EARNINGS HIGHLIGHTS BY KEY OPERATING SEGMENT1

($ in millions)

| DECEMBER 31, 2013 | SERVICING | ORIGINATIONS | REVERSE MORTGAGE |

ALL OTHER | TOTAL CONSOLIDATED |

| REVENUE | $741.8 | $630.4 | $167.7 | $262.6 | $1,802.5 |

| INCOME (LOSS) BEFORE INCOME TAXES | $224.1 | $263.0 | $0.4 | ($74.7) | $412.8 |

| CORE EARNINGS (LOSS) BEFORE INCOME TAXES | $285.8 | $273.2 | $40.3 | ($3.9) | $595.4 |

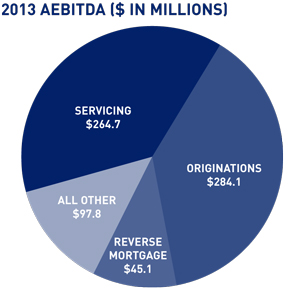

| ADJUSTED EBITDA | $264.7 | $284.1 | $45.1 | $97.8 | $691.7 |

| DECEMBER 31, 2012 | SERVICING | ORIGINATIONS | REVERSE MORTGAGE |

ALL OTHER | TOTAL CONSOLIDATED |

| REVENUE | $348.9 | $5.9 | $13.6 | $255.4 | $623.8 |

| INCOME (LOSS) BEFORE INCOME TAXES | $45.8 | ($2.4) | $3.1 | ($82.0) | ($35.5) |

| CORE EARNINGS (LOSS) BEFORE INCOME TAXES | $125.3 | ($2.2) | $6.9 | $4.1 | $134.1 |

| ADJUSTED EBITDA | $145.6 | ($2.2) | $7.7 | $90.6 | $241.7 |

2013 KEY OPERATING SEGMENT HIGHLIGHTS

| SERVICING | |

| Average Serviced UPB (in billions) | $178.7 |

| Number of Units Serviced | 2.0 million |

| AEBITDA as a % of Average Serviced UPB | 15 bps |

| ORIGINATIONS | |

| Funded Volume (in billions) | $15.9 |

| Capitalized Mortgage Servicing Rights (in millions) | $187.7 |

| Consumer Lending Direct Margin | 345 bps |

| REVERSE MORTGAGE | |

| UPB Securitized Volume (in billions) | $2.9 |

| Serviced UPB (in billions) | $15.9 |

| Cash Gain Margin | 336 bps |

CONSOLIDATED BALANCE SHEET HIGHLIGHTS

($ in millions)

1 See reconciliations and definitions of Non-GAAP Financial Measures included in the Company’s accompanying December 31, 2013 Form 10-K filed with the SEC.

| 2013 | 2012 | |

| CASH | $491.9 | $442.1 |

| CORPORATE DEBT | $2,268.0 | $886.7 |

| EQUITY | $1,167.0 | $894.9 |