 2012. We used the equity

methodof accounting to account for our investment inRegulus until Regulus’ IPO inOctober 2012.We began accounting for our

investment inRegulus at fair value in the fourthquarter of 2012whenour ownership inRegulus droppedbelow20percent andwe no

longer had significant influence overRegulus’ operating and financial policies. Therefore, we didnot recognize any equity innet loss

ofRegulus in2013.

Investment Income

Investment income for the year endedDecember 31, 2013 totaled $2.1million compared to$1.8million for 2012. The

increase in investment incomewas primarily due to a higher average cashbalance and currentmarket conditions.

Interest Expense

Interest expense includes non-cash amortizationof the debt discount anddebt issuance costs onour convertible notes, non-

cash interest expense related to the long-term financing liability for our primary facility, and interest expense payable in cash for our

convertible notes andothermiscellaneous debt related items.

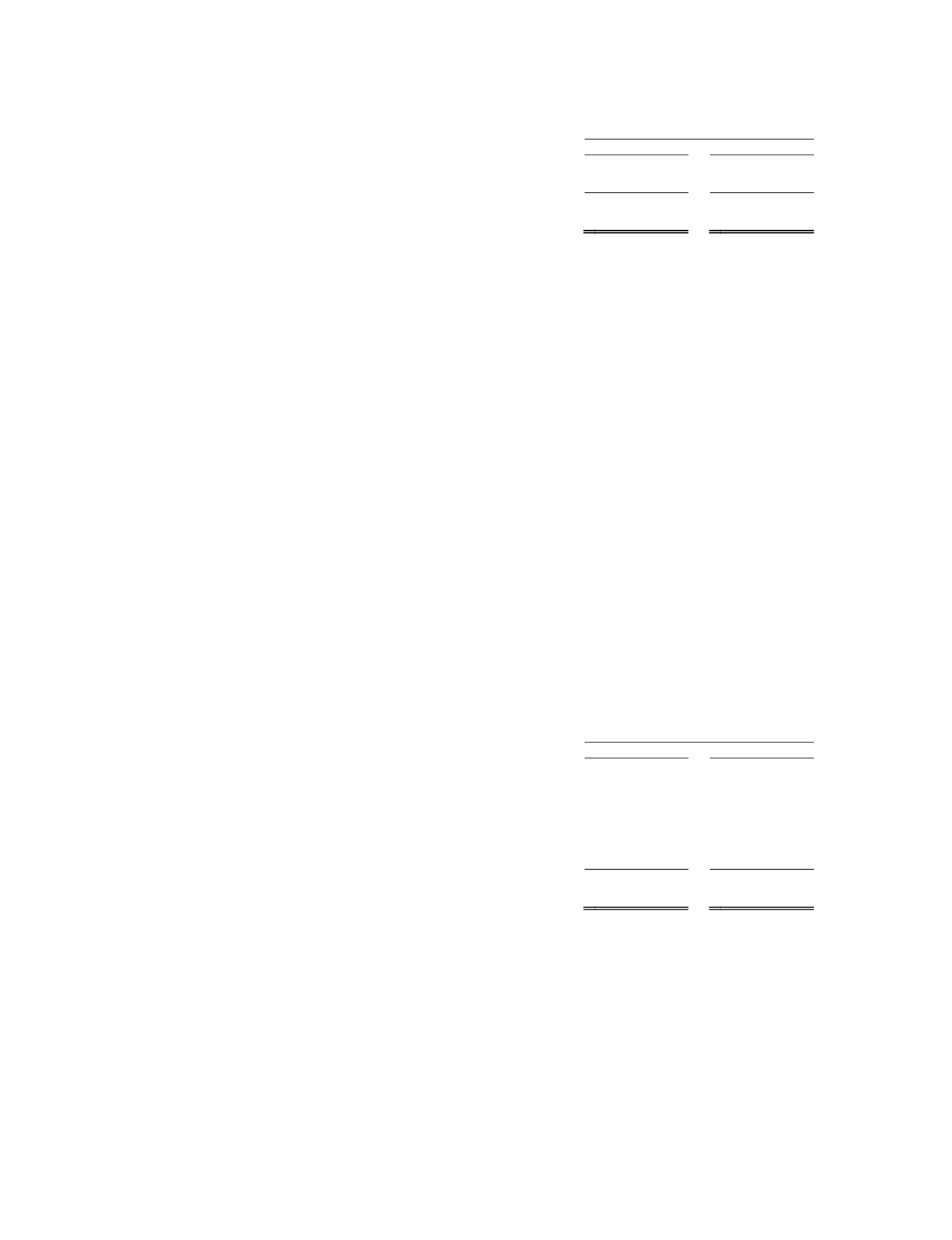

The following table sets forth information on interest expense (in thousands):

YearEnded

December 31,

2013

2012

ConvertibleNotes:

Non-cash amortization of the debt discount anddebt

issuance costs .................................................................... $

6,758 $

9,845

Interest expense payable in cash ...........................................

5,534

4,306

Non-cash interest expense for long-term financing liability .........

6,568

6,502

Other .............................................................................................

495

498

Total interest expense ............................................................... $

19,355 $

21,152

Interest expense for year endedDecember 31, 2013was $19.4million compared to$21.2million in 2012. The decrease in

interest expensewas primarilydue to a decrease in amortizationof the debt discount related toour convertible notes. We recordnon-

cash amortization of the debt discount onour convertible notes becausewe account for our convertible notes by separating the liability

and equity components of the instrument in amanner that reflects our nonconvertible debt borrowing rate. As a result, we assign a

value to the debt component of our convertible notes equal to the estimated fair value of similar debt instrumentswithout the

conversion feature. Thismeanswe recordour convertible notes at a discount that we amortize over the life of the notes as non-cash

interest expense.We are using an eight percent borrowing rate for the 2

3

/

4

percent convertible senior notes compared to a 9.3percent

borrowing rate for the 2

5

/

8

percent convertible subordinatednotes thatwe redeemed inSeptember 2012. The borrowing rate for our

2

3

/

4

percent notes is less than the rate for our 2

5

/

8

percent notes because ofmarket conditions at the time of each issuance. As a result,

we are amortizing less debt discount for the 2

3

/

4

percent notes compared to the 2

5

/

8

percent notes. This decrease is partiallyoffset by

an increase in interest expense payable in cashbecause the interest rate is slightly higher on our 2

3

/

4

percent notes compared toour 2

5

/

8

percent notes.